Poland has become the European Union's sole country not to have a domestic framework for crypto-assets, following a failed vote to overturn the president's veto on the Crypto-Asset Market Act. This political deadlock means lawmakers must restart the entire legislative process, even as the rest of Europe prepares for full MiCA enforcement.

Why the Veto Override Failed

The Sejm fell 18 votes short of the three-fifths majority required to override President Karol Nawrocki’s veto of the Crypto-Asset Market Act. The failure exposed a significant political divide between Prime Minister Tusk's pro-EU coalition and Nawrocki's nationalist base.

Prime Minister Tusk had framed the bill as a national security imperative, arguing that digital assets were being exploited for discreet funding channels by Russian intelligence services and organized crime. President Nawrocki, however, rejected this characterization. He viewed the legislation as overly complex compared to similar implementations in other EU states, and expressed concerns that the compliance burden could drive Polish crypto firms to relocate.

Nawrocki's chancellery chief stated that accusing lawmakers of supporting the Russian mafia for voting against the bill was an unfair and exaggerated dichotomy.

Industry Split on the Bill's Impact

The cryptocurrency industry itself was divided on the bill's potential impact. While some organizations advocated for regulatory clarity after years of uncertainty, others warned that the proposed framework was too far-reaching. The CEO of Zondacrypto, one of Poland's largest exchanges, described the bill as a step backward, suggesting its language could inadvertently criminalize legitimate development work in blockchain technology.

This internal division weakened the political momentum that the Prime Minister needed. Without widespread industry support or a united parliamentary front, the presidential veto was upheld.

The Consequences for Poland’s Crypto Landscape

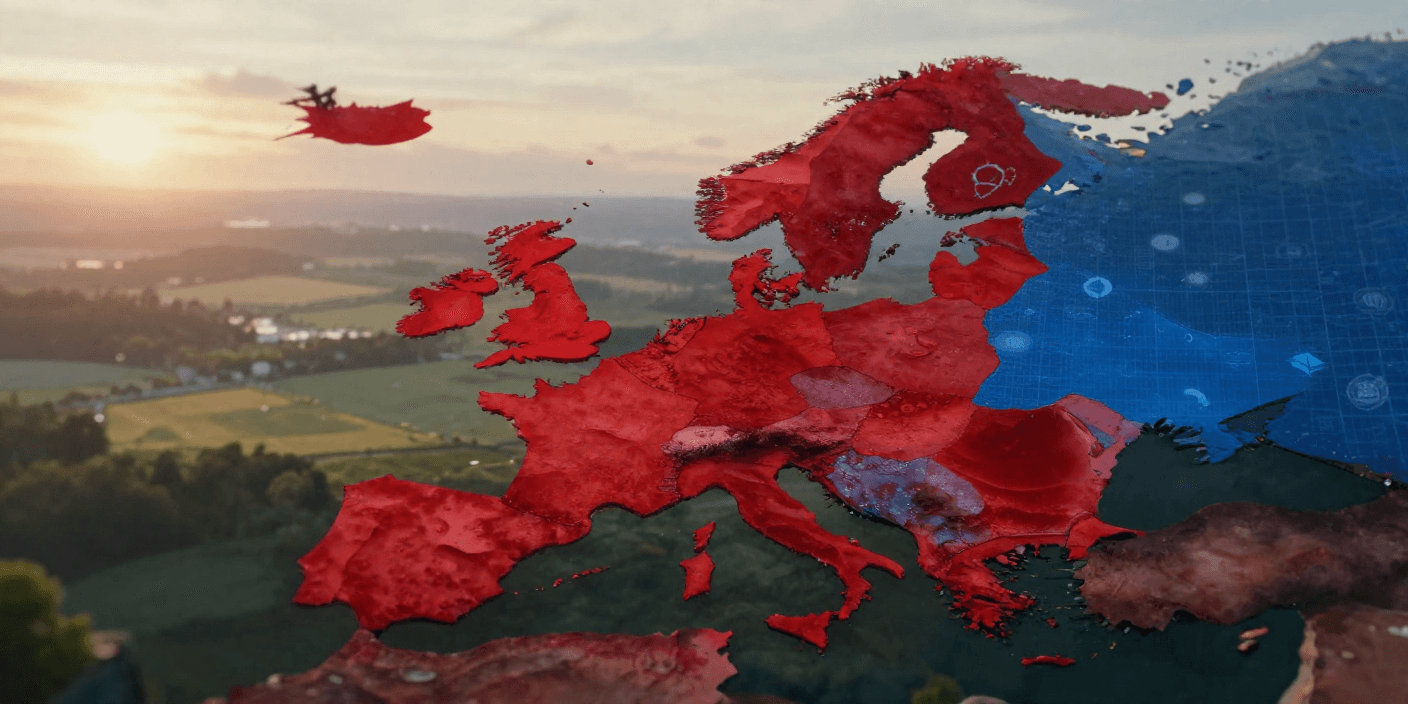

With the bill's demise, Poland is now the only EU member state without a domestic implementation of MiCA. In contrast, countries like Germany, Malta, Lithuania, and the Netherlands have already begun issuing MiCA-compliant licenses. Firms in these jurisdictions are benefiting from early regulatory certainty, operational continuity, and an improved ability to attract capital.

Despite the regulatory stagnation, Poland's crypto market continues to grow. According to Chainalysis data, the country ranked eighth in Europe for crypto value received between mid-2024 and mid-2025, with transaction volumes increasing by over fifty percent year-over-year. Approximately 7.9 million Poles are estimated to use cryptocurrency, indicating rising adoption even as regulation lags.

This combination of high user engagement and a lack of a regulatory framework creates a significant vacuum. Businesses operate in a legal grey area, consumers face uncertain protections, and policymakers are falling behind as the rest of Europe aligns its regulations.

Meanwhile, the Rest of Europe Pushes Ahead

Other EU regulators are actively advancing their own frameworks. Italy has reminded virtual asset service providers of the December 30 MiCA deadline, warning of potential shutdowns for non-compliance. European officials are also exploring the possibility of a single bloc-wide supervisor for crypto exchanges, similar to the U.S. SEC. While such consolidation could diminish the long-term importance of individual state-level implementations, it would require years of negotiation.

For the time being, the domestic framework in each member state dictates how local firms operate, and Poland is the only country without such a framework.

What This Means Going Forward

Poland now faces the challenge of starting anew. Lawmakers must develop a new bill that can garner support from both political factions while ensuring the country remains aligned with the EU's regulatory trajectory. The longer this process takes, the greater the risks for Poland, including increased consumer exposure, potential for regulatory arbitrage, and missed economic opportunities.

Ultimately, Poland did not reject the MiCA bill itself, but rather this specific version of its implementation. However, with the rest of the EU progressing, inaction is no longer a neutral stance; it represents a strategic disadvantage.