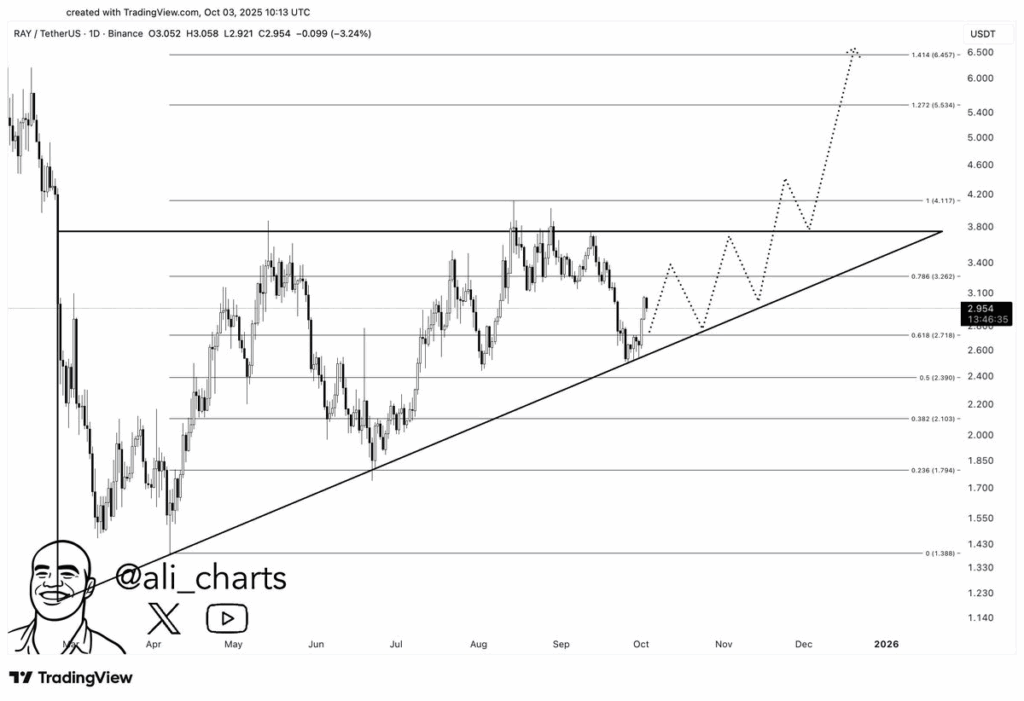

- •Raydium’s accumulation zone continues with a breakout target of $6.50 aligning with Fibonacci extension levels.

- •Market cap at $785M and TVL of $2.54B suggest undervaluation against circulating supply dynamics.

- •Resistance near $3.80 remains the key hurdle before higher levels can be tested with stronger volume.

Raydium ($RAY) remains stuck on an accumulation set up, and traders can observe resistance levels that can establish a pathway to a possible breakout at $6.50. Market data shows steady liquidity inflows and a resilient technical setup.

Raydium consolidates before a potential breakout

Raydium ($RAY) continues to trade within a prolonged accumulation zone that has developed over several months. Price structure indicates steady higher lows supported by an ascending trendline, signaling controlled demand despite market resistance.

According to analyst Ali (@ali_charts), $RAY remains coiled for expansion with a projected breakout level marked at $3.80. The technical target of $6.50 corresponds with the 1.414 Fibonacci extension, aligning with the broader setup. The consolidation is considered a preparatory phase before larger moves.

Raydium is at the time of writing, valued at 2.93, which is close to the 0.618 Fibonacci retracement at 2.71. This area has repeatedly provided a base for rebounds, suggesting that buyers continue to defend the mid-range zone effectively.

Resistance levels shape short-term trading dynamics

The intraday performance revealed active rejection around $3.06 before retracing under the $2.95 mark. The $3 psychological level remains a barrier where sellers take profits, preventing clean upside continuation. Sustained movement above $3.80 is required for a breakout confirmation.

The dotted projection in the shared chart suggests possible oscillations within the triangular range. These movements may persist until momentum builds to challenge resistance decisively. Such extended consolidation periods often strengthen the long-term technical case.

The trading volume is at $51.5 million in 24 hours which is healthy when in comparison with the market capital of $785 million. Such liquidity guarantees that both the retail traders and the larger accounts participate in an orderly manner to minimize the volatility risks associated with thin markets.

Fundamentals point to undervaluation potential

Raydium’s circulating supply is at 268 million tokens against a total of 555 million, meaning less than half is active. This balance leaves room for supply expansion, but also requires demand growth to offset future unlocks.

The fully diluted valuation (FDV) at $1.62 billion positions Raydium at nearly double its current capitalization. This reflects the effect of future supply, though strong adoption may ease dilution pressure. Investors watch carefully for vesting schedules and emissions that could influence price stability.

Total Value Locked (TVL) at $2.54 billion is a standout measure, exceeding three times the current market capitalization. This ratio suggests that Raydium’s token utility is deeply embedded across liquidity pools and DeFi operations, adding weight to the undervaluation case.