💡 Why Stablecoin Infrastructure Matters Now

The global stablecoin market has exploded past $160 billion, growing faster than any other crypto sector.

But here’s the truth: most stablecoins still live on networks that weren’t designed for them. High gas fees, slow confirmation times, and lack of fiat access make them hard to use for the next billion users — especially in emerging markets like Nigeria, India, Bangladesh, Brazil, and Turkey.

This is where Plasma steps in — not as a competitor to Ethereum or Solana, but as the first blockchain purpose‑built to move digital dollars freely, instantly, and cheaply.

💤 Plasma Network: Money 2.0 Infrastructure

Unlike other L1s that focus on DeFi, NFTs, or gaming, Plasma is laser‑focused on stablecoin usability. Here’s what makes it revolutionary:

🔹 Zero‑Fee USDT Transfers — making micro‑transactions and remittances viable again.

🔹 Localized On/Off‑Ramps — Plasma integrates directly with fintechs, exchanges, and cash networks to bridge fiat ↔ crypto.

🔹 Custom Gas Models — dApps can sponsor fees or denominate gas in stablecoins, reducing user friction.

🔹 Confidential Transactions — optional privacy layers for payments and enterprise use cases.

🔹 Institutional Access Layer — built to plug into banks, payment gateways, and stablecoin issuers.

Essentially, Plasma is the Layer 1 designed for stablecoin velocity — not speculation.

💰 A Launch Backed by Real Liquidity, Not Promises

Most blockchains launch with buzzwords and thin liquidity. Plasma launches with $3+ billion in confirmed liquidity on day one.

✅ $2.5 B+ USD₮ Liquidity from deposit campaigns and Binance Earn users.

✅ $500 M ETH Liquidity via EtherFi restaking pools.

✅ $200 M SyrupUSDT (Maple) + $250 M USDai (USD.ai) integrations.

✅ $50 M public sale, oversubscribed 7× with $373 M in commitments.

That’s not marketing fluff — that’s actual capital ready to move through Plasma’s payment rails.

💻 The Economic Vision Behind Plasma

The Plasma vision goes deeper than DeFi yields or transactions per second. It’s about monetary accessibility — making digital dollars usable by anyone with a phone.

While Ethereum built programmable money, Plasma is building programmable finance infrastructure:

- •Stablecoin remittance rails across borders

- •Merchant payment networks for local businesses

- •API gateways for fintechs to plug into stablecoin payments

- •Credit and yield markets denominated in USD

Imagine a world where a user in Lagos can send $10 instantly to a freelancer in Manila, who spends it directly through a Plasma One Card — all without touching a bank or paying a cent in fees. That’s the future Plasma is building.

💳 Plasma One: The Gateway to Real‑World Usage

Plasma One is the project’s consumer‑facing bridge — a neobank + debit card system that allows stablecoin users to:

- •Deposit, withdraw, and spend USDT seamlessly

- •Access yield‑bearing DeFi products directly from the app

- •Get a virtual or physical card linked to their Plasma wallet

- •Withdraw at supported ATMs and pay at stores

Where traditional DeFi stops at “yield,” Plasma One goes to “daily utility.”

It effectively turns stablecoins into a global bank‑account alternative — something 1.7 billion people still don’t have.

🚀 Ecosystem at Launch

Plasma’s launch ecosystem is unusually robust — not a barren chain with empty TVL dashboards. From day one, major protocols are integrated:

- •Aave — lending and borrowing for stable assets.

- •Ethena — synthetic yield and delta‑neutral products.

- •Maple Finance — institutional credit pools.

- •Fluid — liquidity aggregation and cross‑chain swaps.

- •USD.ai — algorithmic stable‑yield systems.

- •EtherFi — ETH staking & restaking layer.

This is the kind of economic base‑layer that ensures users, liquidity, and capital all converge organically.

🔍 Institutional Attention & Credibility

Independent research firms like Delphi Digital, DeFiLlama Research, Tiger Research, and Kairos Research have already covered Plasma — a rare sign of early institutional acknowledgment for a still‑young network.

That coverage reinforces the message: Plasma is being built not as a meme, but as a settlement layer for stablecoin economies.

⚡ Binance Integration: The Acceleration Layer

Here’s where the Binance partnership amplifies everything.

- •Binance users can earn and hold $XPL through Binance Earn integrations.

- •$1 B+ of stablecoin liquidity already migrated through Binance users.

- •Plasma is part of Binance’s global affiliate program, enabling influencers and community leaders to onboard users directly.

- •Binance’s infrastructure (Launchpad, Earn, Card, Pay) synergizes perfectly with Plasma’s payment‑first design.

That’s not random collaboration — it’s Binance aligning its user base with Plasma’s stablecoin rails to create a full‑circle ecosystem.

💪 The Bigger Picture: Why $XPL Matters

$XPL isn’t just the native token — it’s the heartbeat of the system.

It powers:

- •Transaction validation

- •Stablecoin liquidity pools

- •Payment settlements

- •Governance and staking

- •Gas abstraction and cross‑app rewards

But unlike most L1 tokens, $XPL’s long‑term value derives from real financial volume — not speculative cycles.

As stablecoin usage grows, the demand for Plasma’s settlement capacity and gas layer increases — directly feeding value back into $XPL.

💵 The Stablecoin Race: Plasma vs The World

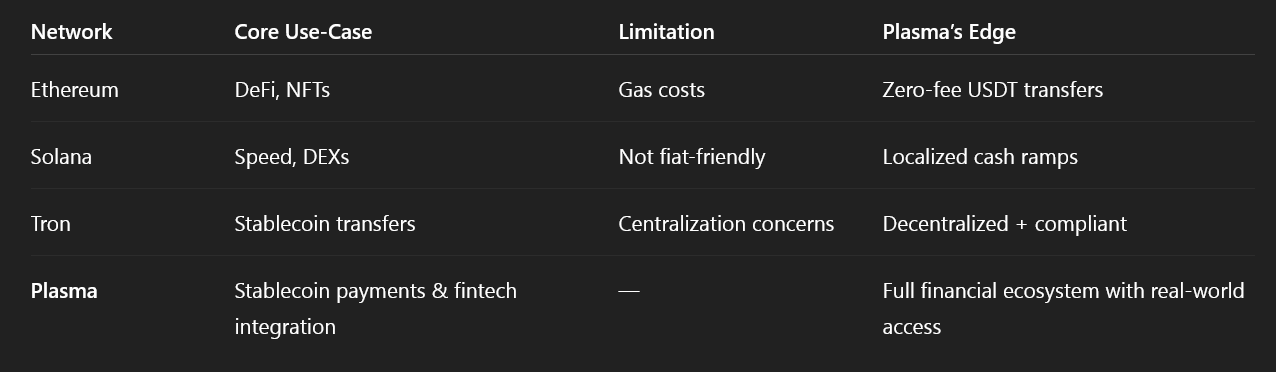

While Ethereum remains the DeFi hub, and Solana dominates trading activity, Plasma is carving out a new vertical: “Payments & Financial Access.”

This makes Plasma the “Stablecoin Layer” that complements, not competes with, existing ecosystems.

🔗 Get Started Today

🌐 Explore the Plasma Network ($XPL): https://www.plasma.to

The future of borderless stablecoin finance has begun.

🚀 Be part of the ecosystem that’s transforming digital dollars into real‑world currency.

#Plasma #XPL #Binance #Stablecoins #CryptoPayments #DeFi #fintech #Layer1 #EmergingMarkets #Web3 $XPL