This week brought significant Ripple news, highlighted by a substantial capital injection that sparked considerable speculation. CEO Brad Garlinghouse confirmed a $500 million investment, which quickly led to rumors about the company's potential to go public. The investment boosted Ripple's valuation to over $40 billion, and the involvement of venture capital firms such as Galaxy Digital, Citadel, Fortress, Pantera, and Brevan Howard fueled these IPO speculations, as these firms are known for their pre-IPO investments.

However, Ripple President Monica Long clarified that the company has no immediate plans for an Initial Public Offering (IPO). Despite dismissing IPO intentions, the recent capital infusion from venture capitalists underscores a strong belief in Ripple's future growth potential. Choosing not to pursue an IPO also suggests Ripple's desire to maintain greater control over its operational direction.

Can Rising Institutional Appeal Shift Sentiment Around XRP?

Similar to many other cryptocurrencies, Ripple's native digital asset, XRP, has been navigating a downtrend. Its recent bearish momentum saw it find support around the $2.20 price level. At the time of reporting, XRP was trading at $2.31, marking a notable rally of over 5% in the preceding 24 hours. This recovery performance outpaced that of Bitcoin and Ethereum, which saw gains of 1.2% and 3.2% respectively during the same period.

XRP's stronger rebound could indicate increased investor confidence, potentially driven by the positive sentiment surrounding the recent venture capital funding. While this recovery might suggest the beginning of a new uptrend, certain on-chain data present a more cautious outlook. Analysis of whale activity, for instance, has shown a leaning towards bearish sentiment. Data from Coinglass on large order book statistics revealed that whales executed net outflows totaling nearly $7 million in the spot market. Furthermore, short positions initiated by these large holders amounted to $338 million, suggesting that whales may be anticipating further price declines or are capitalizing on the current uptick to secure exit liquidity. This activity could signal potential downside pressure in the near term, especially if current demand levels are insufficient to absorb the selling pressure, possibly leading to a retest of the $2 support level.

XRP Bulls Have a Major Catalyst in Their Arsenal

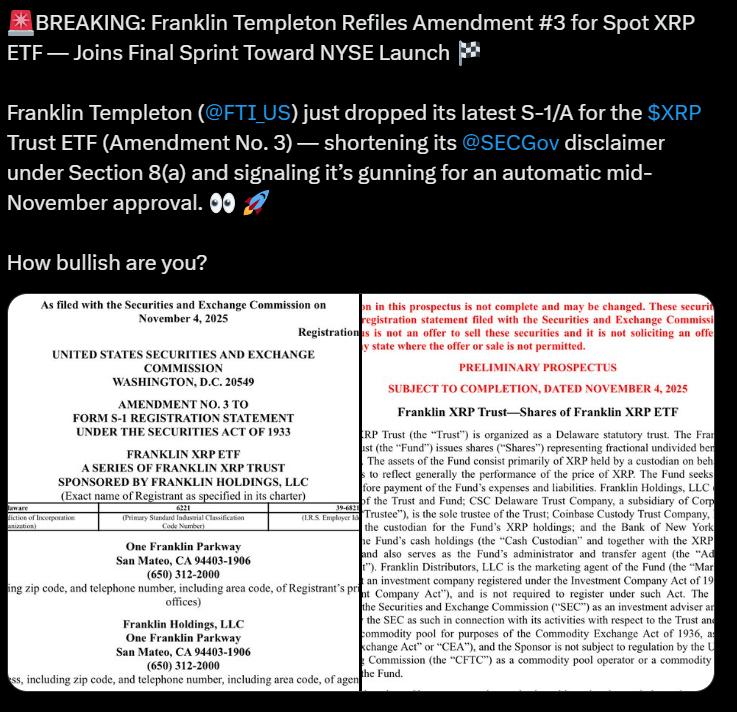

Beyond the recent VC funding and the significant $40 billion valuation, the prospects of an XRP Exchange-Traded Fund (ETF) are emerging as a key driver for bullish sentiment surrounding Ripple and XRP. News regarding XRP ETF applications has been gaining traction, further bolstering positive sentiment for the cryptocurrency. A significant development in this area is Franklin Templeton's filing of another amendment for its XRP ETF application.

Reports suggest that Franklin Templeton is targeting a mid-November approval for its ETF, potentially as early as the following week. Adding further weight to these expectations, the same ETF has been listed on the DTCC. Such listings are often precursors to regulatory approval, strengthening the likelihood of approvals in the coming week. The Franklin Templeton XRP ETF is not the only contender seeking regulatory clearance. Steven McClurg, CEO of Canary Capital, indicated earlier this week that his company is prepared to launch its XRP ETF, hinting at a potential launch also occurring next week. The approval of XRP ETFs is anticipated to usher in a significant period for the cryptocurrency, with the potential for substantial institutional inflows to support its recovery once the broader market enters another bullish phase.