Michael Saylor is preparing another sizable Bitcoin purchase as BTC trades near $94K, signaling ongoing institutional conviction despite the recent correction. The broader market has flushed out leverage, pushing traders to look past meme coins and focus on infrastructure that can actually extend Bitcoin’s utility. Bitcoin Hyper is building a high-speed Bitcoin Layer-2 using rollups, zero-knowledge proofs, and an SVM execution layer to unlock payments, DeFi, and dApps. A HYPER presale above $27.8M with staking and upside forecasts gives dip-buyers a higher-beta way to express long-term confidence in the Bitcoin ecosystem.

Michael Saylor is back doing what he does best: hinting at another big Bitcoin buy while the market bleeds.

In a recent interview, the Strategy co-founder said the company is accelerating its accumulation, and that ‘people will be pleasantly surprised’ when it reports on its latest buys.

At the same time, Bitcoin is hovering just above $94K after a sharp correction from the $120K+ range, with sentiment still shaky and traders split on whether this is a mid-cycle flush or the start of something nastier.

With a cryptic post on X, is Saylor about to unveil a larger-than-normal BTC purchase to buy the dip?

The twist is that even a large new purchase from Strategy is unlikely to single-handedly catapult Bitcoin higher. The market is larger and more liquid than in Saylor’s early accumulation days, and leverage has already been flushed out by the recent deleveraging wave.

What his comments do signal, though, is that large, long-term players still see this zone as a dip, not a top.

That matters for everyone watching from the sidelines. If a major corporate stacker is preparing to buy size into weakness, the base Bitcoin thesis looks intact. At the same time, traders are increasingly hunting for ways to get higher upside than just adding a bit more BTC at $94K.

This is where Bitcoin Hyper ($HYPER) slides into the conversation.

While Saylor focuses on stacking coins, Bitcoin Hyper focuses on making those coins actually usable. It’s a Bitcoin Layer-2 designed to fix slow transactions and high fees, and its $HYPER presale has already $27.8M raised with staking rewards at around 41% and a current token price of $0.013285.

For anyone eyeing the same dip as Saylor but wanting more torque, a BTC-centric Layer-2 narrative has obvious appeal.

Bitcoin Hyper Turns Saylor-Style Conviction into Layer-2 Utility

Saylor’s thesis has always been simple: Bitcoin is pristine collateral and the world’s best long-term store of value.

What it has never been, however, is fast or cheap to use. Bitcoin Hyper ($HYPER) aims to plug that gap without touching Bitcoin’s base layer, by shifting most activity to a dedicated Layer-2 chain that settles back to BTC.

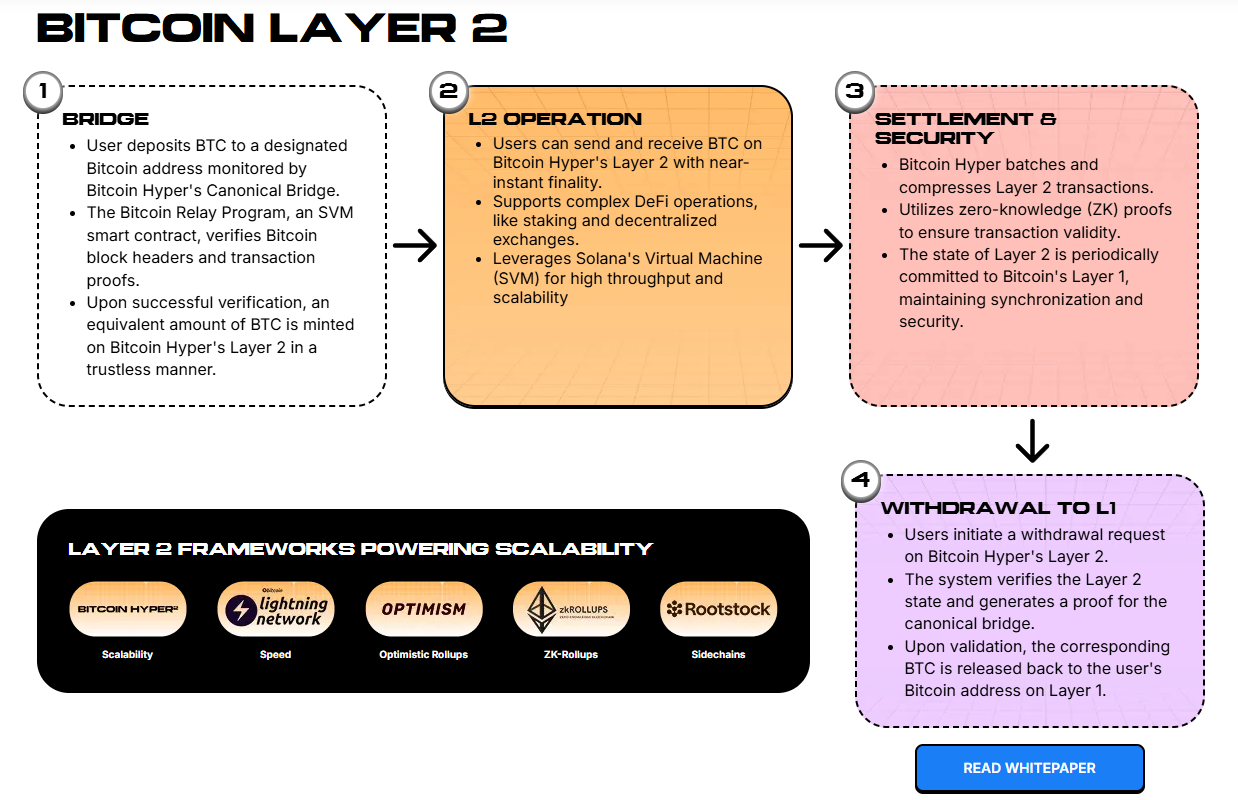

The design revolves around a canonical bridge and the Solana Virtual Machine execution layer. Users send BTC to a monitored address on Bitcoin, a relay program verifies block headers and proofs, and then an equivalent amount of BTC is minted on the Bitcoin Hyper Layer-2. From there, transactions can clear with near-instant finality and low fees, while still anchoring value to Bitcoin.

On this Layer-2, BTC will be able to power DeFi protocols, payments, NFTs and meme coins in a way that just is not practical on the base chain. The network leans on rollup techniques and zero-knowledge proofs to batch transactions and periodically commit the state back to Bitcoin. That way, users inherit Bitcoin’s security while gaining modern throughput.

That mix aligns neatly with where the market is rotating. After the recent correction, capital is drifting away from thinly veiled memes and back toward projects that either extend Bitcoin’s usefulness or provide core infrastructure.

A Layer-2 that promises high-speed BTC transfers, composable smart contracts, and a familiar SVM environment for developers sits right on that seam between conservative macro bet and higher-beta growth narrative.

In simple terms, if Saylor is buying the underlying asset, some traders will want exposure to the rails that could make that asset more useful in the next cycle. Bitcoin Hyper offers exactly that angle.

Presale Momentum Builds As $HYPER Prices In Future Upside

The numbers behind $HYPER suggest that this is more than just buzz. The presale has already crossed the $27.8M milestone, putting it in the upper tier of current token sales by size. That level of capital usually implies a mix of retail participation and serious whale entries, which lines up with reports of multiple six-figure buys into the sale.

At a current price of $0.013285, $HYPER still sits firmly in micro-cap territory. But with staking rewards at 41%, early participants can lock tokens and start compounding yield even before full mainnet traction and exchange listings arrive.

For anyone sitting on stablecoins or sidelined capital after the correction, parking a portion in a stakable presale while Saylor lines up his next BTC buy is a different way to express the same dip-buying conviction.

Check out this guide to buying Bitcoin Hyper before you join the presale.

What also stands out is how Bitcoin Hyper allocates resources. A significant share of the token supply is earmarked for development, infrastructure and listings, rather than short-term gimmicks.

The project’s whitepaper puts heavy emphasis on security research, rollup sequencing models, and developer-friendly tooling. That emphasis on plumbing rather than pure marketing fits with a broader market pivot toward real utility after this latest deleveraging event.

If Strategy does announce a major new buy and Bitcoin starts to stabilize or recover, attention is likely to swing back toward assets directly plugged into the BTC ecosystem.

A fast, Bitcoin-settled Layer-2 that already has tens of millions committed to its token and an active staking program will naturally sit on that watchlist.

Join the $HYPER presale before the next price increase.