XRP ETFs Achieve Milestone Growth

Ripple CEO Brad Garlinghouse recently noted that U.S. spot exchange-traded funds (ETFs) tied to XRP have become the fastest offering to reach $1 billion in assets under management (AUM) since Ethereum (ETH) ETFs. This rapid ascent underscores a significant demand for regulated cryptocurrency products.

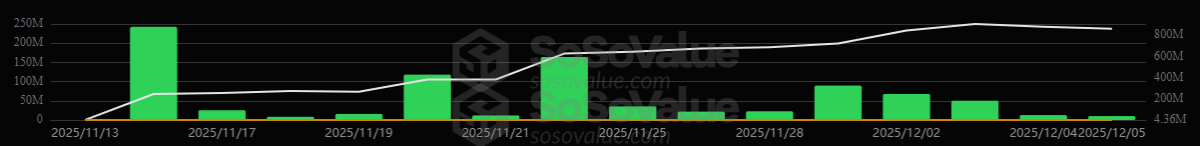

According to data from the on-chain analytics platform SoSoValue, spot XRP ETFs have accumulated a cumulative total net inflow of $897.35 million as of December 5.

The performance of individual XRP ETFs is as follows:

- •Canary XRP ETF (Nasdaq: XRPC): $363.85 million

- •Grayscale XRP Trust ETF (NYSE: GXRP): $211.85 million

- •Bitwise XRP ETF (NYSE: XRP): $187.14 million

- •Franklin XRP ETF (NYSE: XRPZ): $134.50 million

Garlinghouse commented on this trend, suggesting there is a "pent up" demand for regulated crypto products. He further highlighted that with initiatives like The Vanguard Group's plan to offer crypto exposure through its products, digital assets are becoming accessible to a much wider audience.

The Ripple CEO also emphasized that themes such as longevity, stability, and community are often underestimated but are crucial for this new demographic of "offchain" crypto holders.

Steven McClurg, CEO of Canary Capital, echoed this sentiment, stating that his fund identified strong institutional demand for XRP.

We are very humbled to be a part of this. I spent the majority of my career managing institutional money, and Canary identified the strong institutional demand for XRP. Watch RLUSD blow past other stable coins under the guidance of Brad and the Ripple team. The growth of the two… https://t.co/8wlZ5Kx6UL

— Steven McClurg (@stevenmcclurg) December 8, 2025

McClurg also advised his followers to pay attention to RLUSD, Ripple's stablecoin, noting that its growth is closely tied to that of XRP.

Comparison with Other Crypto ETFs

In comparison, spot Bitcoin (BTC) ETFs, which launched in January 2024, have garnered a cumulative total net inflow of $57.62 billion. BlackRock led this category, with its ETF accumulating $57.62 billion in assets.

For spot Ether ETFs, launched in July 2024, the total net inflow figure stood at $12.88 billion. BlackRock also led this segment, with $13.09 million in assets.

Current Crypto Market Performance

The overall cryptocurrency market cap was $3.08 trillion at the time of writing, reflecting a 0.8% decrease over the past 24 hours.

Bitcoin was trading at $90,303.14, down 1.2%, while Ethereum was exchanging hands at $3,123.77, down 0.5%.

Despite attempts to recover, XRP saw a 0.5% decrease in its value over the day, trading at $2.08.