Peter Schiff has launched a strong critique against Michael Saylor and his company, Strategy, labeling Saylor the "biggest con man on Wall Street" and deeming Strategy's business model a fraud. This criticism naturally segued into Schiff's long-standing assertion that Bitcoin is a "fake" asset.

On Monday, December 1, Schiff took to X to express his views, stating: "Today is the beginning of the end of $MSTR. Saylor was forced to sell stock not to buy Bitcoin, but to buy U.S. dollars merely to fund MSTR’s interest and dividend obligations. The stock is broken. The business model is a fraud, and Saylor is the biggest con man on Wall Street."

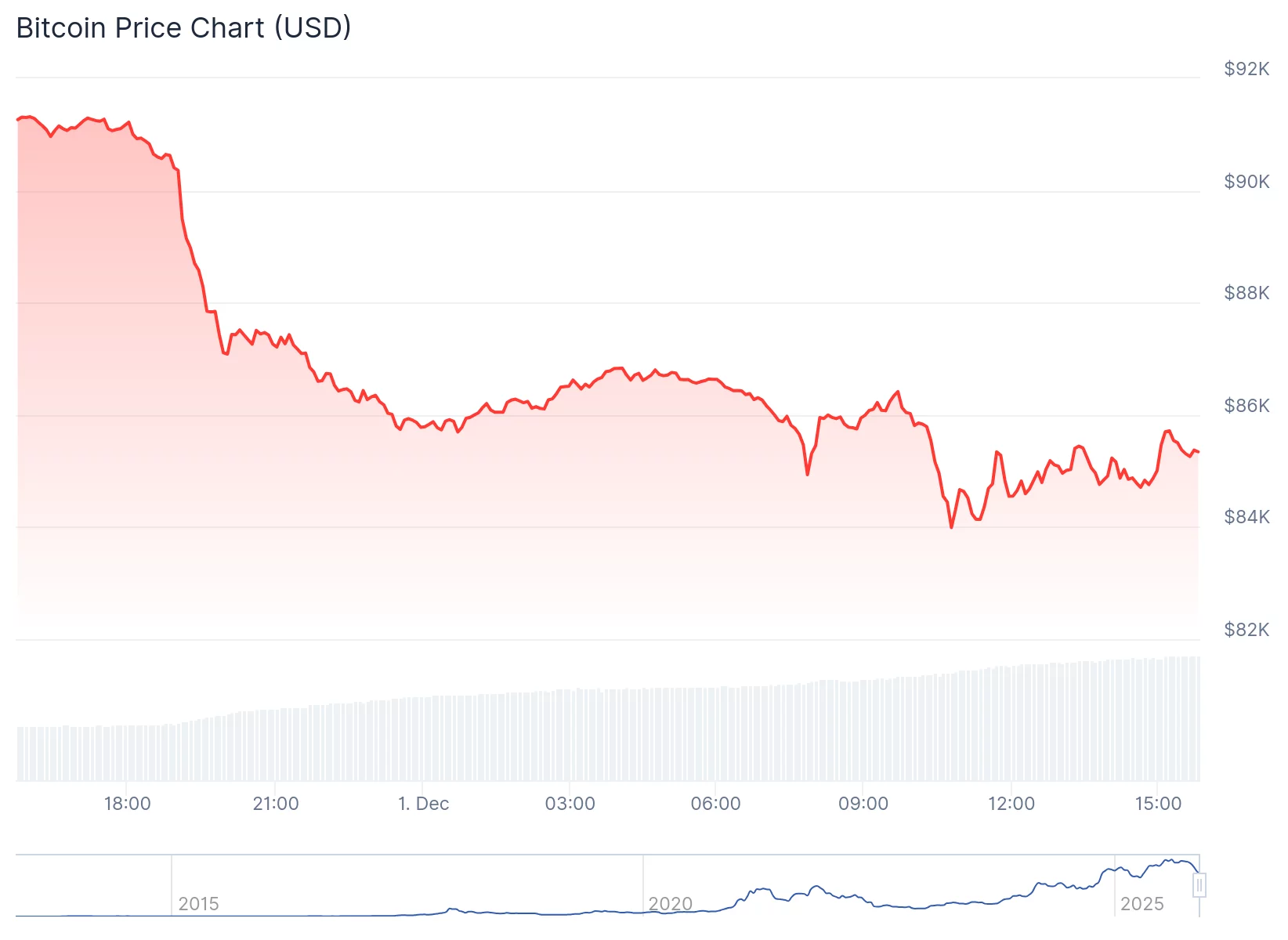

Schiff also highlighted Bitcoin's recent performance, noting that the cryptocurrency had slid 28% from its all-time highs, while the Nasdaq remained only 2% below its peak. He argued that the $500 billion market wipeout in November was evidence that investors are abandoning what he perceives as an imaginary asset in favor of "real ones."

Bitcoin's Resilience Amidst Market Fluctuations

Despite Schiff's pronouncements, Bitcoin has shown signs of resilience. Schiff posted late Sunday that Bitcoin was "breaking down again," noting that the world's top digital asset had been in the red, down over 6% in the preceding 24 hours.

Michael Saylor, however, has remained confident despite the recent market downturn. Strategy, formerly known as MicroStrategy, has demonstrated its ability to withstand significant market drops. Saylor stated on Fox Business that the company is "engineered to take an 80–90% drawdown." He predicts that Bitcoin will continue to decline gradually but will eventually stabilize, exhibiting volatility approximately 1.5 times that of the S&P 500 while outperforming it proportionally. He concluded that "Bitcoin is stronger than ever."

Saylor views the recent drop from $110,000 to $81,000 not as a failure, but as a validation of his strategy.

Institutional Adoption and Market Sentiment

The narrative surrounding Bitcoin is increasingly shaped by institutional adoption and market performance. BlackRock's Bitcoin ETFs, despite being relatively new, have become the firm's most profitable product line, with IBIT approaching $100 billion in assets. These ETFs continued to see inflows even during November's market slump.

Furthermore, institutional interest is expanding. Robinhood is reportedly considering holding Bitcoin on its balance sheet, Kazakhstan's central bank is planning a $300 million crypto allocation, and corporations such as Strategy and Metaplanet are treating Bitcoin as a strategic asset.

While volatility is an inherent characteristic of the cryptocurrency market, the persistent interest from major financial institutions and governments suggests that Bitcoin is far from being considered "dead." Wall Street sees significant revenue opportunities, and governments are exploring potential benefits.

Ultimately, the substantial capital flows into Bitcoin and related financial products often speak louder than individual critiques.