A System Struggling to Hold Together and a New Layer Emerging from its Cracks

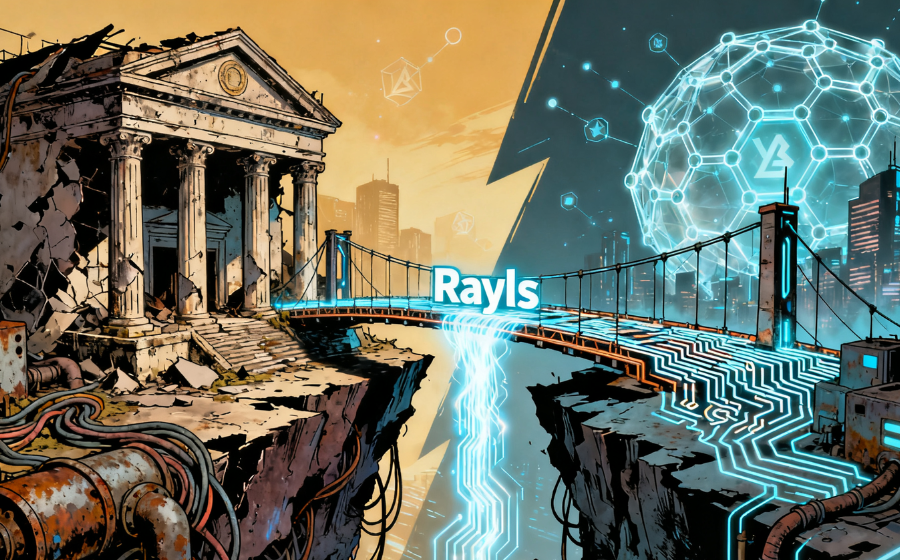

The global financial system, once perceived as a robust edifice, now appears as a machine undergoing critical repairs mid-operation. Cross-border payments navigate a complex network of intermediaries, securities settlement involves extensive reconciliation processes, and regulators rely on delayed reports to assess evolving risks. Concurrently, the onchain world operates with a distinct dynamism, characterized by real-time fund movements, volatile liquidity pools, and smart contracts executing markets at speeds unattainable by legacy systems. These two environments diverge not only in technology but also in their fundamental worldviews. Traditional finance prioritizes privacy as a cornerstone of stability, while onchain systems emphasize transparency as the basis of trust. One side conceals excessive information, the other exposes too much. For a decade, attempts to bridge these realms have proven unsuccessful. Enterprise blockchains have replicated private intranets, and public chains have offered no protection for sensitive data, leading to repeated impasses and a widening chasm between them.

Rayls was conceived within this very gap. It eschews the established positions of traditional finance or the onchain world, aiming instead to construct a framework previously deemed impossible. Each bank operates its own EVM chain within its secure domain, ensuring sensitive data never leaves its perimeter. Institutions collaborate through encrypted subnets, granting them access only to necessary information. Assets traverse a zero-knowledge bridge, arriving on the Rayls public chain with verified compliance. This architecture provides regulators with real-time visibility while institutions retain complete data control, and developers can build without adopting new tools, all while granting assets access to open liquidity. Privacy is redefined to eliminate obscurity, and transparency is re-envisioned to avoid overexposure. Rayls functions as a novel financial species, emerging precisely from the disintegration of the existing system, driven by necessity rather than ideology.

A Privacy Layer That Rewrites How Financial Systems Balance Secrecy and Oversight

Traditional cryptocurrency privacy solutions operate at two extremes: either complete visibility or absolute concealment. However, real-world finance has never adhered to such binary principles. Banks cannot disclose their trading activities, and competitors cannot ascertain each other's positions. Yet, regulators require a clear view of systemic risk. Institutions necessitate isolated ledgers, but assets must flow freely between them. Data must remain encrypted, but its validity must still be confirmed. These inherent contradictions define the unwritten rules of global finance, and for ten years, no blockchain architecture has successfully encoded them. Rayls introduces a paradigm shift with Enygma, its privacy execution layer. This technology not only conceals data but also makes encrypted transactions verifiable. It enables balances to update in ciphertext and grants regulators a viewing key, allowing them to observe the risk structure without accessing sensitive commercial details. For the first time, privacy and supervision coexist within the same framework, providing regulators with continuous visibility, institutions with preserved secrecy, and the network with maintained cryptographic integrity.

Rayls also mirrors the organizational structure of real financial infrastructure. Privacy nodes serve as the sovereign territory for each institution. Value exchange subnets function as encrypted diplomatic zones for interbank workflows. The Rayls public chain acts as the global gateway where assets gain controlled liquidity. These layers are not merely connected; they are linked through zero-knowledge proofs, ensuring that identity rules and compliance attributes persist across every transaction. EVM compatibility opens this domain to thousands of developers who were previously excluded. Furthermore, Rayls' forthcoming Axyl consensus mechanism is designed for sub-second finality, not to compete in transaction speed races, but to meet the stringent settlement certainty required for FX, government bonds, and institutional flows. Rayls' objective is not to accelerate blockchains but to enable them to function like the systems that manage substantial financial transactions.

When Central Banks, Clearing Giants, and J.P. Morgan Enter the Room, the Story Turns into Reality

In institutional finance, the ultimate validation comes from actual adoption by key players. Rayls has successfully undergone three critical trials that few technologies ever achieve. The first was with the Central Bank of Brazil. Drex, a leading wholesale CBDC project globally, faced the challenge of enabling banks to maintain transaction privacy while allowing the central bank real-time oversight of systemic risk. Transparent chains expose all data, while private chains hide everything. Rayls' encrypted nodes and Enygma layer provided a solution to this paradox. Banks utilized digital reais to acquire tokenized bonds within an encrypted environment, and the central bank could monitor risk without viewing individual trades. This represents a validation at a sovereign level.

The second trial involved Núclea, the institution responsible for Brazil's national clearing and payment infrastructure. Núclea selected Rayls to tokenize and settle receivables. This pipeline processes over ten thousand real-world assets weekly, impacting supplier cash flow, business creditworthiness, and bank liquidity. This is not a test environment; it is a live production system where failure would have tangible economic consequences. Rayls' performance in this critical application demonstrated its capability to manage national-scale financial flows.

The third and most demanding trial came from J.P. Morgan's Project EPIC, a rigorous evaluation within global finance. Out of six participating privacy solutions, Rayls emerged as the top performer. EPIC assessed the most challenging requirements for institutional blockchain design, including identity integration, encrypted validity, cross-chain composability, compliance inheritance, and regulator visibility. Rayls' success signifies its recognition by an institution with unparalleled expertise in modern financial infrastructure. These three trials collectively elevate Rayls from a mere project to a foundational infrastructure.

Rayls is Not Competing to Be a Chain — It Is Positioning Itself as the Interface for Global Asset Flow

Rayls' ambition extends beyond becoming another L1 or L2; it aims to establish itself as the essential interface layer for all assets entering the onchain world. Public chains struggle to meet regulatory demands, alliance chains lack sufficient liquidity, and bank-built chains can create conflicts of interest, while cross-border regulation remains fragmented. Rayls operates at the nexus of these constraints. It is independently governed by a foundation, not owned by any single bank. It mandates KYC compliance, facilitating regulatory approval, and its EVM compatibility empowers developers to build applications. Its encrypted bridge allows assets to access open markets without exposing sensitive data. Rayls functions more as a crucial financial protocol—a neutral gateway for tokenized government bonds, receivables, deposits, fund shares, FX positions, and many other assets—that the world has lacked for decades.

The global real-world asset (RWA) market is projected to reach trillions in the coming cycle. Every jurisdiction seeks a secure pathway to tokenize real assets onchain while maintaining regulatory control and safeguarding private information. Rayls is actively shaping itself to fulfill this need. As it transitions from an Ethereum L2 to its own L1, Rayls is not distancing itself from the ecosystem but rather preparing to become the standard interface for verifying, transferring, and supervising real assets onchain. Rayls is not engaged in a battle for market share; it is competing to define the future standard for global asset movement.