Pudgy Penguins (PENGU) is currently drawing attention across both technical charts and on-chain data. Crypto analyst Ali Martinez has outlined several signals suggesting the token may be preparing for a significant move. The token's current price stands at $0.022 at press time, reflecting a 5% gain over the last 24 hours, with trading volume reaching $223 million during the same period. While the token experienced a minor dip over the past week, broader activity surrounding the asset indicates signs of renewed momentum.

Technical Setup Suggests a Breakout Zone

Technical analysis of the PENGU chart reveals the formation of a cup-and-handle pattern, a pattern often observed preceding upward price movements. The support level around $0.0174 has remained firm, and the price has been gradually climbing from this area. A key resistance level is identified at $0.045. If PENGU surpasses this level, it could potentially target prices near $0.08, $0.114, and possibly $0.185, based on past Fibonacci-based projections.

Analyst Ali Martinez has noted that “everything lines up for a new bull rally,” referencing the alignment between real-world traction and the token's technical structure.

The development team behind PENGU has recently announced strategic partnerships with DreamWorks’ Kung Fu Panda and Invariant, a policy firm based in Washington. Furthermore, the project has received mention from Jefferies, one of the largest investment banks, within its broader coverage of digital assets.

The brand's expansion is also notable, with over 1 million Pudgy Penguin toys sold globally. The mobile game, Pudgy Party, has achieved more than 900,000 downloads. The brand was also present at a film awards event in South Korea, and an ETF application is currently under review.

Indicators Point to a Shift in Momentum

On the daily chart, the Bollinger Bands have tightened, indicating lower volatility. This configuration often precedes a price movement. PENGU recently experienced a bounce off the lower band around $0.01708 and is now trading near the 20-day moving average at $0.023. For momentum to build effectively, the price will need to challenge the upper band, which is currently situated near $0.029.

The MACD data has also turned positive, with a bullish crossover occurring as the MACD line moved above the signal line. The histogram is now displaying green, which is a common early indicator of a potential shift in momentum.

Futures and On-Chain Data Reinforce Positive Outlook

According to Coinglass data, the open interest in PENGU futures currently stands at $122.36 million. While this figure is lower than the peak of over $650 million observed in July, activity has stabilized in recent days. The current open interest level suggests that some traders are beginning to re-establish positions.

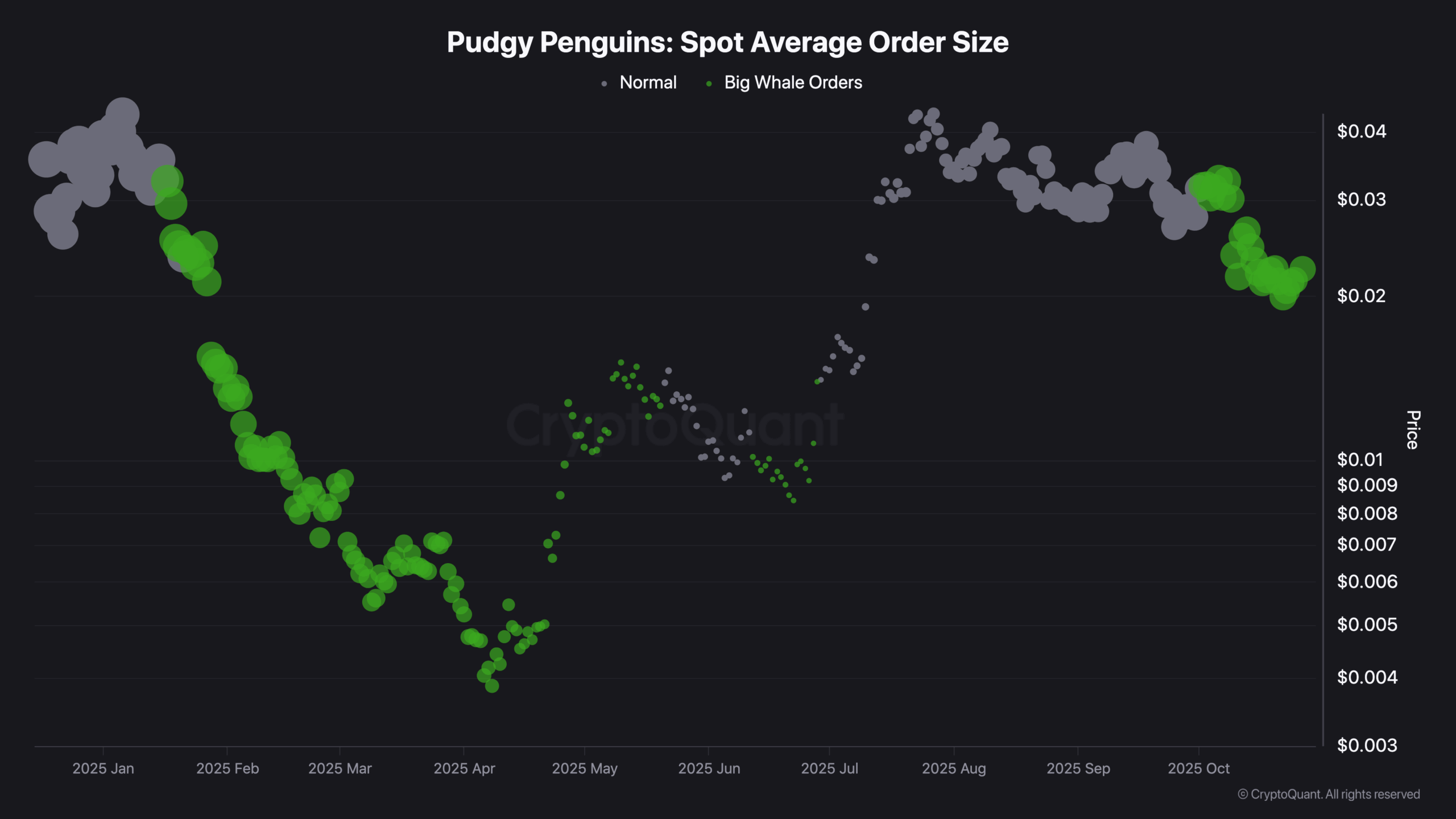

Data from CryptoQuant indicates a resurgence in large whale orders. Since the beginning of October, transactions of whale size have been concentrated between $0.02 and $0.03. These price levels are consistent with previous accumulation zones identified earlier in the year.

This observed activity may provide support near current price levels, particularly if large buyers maintain their engagement as the asset approaches key resistance points.