Tokenized Real World Assets have become integral to DeFi in recent years; and what started as a blip in the matrix has started turning heads.

RWAs are bridges between #TradFi and #DeFi, one that is growing increasingly relevant with the involvement of web2 giants in DeFi, especially with the approvals of various ETFs in the past few years.

Many #RWAs have sprung up, providing access to market options that would otherwise be beyond the reach of an average degen. For instance, with $PAXOS, you can have access to an ounce of real gold per token purchased- and with it an exposure to the gold market. Other such options include government bond from $ONDO and real estate from $BUIDL.

Exposure to RWAs gives large-stake participants, like institutions, a better sense of security than the typical DeFi product.

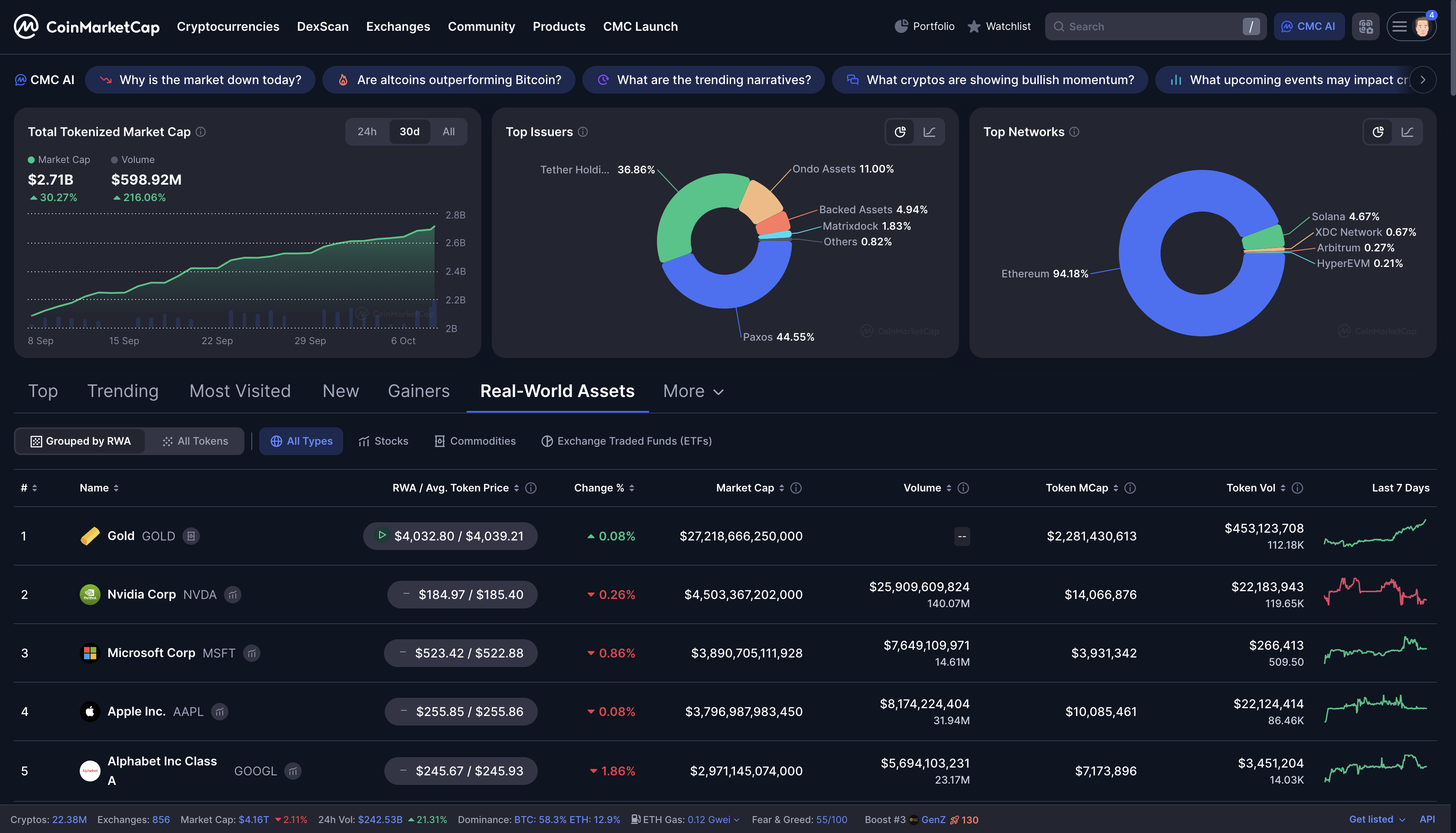

A quick glance at top traded RWAs would show some crucial information:

- •The total RWA (on-chain) mcap is $2.71B

Given the total crypto mcap of $4.1T, RWAs are definitely in an early growth phase. It will not be out of place to expect this niche of web3 to hold a $Trillion mcap for itself. As such, it can be said that the pie is literally on the table.

- •By protocol, Tether accounts for $1B mcap while PAXOS accounts for $1.2B

Tether investments, majorly $Gold, constitute a significant portion of the mcap, trailing PAXOS (also $Gold) by $200M. It is easily inferred that Gold is capturing most attention in this ecosystem.

- •Majority of all RWAs are settled on #ETHEREUM

Despite it being expensive and relatively slow, #Ethereum remains the choice blockchain for RWA settlement with 94% of all RWAs trades being conducted on the chain. It is surmised that web2 participants, like early web3 OGs, value the robust security architecture, and scalability of #Ethereum over any features on other chains like low fees and faster tpm. However, #Solana with a marketshare of 4.7%, is a chain that shows increasing promise.

- •By tokens, $Gold is the ‘only’ popularly traded commodity, and the first RWA by mcap at $2.2B.

I expected to see more commodities being traded but to my dismay only $Gold and $Silver seemed to make the cut, with the latter leaving an almost negligible trail. This is however another testament to the fact that there remains an immense opportunity to be explored in the ecosystem.

- •The next 50+ RWA by mcap are stocks with $TESLA leading the pack.

This is as expected. The major allure of RWAs is the feature of decentralized access to the stock markets. However these are still in their infancy, with the leading stock $TESLA having a measly mcap of $39M.

- •The total mcap is on an uptrend

Indeed, when you analyse the chart below, you can infer that total RWA mcap is on an uptrend, with a sharp rise in the past 2 months. Individual chart analysis tells a different story though. Gold is the consistent “uptrender” in this story and it seems to be carrying the whole group. Again, this is not shocking; RWAs of course model the real world afterall. Majority of stocks saw a steep decline a few months ago, that saw their values fluttering since then. Gold, on their other hand, has had a great run, despite the general market condition. Just this morning, it reached another ATH.

In conclusion, Real World Asset tokenization is a growing sector worthy of a smart investor's attention. Despite the industry's focus on Ethereum as a trusted blockchain, investors should be on the lookout for opportunities on emerging blockchain like Solana and HyperEVM. The most profitable traders trade $GOLD, as of today, however, low‑hanging fruits in stocks should be added to watchlist, especially as they gain more traction.

An important RWA option is real estate which grants access to real proven value and potentially appreciates forever. Think of apartments on-chain, booking travels and hotels on-chain, e.t.c. This is the superpower that RWAs are.

Discuss more: x.com