Hong Kong Charges Crypto Influencers Over JPEX Promotion

Hong Kong authorities have formally charged influencers linked to the defunct crypto exchange JPEX. Among those charged are Joseph Lam Chok, a lawyer turned influencer, and Chan Yee, a prominent KOL in the crypto community. Prosecutors allege they promoted JPEX while knowing or ignoring that the platform lacked approval to operate in Hong Kong. Promoting crypto investments fraudulently or recklessly is an offense under Hong Kong's Anti-Money Laundering Ordinance.

In addition to the influencers, six core members of the alleged JPEX group and seven operators of over-the-counter crypto shops were also charged. Three individuals accused of serving as front account holders were also included in the charges.

JPEX, launched in 2020, heavily utilized influencer endorsements and social media marketing. Following a public warning from the Securities and Futures Commission in September 2023, the platform significantly increased withdrawal fees, preventing many users from accessing their funds. Authorities report that over 2,700 victims have reported losses totaling approximately 1.6 billion Hong Kong dollars, equivalent to about $205 million.

Joshua Chu, a co-advocate in the first civil action against JPEX, stated that the case against KOLs is clear-cut. He explained that claims made by influencers that JPEX was safe, licensed, or soon to be licensed in Hong Kong or Dubai were repeatedly flagged as false by the SFC. Chu added that if these influencers were aware of JPEX's lack of a license, their actions constitute fraudulent inducement. If they failed to verify such easily verifiable information, they are equally liable for reckless misrepresentation, making liability almost inescapable in either scenario.

While Hong Kong's charges are specific to the JPEX case, they reflect a growing regional trend of targeting promotional activities surrounding cryptocurrencies.

In the Philippines, promoting unlicensed crypto and companies through paid social posts can result in fines or imprisonment. Singapore's Monetary Authority (MAS) rules prohibit the promotion of crypto services to the general public, thereby limiting influencer marketing. Singapore has also recently expanded penalties for fraud, which now include mandatory minimum prison sentences.

Philippines Explores Blockchain for Transparency with CADENA Act

A Philippine Senate committee has concluded its deliberations on a proposal that would mandate government agencies to publish budget and procurement documents on a blockchain. This proposed law, known as the Citizen Access and Disclosure of Expenditures for National Accountability (CADENA) Act, aims to simplify public tracking of government fund allocation and spending. The bill was previously referred to as the Budget Blockchain Act.

Senator Bam Aquino drafted the measure, which seeks to combat corruption by making budgeting and contracting records accessible to citizens. According to a Facebook post by the Senate, the bill establishes transparency as a legal obligation under Section 5, requiring all government agencies to upload budget documents to the Cadena system. This platform is designed to ensure data verifiability, traceability, and auditability through its blockchain-based infrastructure.

Senator Bam Aquino is part of the Aquino political family, which is generally linked to the anti-corruption movement in the Philippines. His uncle, former Senator Benigno Ninoy Aquino Jr., was a prominent opposition figure against dictator Ferdinand Marcos Sr. during the martial law era. Ninoy Aquino's assassination in 1983 is credited with galvanizing public pressure that led to the 1986 revolution and the end of the Marcos regime.

Transparency International's 2024 corruption index ranked the Philippines 114th out of 180 countries.

The committee is set to finalize its report, and Aquino is expected to sponsor it for plenary debate in the Senate on November 12.

Japan's Industry Initiates Legal Framework for Tokenization

Progmat has launched a new working group dedicated to drafting a legal framework for tokenized securities in Japan. The initiative aims to facilitate the on-chain transfer of financial instruments, including stocks and investment trusts.

Progmat, a tokenization platform supported by major Japanese financial institutions, was originally developed within Mitsubishi UFJ before becoming an independent company. Progmat also leads the Digital Asset Co-Creation Consortium (DCC), which comprises 315 member organizations from the finance, law, asset management, and market infrastructure sectors.

The newly formed group will focus on studying regulatory design and market structure for digitizing existing securities. The target is to publish a draft law and a final report by March 2026, with commercial product development for tokenized equities scheduled to begin in spring 2026.

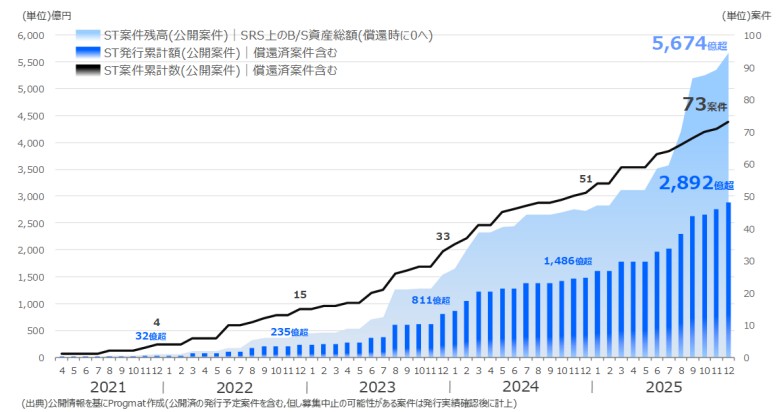

According to Progmat, the total outstanding security token issuance in Japan exceeds 567 billion yen, with cumulative issuance surpassing 289 billion yen. To date, most activity has involved real estate securitization products and tokenized corporate bonds. The tokenization of investment trusts and equities has progressed more slowly due to legal constraints and the robustness of Japan's existing securities infrastructure.

Zhaojin Mining to Explore Gold Tokenization with Ant Digital

Zhaojin Mining's Hong Kong subsidiary has entered into a cooperation agreement with SigmaLayer, a company under Ant Digital Technologies. The collaboration will focus on the tokenization of gold as a real-world asset (RWA).

Zhaojin Mining is a significant gold producer in China and is backed by Shandong Zhaojin Group. The group is a major supplier on the Shanghai Gold Exchange and is a qualified refiner recognized by the London Bullion Market Association.

The cooperation will involve exploring methods for converting physical gold into digital tokens and establishing blockchain-based traceability. The companies also intend to utilize artificial intelligence for supply chain credit assessment and risk management.

Ant Digital Technologies is the technology division spun out from Jack Ma's Ant Group following regulatory restructuring within China's fintech sector. This unit has increasingly focused on blockchain and industrial data systems. The partnership with Zhaojin Mining signifies renewed activity in tokenized assets from firms linked to Ma.