Regulatory Scrutiny Ends After Two Years

The Securities and Exchange Commission (SEC) has concluded its regulatory investigation into Ondo Finance, a prominent tokenization platform, without bringing any charges. This decision comes after a two-year period of scrutiny by the commission.

Ondo Finance specializes in transforming real-world assets, such as stocks and funds, into digital tokens utilizing blockchain technology. This process of tokenization not only digitizes assets but also enables 24/7 trading and fractional ownership opportunities, positioning Ondo Finance as a leading entity in this burgeoning market.

The SEC has formally closed a confidential Biden-era investigation into Ondo — without any charges. The inquiry began in 2024, focused on whether Ondo’s tokenization of certain real-world assets complied with federal securities laws as well as whether the ONDO token was a… pic.twitter.com/yV4xVX7Qrx

— Ondo Finance (@OndoFinance) December 8, 2025

During the Biden administration, the SEC, under the leadership of Gary Gensler, initiated actions against several major cryptocurrency companies, including Ondo Finance, alleging violations of securities laws. In October 2023, the SEC commenced an investigation into Ondo Finance, specifically examining its tokenization of U.S. Treasury products and the potential classification of ONDO tokens as securities.

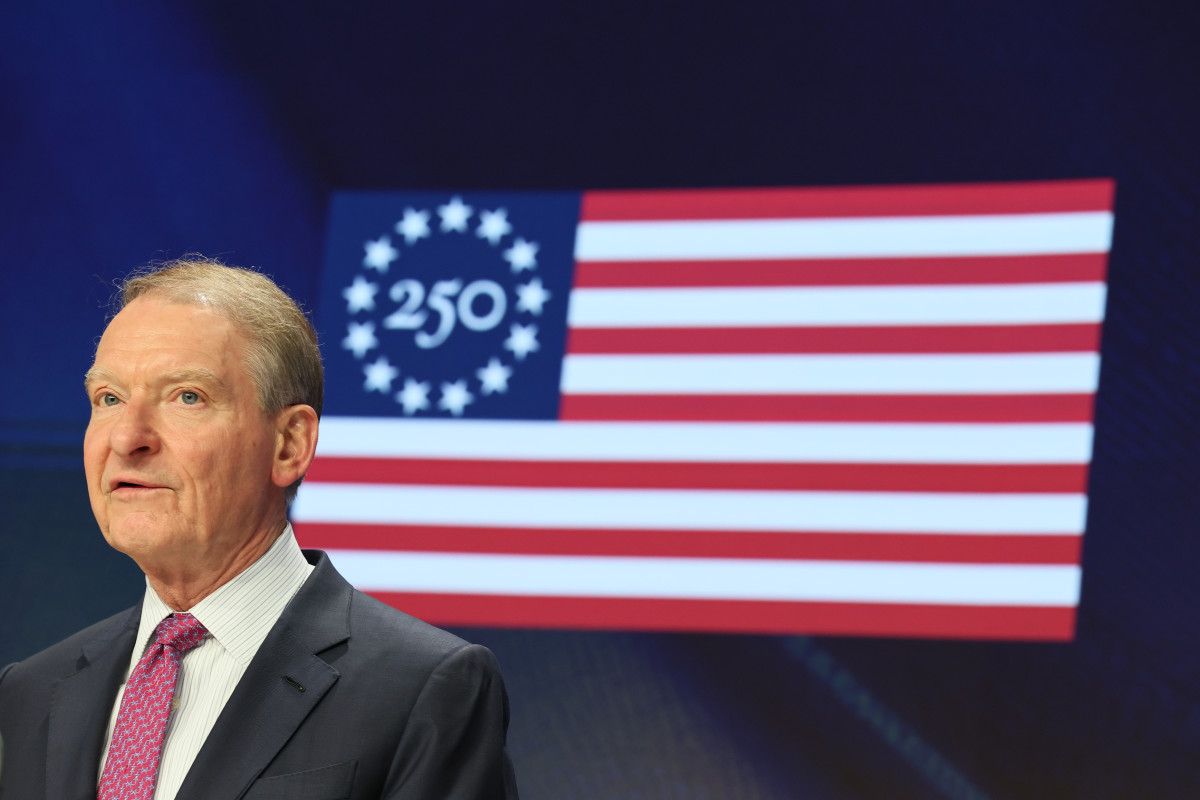

However, the regulatory body, now under the new chair Paul Atkins, closed its two-year investigation in November without recommending any charges, as reported by journalist Eleanor Terrett. Ondo Finance has consistently maintained its stance that regulated and transparent tokenization models, such as its own, are not only compliant with investor-protection principles but also serve to enhance them.

Ondo Probe Resolution Reflects Broader Policy Shift

In a recent interview with Fox Business, Paul Atkins stated his expectation that the entire U.S. financial market will transition to blockchain infrastructure within the next two years, citing the ongoing developments in digital assets, digitalization, and market tokenization.

Ondo Finance has also commented that this recent development signifies a "broader shift in U.S. policy," as regulators re-evaluate previous approaches to digital assets established during the Biden era. The company further indicated that the resolution of the probe facilitates its expansion of U.S. operations, following its registration as an investment advisor and its acquisition of Oasis Pro Markets, an entity registered with the SEC as a broker-dealer, ATS operator, and transfer agent.

The upcoming annual Ondo Summit, scheduled to take place in New York on February 3, 2026, is anticipated to feature the launch of new tokenization tools and products by the platform.