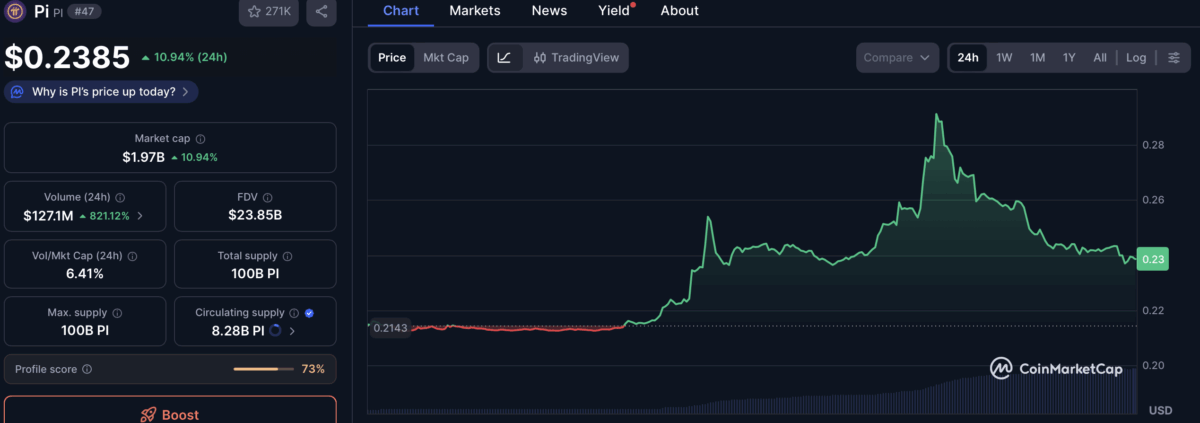

Pi Coin (PI), the native token of the Pi Network, experienced a significant surge this week, climbing over 26% on Monday to reach $0.29 before seeing a subsequent drop. At the time of writing, the token is trading at $0.23, marking a 10% increase in the last 24 hours. This performance has sparked considerable interest among traders regarding the token's potential to sustain its upward momentum.

The price push to $0.28 occurred as the Monday trading session opened, following a period of sideways consolidation throughout the weekend. The token saw a remarkable 821.12% increase in trading volume, exceeding $127 million in a single day, according to data from Coinmarketcap.

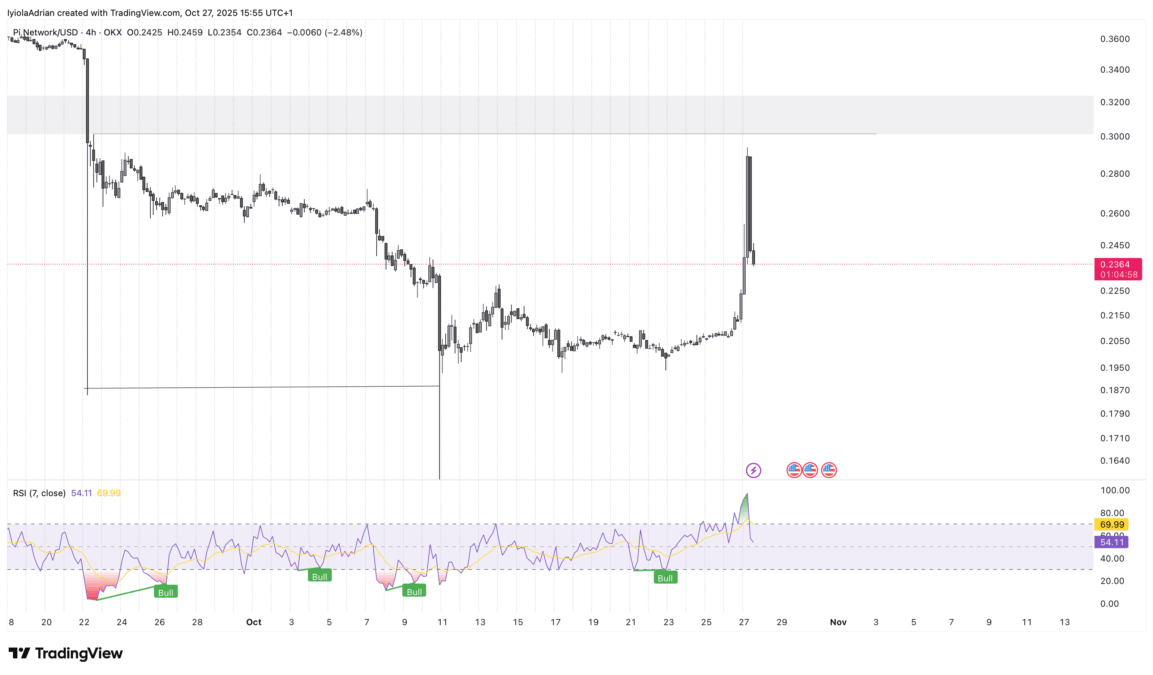

On the technical charts, Pi broke above its 7-day moving averages. The Relative Strength Index (RSI) climbed from 40 to 69 before settling at 53. This indicates an initial bullish takeover by market participants. However, the market is now showing signs of being overbought, which could signal a potential reversal.

Currently, major indicators are bullish. Nevertheless, the token appears to have faced rejection at a resistance zone around $0.28. If the price can close above this level, Pi may continue its upward trajectory. Conversely, failure to break through this resistance could lead to a price drop towards the $0.20 mark.

What Caused the Rally

The recent price surge is attributed to advancements in the Pi Network's mainnet development. A recent report released by the Pi Network team on October 23rd indicated that over 3.32 million users have successfully completed their Know Your Customer (KYC) process and migrated their tokens to the mainnet. This development has led to a reduction in the number of Pi tokens available on exchanges. Furthermore, it has bolstered investor confidence in the network and is seen as a crucial step towards preparing the network for real-world utility.

While approximately 4.76 million accounts are still pending KYC completion, the rates of successful KYC submissions have shown consistent improvement on a weekly basis.