A Shift in Stance: From Skepticism to Strategic Adoption

For years, Russia maintained a cautious, often skeptical, stance on cryptocurrencies. Officials frequently dismissed them as a risky, speculative fad that could potentially weaken the ruble and facilitate illicit financial activities. The Central Bank of Russia (CBR) was particularly wary, issuing warnings about the potential for economic destabilization and the risks faced by retail investors exposed to volatile market swings. This conservative outlook was further solidified in 2020 with the passage of the "On Digital Financial Assets" law, which officially recognized cryptocurrencies but explicitly prohibited their use for everyday payments within the country.

The landscape dramatically shifted in 2022 when Western nations imposed extensive financial sanctions on Russia following the escalation of the conflict in Ukraine. The nation found itself largely excluded from global financial systems, including SWIFT, and its access to U.S. dollars and euros—the cornerstones of international trade—was severely restricted. Facing an economy in dire need of liquidity, the Kremlin began to re-evaluate its position on cryptocurrency, viewing it not as a threat but as a potential lifeline for essential cross-border transactions.

By 2024, the Russian government began to cautiously open the door to crypto's utility. New legislation was introduced to permit companies to utilize cryptocurrencies for international trade, marking a significant departure from its prior restrictive policies. However, the state maintained strict oversight, ensuring that while businesses could engage in global transactions, ordinary Russian citizens still faced limitations on trading and holding cryptocurrencies. This policy indicated a clear intention to leverage crypto for strategic purposes rather than speculative investment.

A pivotal moment arrived when Finance Minister Anton Siluanov announced an agreement between the Finance Ministry and the CBR to legalize crypto for foreign trade. Siluanov described this move as a "necessary adaptation" to sustain trade operations amidst stringent sanctions. This policy shift was not merely a bureaucratic adjustment; it represented a crucial survival mechanism for the Russian economy. Consequently, Russia has been employing blockchain solutions for cross-border payments to maintain its connection to global trade and circumvent sanctions.

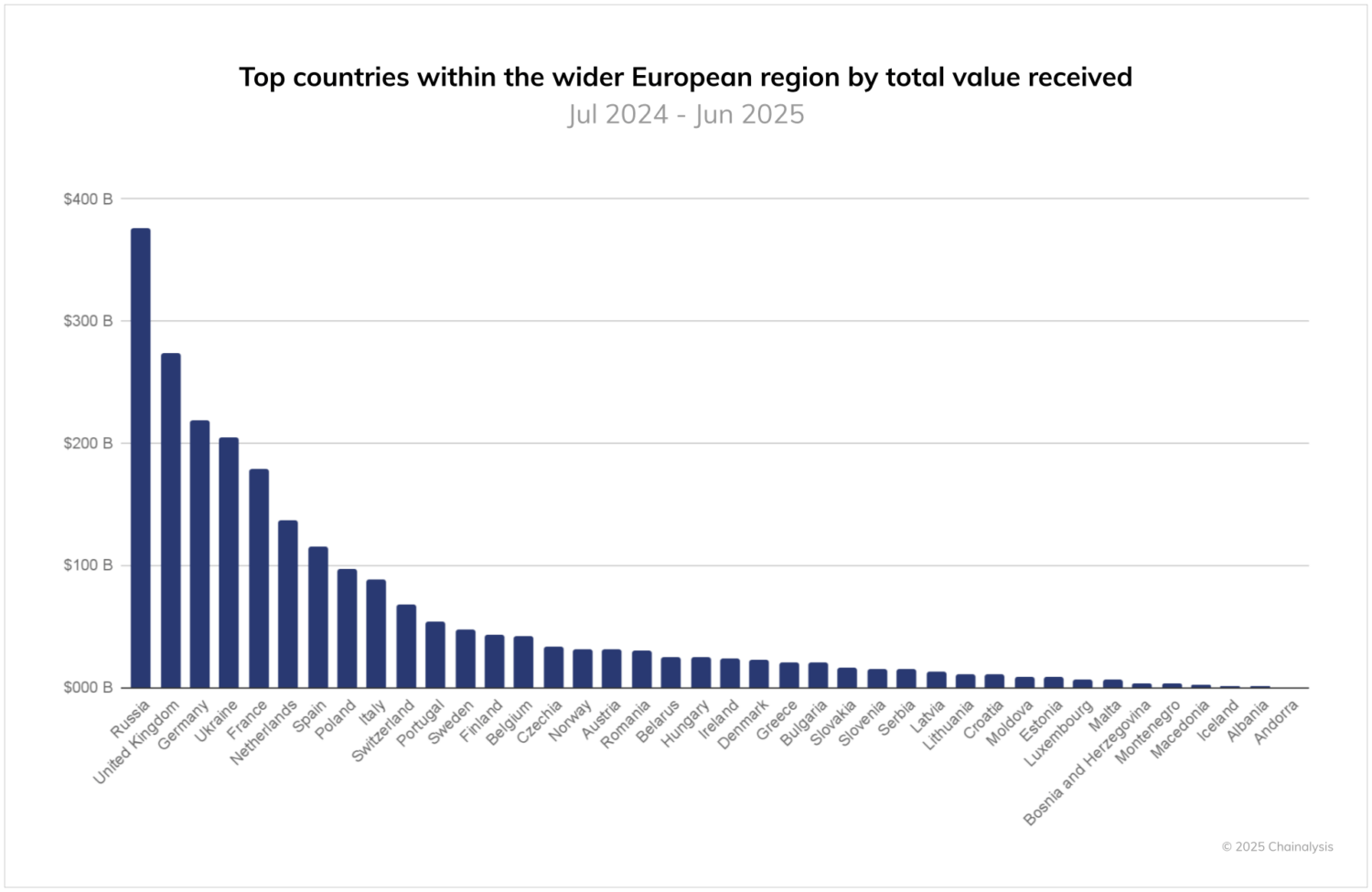

Available data supports this narrative. According to Chainalysis, between July 2024 and June 2025, Russia emerged as Europe's largest cryptocurrency market, receiving an estimated $376.3 billion. This figure significantly surpassed the United Kingdom's $273.2 billion in the same period, highlighting the substantial role crypto has assumed in Russia's international financial dealings.

Crypto's Dual Role: Trade Facilitator or Reinforcer of Isolation?

Russia's engagement with cryptocurrency presents a complex duality. On one hand, it demonstrates how blockchain technology and cryptocurrency cross-border payments can empower nations to circumvent traditional financial obstacles and pursue greater financial autonomy. On the other hand, it raises critical questions about whether genuine innovation can flourish under a government that prioritizes absolute control.

The prospect of a permissioned, state-controlled blockchain system, where every transaction requires official approval, risks morphing into another form of centralized control, paradoxically undermining the very decentralization that governments once feared. This scenario highlights the irony of a state that initially viewed decentralization with apprehension now attempting to leverage blockchain technology without fully embracing the inherent freedom it offers.

Furthermore, the issue of trust is paramount. For cryptocurrency-based trade to achieve widespread adoption, international partners must have confidence in the fairness of the rules, the reliability of transaction records, and the stability of the system. A lack of such confidence could lead to the technology becoming a barrier rather than an enabler of trade.

Implications for Global Sanctions Enforcement

Russia's pivot towards blockchain-based payments has significant implications not only for its domestic trade practices but also for the effectiveness of global sanctions in the digital age. While crypto rails offer alternative avenues for value transfer, they do not inherently guarantee anonymity or immunity from scrutiny.

The increasing use of cryptocurrencies does not negate the power of sanctions. Although digital assets can bypass certain traditional banking checks, most substantial transactions still involve exchanges, over-the-counter (OTC) brokers, or service providers that are subject to close regulatory monitoring. Agencies such as OFAC and the EU have enhanced their capabilities to track on-chain activities, identify transaction patterns, and flag suspicious wallets. What might appear as an escape route is increasingly becoming another domain for surveillance.

It is also crucial to acknowledge the role of mixers, OTC desks, and sanctioned banks in obscuring payment trails. While these entities can obscure transaction pathways, they often leave digital footprints. The inherent transparency of blockchain technology means that every transfer is permanently recorded. Paradoxically, Russia's adoption of more transparent blockchain rails could facilitate easier tracing of financial flows, network mapping, and counterparty identification by analysts, a task considerably more challenging in opaque cash-based systems.

Therefore, the central question is whether cryptocurrency provides Russia with sufficient flexibility to continue trading while regulators work to close existing loopholes. The answer appears to be nuanced: crypto complicates enforcement efforts but simultaneously generates new data points that aid in compliance tracking.

A New Trade Blueprint or a Temporary Solution?

Russia's move towards blockchain-based settlements underscores a broader trend: external pressure often accelerates innovation. When access to traditional financial channels becomes restricted, countries actively seek alternative solutions. By exploring new digital finance tools like cryptocurrency, Moscow is implicitly asking whether technical self-reliance can diminish financial dependence.

If successful, Russia's approach could establish a precedent for other nations facing exclusion from conventional financial systems, demonstrating that blockchain-powered cross-border payments can offer viable alternatives to dollar-centric trade models. However, significant risks are associated with this strategy. A network characterized by heavy oversight and limited integration with the broader global economy might devolve into an isolated system. Despite its digital nature, such a system could remain constrained and struggle with scalability.

Ultimately, this development represents not a complete break from the past but rather a pragmatic response to the current interplay of finance, power, and technology. The long-term viability of this approach—whether it evolves into a sustainable trade framework or remains a temporary workaround—will hinge on a single critical factor: trust. Without it, even the most advanced forms of cryptocurrency cross-border payments risk becoming merely another isolated component within an increasingly fragmented global economy.