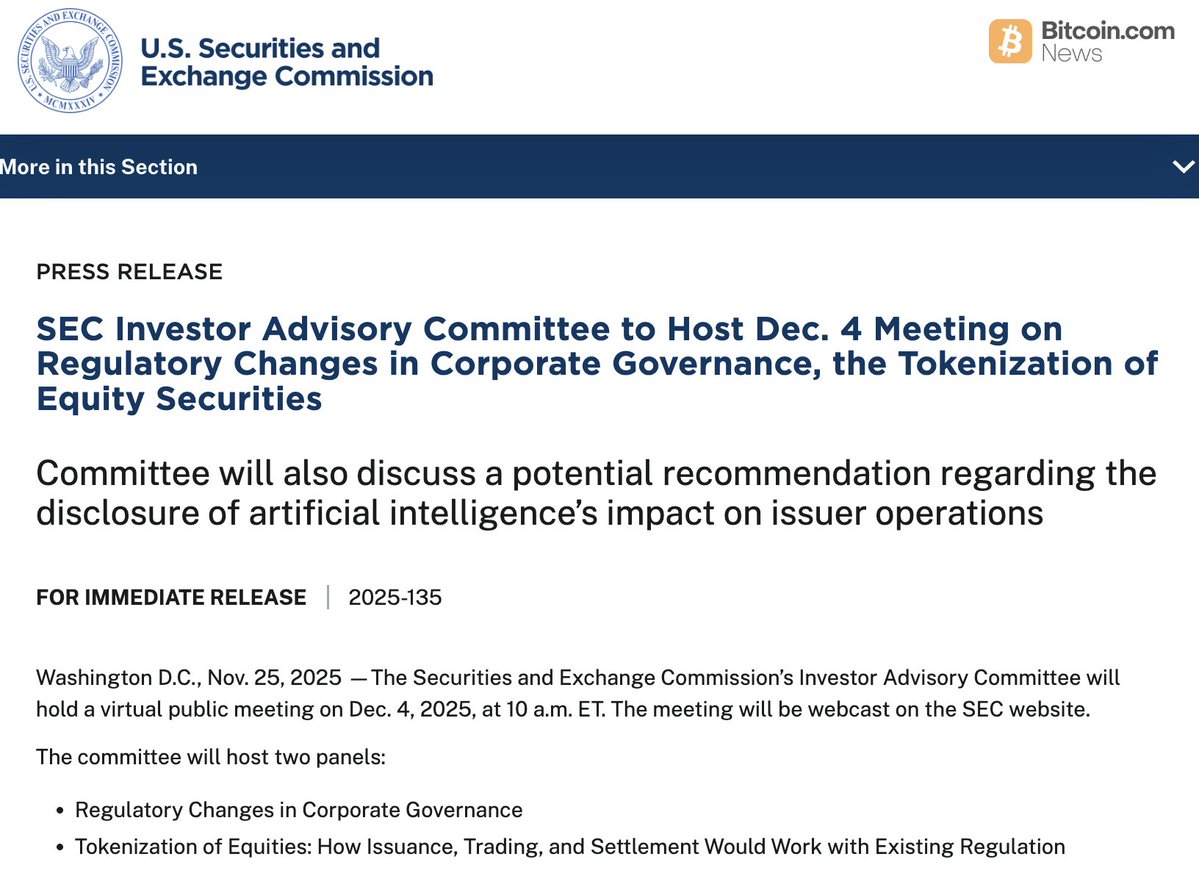

The U.S. Securities and Exchange Commission’s Investor Advisory Committee is preparing for a high-stakes discussion on December 4, with tokenized equities taking center stage. According to a new SEC notice, the virtual meeting will focus on how tokenization could reshape corporate governance, trading infrastructure, and investor protections in U.S. markets.

The committee plans to evaluate how blockchain-based issuance and settlement models might fit within the existing regulatory framework. This marks one of the SEC’s most direct public examinations of tokenized equity systems to date, a topic that has gained momentum as major financial institutions continue experimenting with on-chain assets.

Artificial Intelligence and Corporate Disclosure

A second major theme will be artificial intelligence. The committee is expected to address whether companies should be required to disclose more information about how AI impacts their operations, a growing concern as automated systems become deeply integrated into corporate workflows and decision-making.

Meeting Agenda and Focus Areas

The meeting will feature two formal panels:

- •Corporate governance regulatory changes

- •Tokenization of equities and how issuance, trading, and settlement could operate under current SEC rules

The session will be livestreamed on the SEC website, allowing investors, industry professionals, and policymakers to follow the conversation in real time. With tokenization and AI both pushing regulators into new territory, the December 4 event is likely to signal how the SEC plans to navigate emerging technologies heading into 2026.