Nigeria’s cryptocurrency landscape has historically been shaped by concerns over scams, capital flight, and a perceived loss of control. These anxieties culminated in a 2021 ban that effectively pushed the entire industry underground. Four years later, the country is now attempting to navigate out of this climate of apprehension by designing a new regulatory approach.

Last week, the House of Representatives’ ad hoc Committee on the Economic, Regulatory, and Security Implications of Cryptocurrency Adoption convened with key figures from the crypto industry. Among them, Senator Ihenyen, the executive chair of the Virtual Assets Service Providers Association of Nigeria (VASPA), urged the lawmakers to move beyond a mindset of fear. He emphasized that Nigeria requires a clear, unified, and comprehensive Virtual Assets Act to foster responsible innovation and adoption.

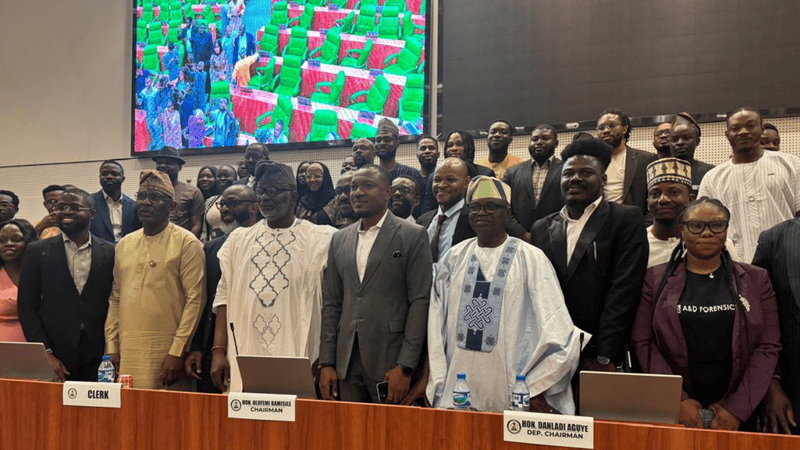

The House committee, comprising 27 members from capital markets, financial services, and cybersecurity backgrounds, has initiated a deliberate process of engagement. Ihenyen noted a palpable sense of genuine curiosity among the lawmakers, who seemed eager to understand the perspectives of industry operators. He described the interaction as a real engagement rather than a mere formality.

Current Reality: Paper Recognition Meets Persistent Friction

A significant disparity persists between regulatory pronouncements and practical implementation. While the Investment and Securities Act (2025) now formally recognizes digital assets as securities, bestowing a degree of legitimacy upon the industry, the Central Bank of Nigeria (CBN) continues to approach cryptocurrencies with extreme caution.

Ihenyen argued that the CBN has not fully abandoned its 2021 mindset, and its overly cautious stance, while appearing responsible, fails to inspire confidence within the industry.

Even after the CBN issued new guidelines in 2023, which effectively lifted the previous ban, the central bank’s communication channels remained indirect. It engaged solely with licensed financial institutions, bypassing direct interaction with virtual asset service providers.

Ihenyen expressed his disappointment, stating that attempts to regulate virtual asset service providers without their direct involvement would not foster the necessary level of confidence.

This situation has resulted in a state of bureaucratic limbo, where cryptocurrency is simultaneously acknowledged as legal and viewed with suspicion, recognized yet heavily restricted. For startups operating with limited resources, this pervasive uncertainty is stifling.

Compounding the regulatory challenges is a fundamental lack of institutional trust. Agencies such as the CBN, the Securities and Exchange Commission (SEC), and the National Security Adviser (NSA) often operate with conflicting objectives, each asserting authority over the same domain.

The SEC classifies all digital tokens as securities, while the CBN largely perceives them as speculative threats. The NSA continues to enforce a blockade on major crypto websites, initially implemented in early 2024 to protect the naira from perceived manipulation.

Ihenyen deems this policy unsustainable. He argued that without specific charges or investigations, there is no justification for the continued blacklisting of these websites, asserting that such actions contradict the Money Laundering Act, the Terrorism Act, and even Financial Action Task Force (FATF) standards. He highlighted that the global standard emphasizes licensing and supervision, not outright bans or blacklisting.

Legislating the Virtual Asset Law Nigeria's Crypto Industry Needs

The proposed Virtual Asset Law of Nigeria aims to replace the current uncertainty with a structured regulatory framework. VASPA has put forth several key recommendations:

- •Unified Regulation: The law should clearly delineate responsibilities among the CBN, SEC, and other relevant agencies to eliminate overlapping mandates and inter-agency conflicts.

- •Risk-Based Classification: A distinction should be made between utility tokens, payment tokens, and security tokens, as a one-size-fits-all approach, according to Ihenyen, would stifle innovation.

- •Tiered Licensing: Entry barriers for startups should be reduced, with oversight scaled according to the associated risks. Ihenyen explained that higher risk levels would necessitate higher requirements.

- •Legal Clarity for P2P Transactions: Peer-to-peer (P2P) trading should be recognized as a legitimate and regulated activity, rather than being treated as a regulatory loophole.

Upon enactment, this law would transition cryptocurrency from being a tolerated entity to an integrated component of Nigeria’s capital markets. It would establish clear compliance channels, safeguard consumers, and encourage investment.

Ihenyen clarified that his advocacy is not for deregulation but for intelligent regulation grounded in dialogue rather than fear.

He cautioned that without cooperation, Nigeria risks perpetuating a cycle of fear-driven bans, which in turn drive activity underground, subsequently fueling further apprehension.

Significantly, for the first time in years, Nigeria’s cryptocurrency discourse appears to have a defined direction, with both chambers of the National Assembly indicating alignment on the necessity of a comprehensive framework.

While the legislative process may be gradual, the House committee is expected to continue its consultations with stakeholders and develop draft legislative text based on the submissions from VASPA and other industry operators. This draft will then undergo committee review, seek cross-chamber support, navigate inter-agency harmonization, and ultimately proceed to final passage into law.