SEGG Media Launches Diversified $300 Million Crypto Strategy

SEGG Media, a company listed on Nasdaq, has announced a significant $300 million initiative, with 80% of these funds earmarked for a multi-asset cryptocurrency reserve. The strategy prioritizes Bitcoin as the primary asset within this reserve.

This strategic allocation highlights the growing institutional interest in digital assets. The initiative is expected to influence cryptocurrency market dynamics and open new avenues in areas such as validator operations and asset tokenization.

SEGG Media, recognized for its involvement in sports and entertainment, has detailed its $300 million plan to establish a diversified multi-asset cryptocurrency reserve, with Bitcoin intended as the initial foundational asset. The company aims to enhance returns through validator operations across various blockchain networks, including Ethereum, Solana, and ZIGChain, integrating these digital assets into its broader ecosystem.

Market reactions to SEGG Media's announcement have been muted so far, with no immediate commentary from prominent crypto figures or financial regulators. Industry analysts are anticipated to closely observe the unfolding strategy for potential market shifts or price movements.

Institutional Crypto Moves: SEGG's Impact and Expert Insights

The involvement of SEGG Media in multi-asset reserves aligns with strategies employed by other institutions, such as MicroStrategy, suggesting a potential trend in institutional Bitcoin accumulation.

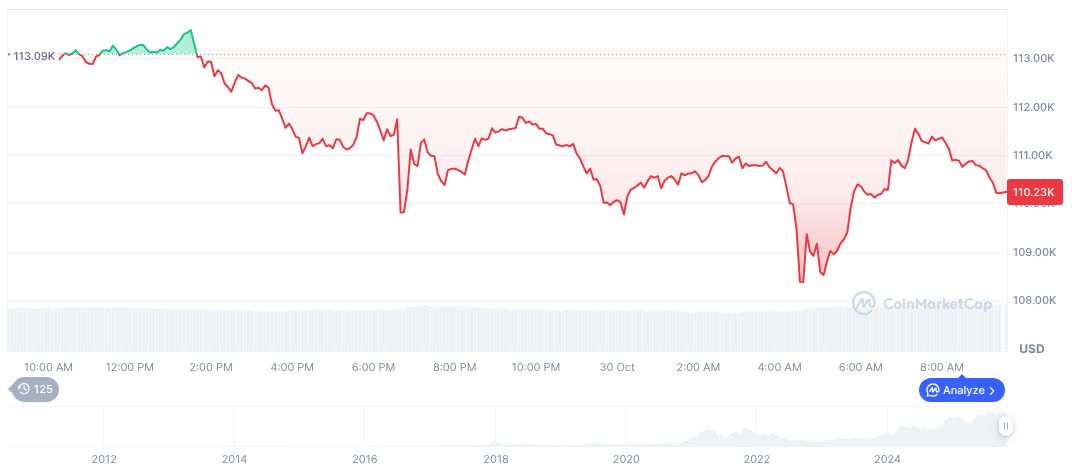

As of October 31, 2025, Bitcoin (BTC) was trading at $109,375.01, with a market capitalization of $2.18 trillion and a dominance of 59.34%, according to CoinMarketCap data. Despite a 24-hour trading volume increase of 21.49%, BTC experienced a minimal price change of -1.41% over the same period.

Research from the Coincu team indicates that SEGG's crypto reserve initiative could attract significant financial and regulatory attention, potentially accelerating trends in asset tokenization. The company's successful integration of alternative assets like Solana and ZIGChain could also stimulate activity within their respective ecosystems.