Key Tokenomics Insights

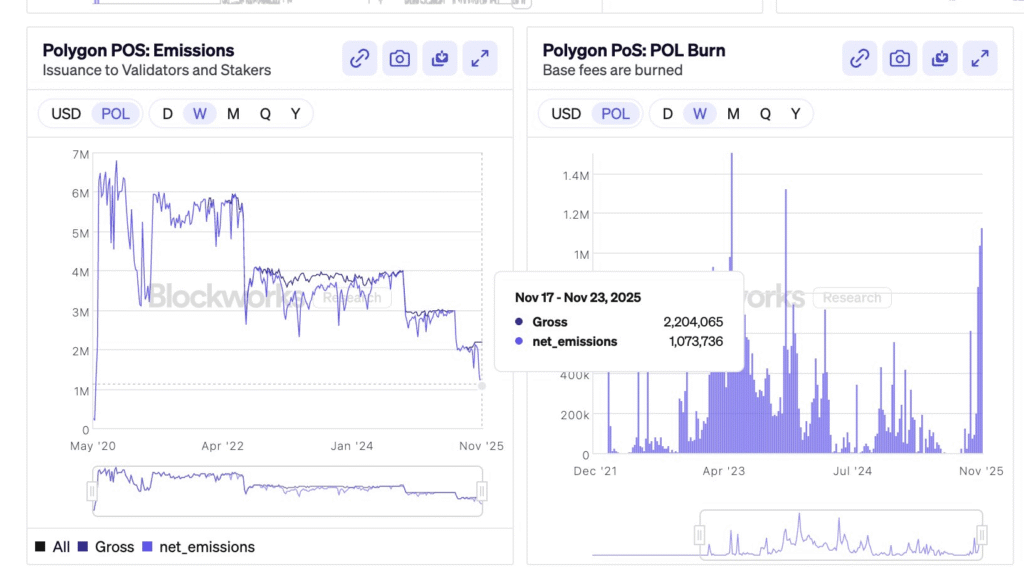

- •POL burns over one million tokens weekly, effectively reducing its total circulating supply.

- •The net inflation rate for POL stands at $140,000 weekly, which is lower than that of most other Layer 1 blockchain tokens.

- •The Relative Strength Index (RSI) is approaching 31.77, indicating that POL is nearing oversold territory.

Polygon's (POL) token is currently trading at $0.1338, experiencing a slight 0.5% dip in the past 24 hours. Despite recent price pressure, current data concerning its tokenomics and burn rate suggests that the token might be undervalued by the market.

POL Price Weakens Amidst Persistent Bearish Momentum

Polygon (POL) is presently experiencing bearish market momentum. The token is trading at $0.1338, marking a 1.11% decrease over the last 24 hours. The current price is hovering near the lower Bollinger Band, which is positioned at $0.1184, suggesting potential oversold conditions. Key resistance levels are identified at $0.1472 and $0.1760, which could represent points where buyer interest might emerge.

The Relative Strength Index (RSI) is currently at 31.77. This level indicates that the token is approaching oversold territory, though a reversal has not yet occurred.

Price momentum has remained weak over the past week as the broader cryptocurrency market undergoes consolidation. Technical indicators suggest that a significant influx of buyers is needed soon to prevent further price declines in early December.

Weekly Token Burns Contribute to Low Supply Pressure

Notwithstanding the weak short-term price action, POL's token mechanics demonstrate stability. According to blockchain analyst crypto_vadim, POL consistently burns over one million tokens each week. This burn rate is attributed to the continuous activity on the Polygon PoS network, where users incur transaction fees in POL.

“POL issuance is at its historical low,” stated crypto_vadim. He further added that “net inflation is just $140,000 per week.”

This low inflation rate is notably favorable when compared to other prominent Layer 1 tokens. Many competing projects exhibit higher issuance rates and less frequent token burns, which can lead to an increase in circulating supply.

Potential Market Mispricing of Long-Term Fundamentals

The POL token, having transitioned from its previous iteration as MATIC, now underpins a wider range of functionalities across the Polygon ecosystem. Analysts suggest that the market might be currently underestimating the significance of this transition. With robust staking mechanisms and substantial burn rates, POL's supply growth is nearly flat, a characteristic that is uncommon among many active blockchain networks.

Despite its declining price in the short term, the network continues to experience steady user engagement. This consistent activity supports ongoing deflationary pressures, which could potentially contribute to price stability over the long term. Traders who solely focus on technical charts might be overlooking these crucial on-chain trends.