Ripple's preliminary Electronic Money Institution (EMI) authorization from Luxembourg's financial regulator has generated significant interest across Europe's financial and crypto communities. This development raises important questions about the future influence of regulated blockchain systems on cross-border payments. The news has captured the attention of students, analysts, institutional observers, and developers who closely monitor the adoption of blockchain technology in real-world applications and Europe's increasing emphasis on compliance-led digital finance.

This preliminary approval marks an early step toward full licensing across the European Union. It follows closely on the heels of the United Kingdom granting Ripple Markets UK Ltd regulatory authorization to issue e-money and operate payment services.

These coordinated decisions reflect a notable shift in Europe's approach to digital assets, with regulators now favoring transparent, supervised frameworks over unregulated experimentation. Analysts suggest this alignment strongly indicates the region's readiness for MiCA-driven oversight, where licensing is becoming a prerequisite for operating at scale.

Europe's Appetite for Regulated Blockchain Rails Gains Momentum

The Ripple EMI approval signifies more than just a procedural milestone. Luxembourg has long cultivated its position as a hub for financial innovation, striving to balance technology-driven growth with regulatory discipline. A recent analysis highlights that regulated digital asset providers tend to achieve faster institutional adoption because banks prioritize predictable settlement environments. This perspective aligns closely with Ripple's strategic objective to build compliant, institution-grade payment rails for European markets.

Ripple Payments already manages the operational complexities inherent in blockchain settlement. A global financial study emphasizes that institutions increasingly prefer systems that reduce operational friction in multi-currency transfers. By strengthening its regulatory profile, Ripple enables European institutions to integrate real-time settlement channels without depending on slow or outdated infrastructure.

The timing of these developments is particularly critical as Europe prepares for the full implementation of MiCA. This regulation necessitates clearer authorization frameworks for e-money issuance, crypto service providers, and blockchain-based payment systems. Ripple's EMI approval positions the company ahead of these upcoming shifts, offering institutions a regulated, MiCA-aligned partner ready for live deployment.

UK Approval Strengthens Ripple EMI Narrative Across Borders

Ripple's UK authorization significantly bolsters its Luxembourg EMI approval, reinforcing confidence as Europe moves towards full MiCA enforcement. The UK's regulatory oversight demonstrates Ripple's capability to operate payment services under stringent standards. Analysts suggest that these dual approvals send a strong message to banks, remittance firms, and fintech companies seeking compliant and scalable blockchain infrastructure.

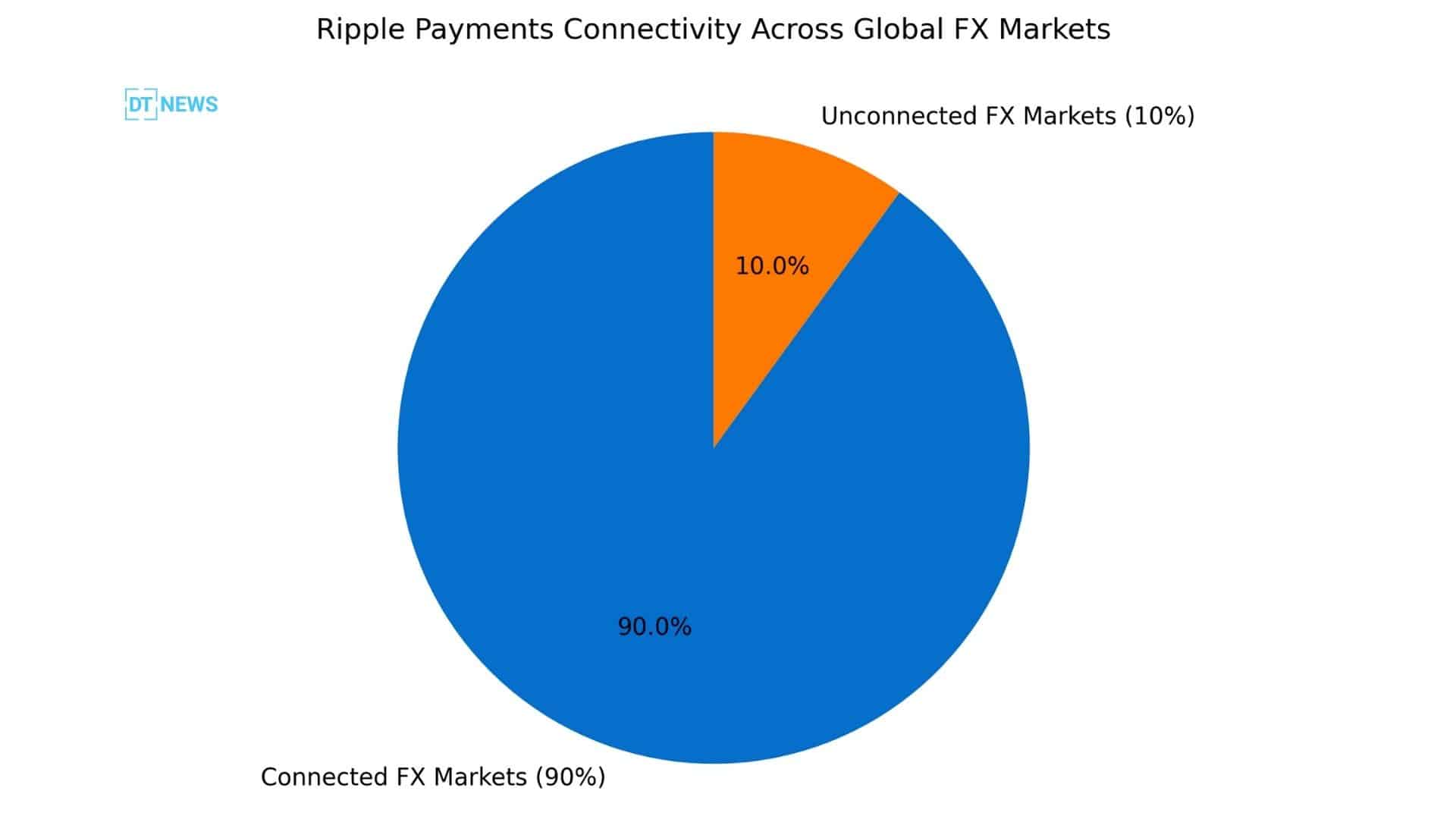

With established teams in London, Dublin, and Luxembourg, Ripple is closely aligned with regional expectations and the needs of institutional clients. Its payment network already connects to most daily FX markets, processing high volumes with reliable settlement speeds.

Market observers report a notable increase in institutional interest following these approvals. Banks are increasingly prioritizing compliance-ready blockchain solutions that align with current and upcoming MiCA requirements.

A Strategic Push Toward Europe’s Institutional Blockchain Shift

The Ripple EMI milestone signals Europe's transition from limited blockchain pilot programs to broader institutional adoption. Luxembourg's receptive stance toward digital assets and its early alignment with MiCA make it an ideal base for Ripple to scale its long-term operations.

Analysts interpret this as a clear indication that Europe's next phase of digital finance will be spearheaded by firms that prioritize licensing, compliance, and transparency.

The cryptocurrency sector is also undergoing maturation, with institutions now favoring partners that adhere to strict supervisory and operational standards. With two major regulatory approvals within a single week, Ripple's momentum highlights the increasing centrality of regulated blockchain systems to Europe's evolving financial landscape.

Conclusion

The Ripple EMI authorization in Luxembourg underscores Europe's decisive shift toward regulated, technology-driven payment systems. As Ripple builds upon its momentum in both the UK and the EU, the company conveys a clear message: the future of digital finance hinges not only on innovation but also on trust, earned through unwavering compliance.

For students, analysts, and developers, this moment highlights the increasingly intertwined nature of regulation and technology within global finance.

Glossary

EMI: A license that allows companies to issue electronic money and provide payment services.

MiCA: The EU’s regulatory framework for crypto assets.

FX Markets: Platforms where currencies are traded globally.

Cross-Border Payments: Transfers made between countries and financial institutions.

FAQs About Ripple EMI

What does preliminary EMI approval mean?

It grants early authorization while the firm completes remaining regulatory requirements.

Why is Luxembourg important for Ripple?

It offers strong financial infrastructure, clear regulatory pathways, and early MiCA readiness.

How does Ripple Payments work?

It supports fast transfers by managing liquidity, compliance, and blockchain operations.

Why does regulation matter in crypto payments?

It builds trust with banks and payment providers that rely on security and transparency.