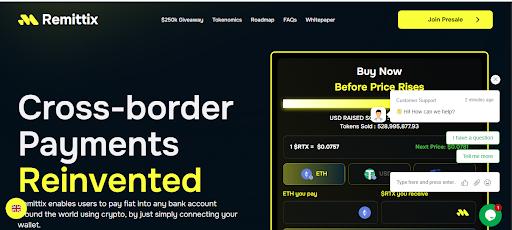

Remittix exemplifies a significant shift in the cryptocurrency market, having successfully raised over $28 million and garnered more than 40,000 holders. Analysts are already positioning it as a potential 100x cryptocurrency.

In contrast, HBAR is trading near $0.16 after a 0.4% dip, a decline attributed to failed institutional ETF expectations. Similarly, AVAX is struggling to maintain its position at $15.56, with a notable 34% drop in network activity. This trend suggests a clear investor migration towards projects that address tangible, practical problems, while abstract or slow-moving layer-2 alternatives are rapidly losing traction.

Hedera's enterprise partnerships have largely remained in the pilot phase, and Avalanche's DeFi ecosystem is experiencing a decline in user engagement despite ongoing technical enhancements. Investors are now faced with a critical decision: to hold onto legacy projects with years of unfulfilled promises or to participate in a presale backed by demonstrable adoption and utility.

HBAR’s Enterprise Dream Faces Retail Reality

Hedera is approaching a critical one-day order block zone, ranging from $0.1428 to $0.1516. A successful hold within this range could significantly alter the price action, potentially providing the momentum needed to reach the next resistance zone around $0.18.

The structure of Hedera's Governing Council, intended to ensure stability, inadvertently discourages decentralized investors. This suggests that HBAR may remain constrained by presale-era valuation perceptions, while genuine utility is increasingly being adopted by other projects.

AVAX Shows a Liquidity Illusion

Avalanche is currently positioned within a key buyer zone, fluctuating between $15 and $15.5. The Relative Strength Index (RSI) is indicating higher lows even as the price continues to decline, which could signal an impending bullish reversal.

Maintaining a position above the $14.40 support line could lead to a substantial bounce. However, a breach below this level might result in a more significant downturn, testing lower price points.

In the short term, market indicators are mixed, prompting traders to closely monitor for any definitive signs of a trend shift.

The organic demand for AVAX has diminished, creating an opening for solutions like Remittix, which generate substantial transaction volume without demanding extensive DeFi expertise from users.

Remittix: Shipping Utility Today

Unlike HBAR and AVAX, Remittix is already operational. The project has attracted over $28 million in funding and boasts more than 40,000 holders, alongside 370,000 participants in its giveaway. Remittix supports over 40 cryptocurrencies and 30 fiat currencies, with its planned wallet launch in 2025 positioning it significantly ahead of established chains.

Why Remittix Stands Out

- •Facilitates direct crypto-to-bank settlement in over 60 countries, featuring real-time foreign exchange conversion.

- •Implements a deflationary model that burns 10% of every transaction, fostering automatic value appreciation.

- •Has received CertiK's seal of approval and ranks highly on pre-launch lists, indicating strong investor confidence.

- •Operates across multiple blockchain networks, including Bitcoin, Ethereum, Solana, and Tron, addressing the complexities of inter-chain transfers.

The final opportunity for early participation is rapidly closing, with the $250,000 giveaway having surpassed 370,000 entries. Additionally, the 15% USDT referral program is actively generating passive income for presale participants. The wallet beta is currently active, audits are complete, and exchange listings have been confirmed. Once the RTX token is listed on centralized exchanges, the current presale pricing will be discontinued.

Investors who participate now will not only acquire tokens but also gain stakes in an infrastructure designed to replace traditional remittance services like SWIFT and Western Union. While HBAR and AVAX have had years to make a market impact, Remittix has been actively disrupting the space for months.