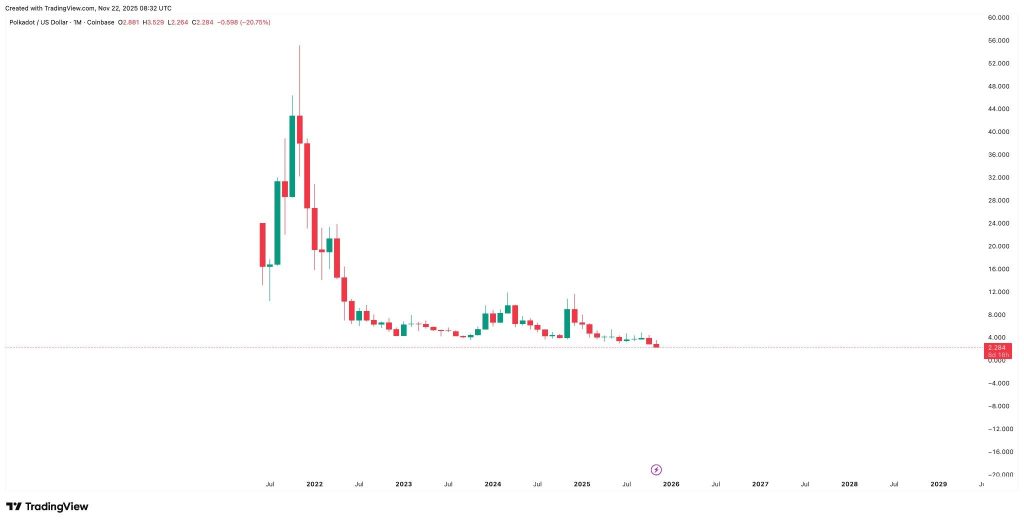

The Polkadot (DOT) price has been experiencing a prolonged period of consolidation, with limited bullish momentum. However, recent price action suggests a potential shift, as DOT revisits critical support levels that have historically acted as floors.

Currently, DOT is trading near the $2.29 mark, a zone that has repeatedly prevented further price declines throughout the year. This presents a crucial juncture, raising questions about whether this support will hold and pave the way for a recovery towards the $5.00 target.

DOT Reclaims Key Support Level

According to analyst Erick Crypto, DOT recently experienced a bounce from the $2.29 support level, rallying to $3.50 before encountering resistance. The price has since retreated to this same support zone, creating a recognizable pattern on the daily chart.

The consistent inability of DOT to break below the $2.29 level indicates sustained buyer interest. While this does not guarantee a bullish reversal, it highlights the significance of this price point and the close attention traders are paying to it.

Despite the seemingly promising technical setup, analysts remain cautious about declaring a new uptrend. Erick Crypto suggests that a move towards $5 is plausible, but only if DOT demonstrates further strength. This could involve reclaiming the $2.80 level, breaking decisively above $3.50, or observing a notable increase in trading volume.

At present, the DOT price is trading quietly above its support, with trading volume remaining thin. This typically signifies indecision rather than strong conviction. Until the market exhibits more confidence, the risk of further downside persists.

The Question of Polkadot's Recovery

A prevailing sentiment within the community questions the potential for Polkadot's recovery. Crypto trader Ray aptly captured this sentiment by asking, “Will $DOT ever recover?”

This sentiment is understandable, given the significant decline in the DOT price from over $50 in 2021 to its current level below $3. Long-term holders have been anticipating a return of momentum for an extended period. However, it is common for assets to spend considerable time building a base before initiating a reversal, and DOT may currently be in such a phase.

Should the $2.29 support continue to hold, the initial resistance to monitor is located around $3.50. A successful breakout above this level could open the path towards the $4.50–$5.00 range, where DOT previously encountered significant selling pressure.

Future Outlook for DOT

The trajectory of the DOT price hinges on its behavior at the current support level. Sustaining this zone, coupled with a period of price consolidation and a modest increase in volume, would suggest a resurgence of buyer interest. Conversely, a breach of this support would likely invalidate the current bullish setup, leading the DOT price to seek lower support levels.

Polkadot stands at a critical decision point. While a definitive recovery has not yet been confirmed, this current support level represents a probable starting point for any potential rebound.