Key Takeaways

- •Pan Gongsheng, Governor of the People's Bank of China, highlighted the risks associated with stablecoins at the Financial Street Forum.

- •He stated that stablecoins may pose a threat to financial security and monetary sovereignty.

- •The PBoC is prioritizing robust regulatory measures to address potential cryptocurrency threats.

PBOC Addresses Stablecoin Risks and Regulatory Imperatives

Pan Gongsheng, Governor of the People's Bank of China, underscored ongoing regulatory concerns over stablecoins at the Financial Street Forum in Beijing on October 27, 2025. This reinforces global cautions about financial risks and impacts on monetary sovereignty, affecting market dynamics amid regional regulatory disparities.

Pan Gongsheng addressed global delegates at the Financial Street Forum Annual Meeting, underlining the financial risks associated with stablecoins. He noted that stablecoins fail to meet minimum compliance requirements for customer identity verification and anti-money laundering. These shortcomings were similarly highlighted at the recent IMF/World Bank meeting in Washington.

Such scrutiny increases compliance costs for entities associated with Chinese financial channels and may affect global market stability. Federal Reserve announcements can also influence global financial stability occasionally.

The global financial community's response indicates heightened caution towards stablecoins. Governments and financial institutions are considering more robust regulatory measures to curb potential exploitation of these digital assets. As stated by Pan, China's strategy involves collaboration with law enforcement to combat illicit crypto activity.

Historical and Market Influences on Stablecoin Volatility

China's initial crackdown on cryptocurrencies in 2017 triggered noticeable shifts in the market, prompting sharper regulatory focus globally.

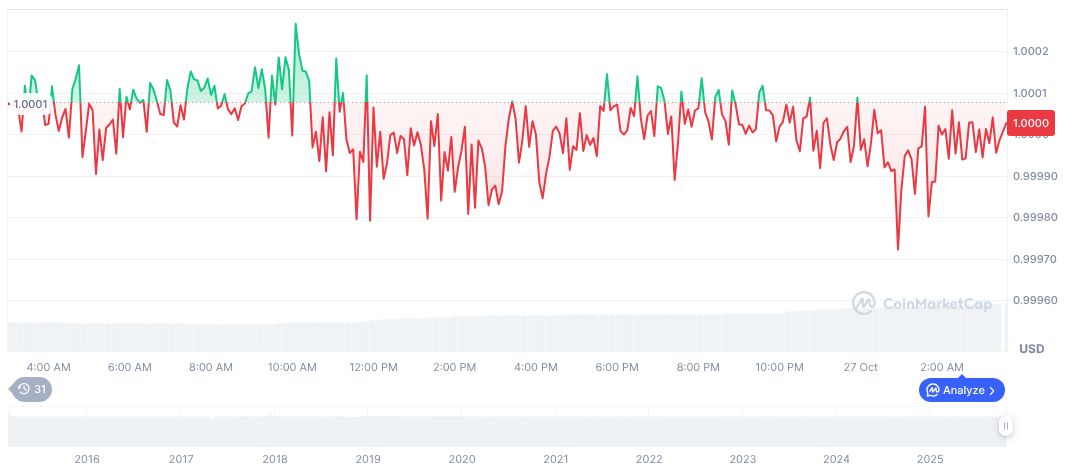

According to market data, Tether (USDT) maintains a steady price of $1.00 with a market cap of $183.17 billion and a daily trading volume nearing $136.05 billion, reflecting a 0.01% dip in price over the past 24 hours. Regulatory pressures influence stablecoin liquidity while contributing to notable market volatility.

Market analysts suggest that ongoing regulatory scrutiny, particularly from major economies like China, could prompt significant restructuring within the global crypto ecosystem. Market analysts anticipate divergences in regulatory frameworks, with regions like Hong Kong potentially adopting more liberal policies regarding stablecoin issuance and governance.