XRP: Minor Setback Within a Larger Breakout

Brandt’s chart of XRP shows the token breaking out from a long‑term symmetrical triangle, a formation that typically precedes large directional moves. He described the recent price dip as “just a minor reaction,” indicating that XRP remains within its broader bullish trajectory. The consolidation phase, he suggested, is part of a larger structure that could resume upward momentum if the breakout holds above key support.

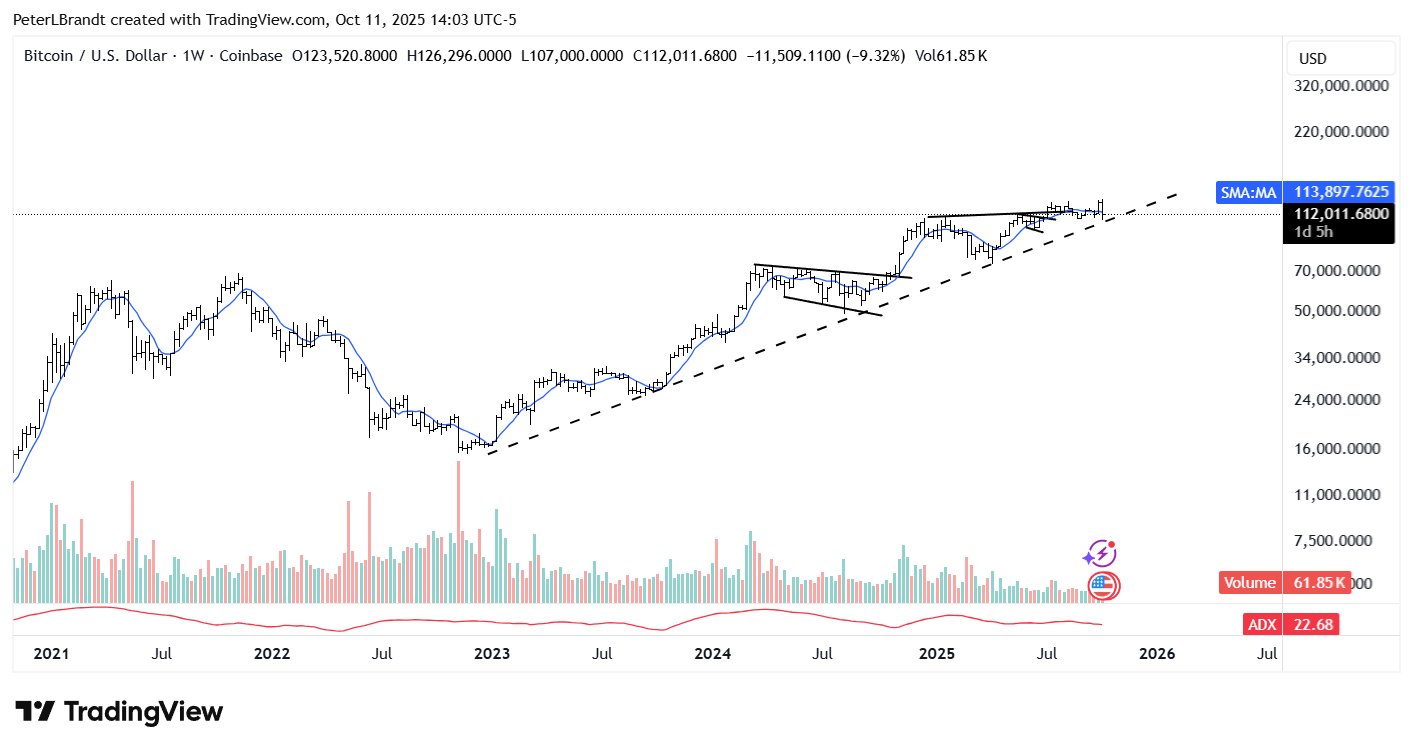

Bitcoin: The Macro Bull Still Alive

For Bitcoin, Brandt’s multi‑year chart highlights a clear ascending trendline, showing that BTC continues to respect its long‑term support structure. Despite last week’s liquidation‑driven drop, he emphasized that Bitcoin’s “bull is still alive and well.” His chart illustrates consistent higher lows and volume stability, a hallmark of healthy accumulation within an extended bull phase.

Stellar (XLM): A Bull Waking Up

Brandt referred to Stellar (XLM) as “a bull waking from a nap,” referencing what appears to be an inverse head‑and‑shoulders pattern on his chart. The formation suggests a potential shift from accumulation to breakout territory, with momentum gradually returning after months of sideways movement.

Ethereum: “Ready to Rock and Roll”

Among Brandt’s most confident takes was Ethereum (ETH), which he described as “ready to rock and roll.” His ETH chart shows a tightening ascending wedge, where repeated resistance tests hint at an impending breakout. The setup implies that Ethereum may soon lead the next leg higher if broader market sentiment steadies.

A Veteran’s Perspective

Brandt’s analysis contrasts with widespread caution following the recent liquidation event. Known for his classical approach to technical analysis, he reminded traders that short‑term turbulence rarely invalidates long‑term trends. As he quipped in closing, “If I change my mind, I won’t let you know.”