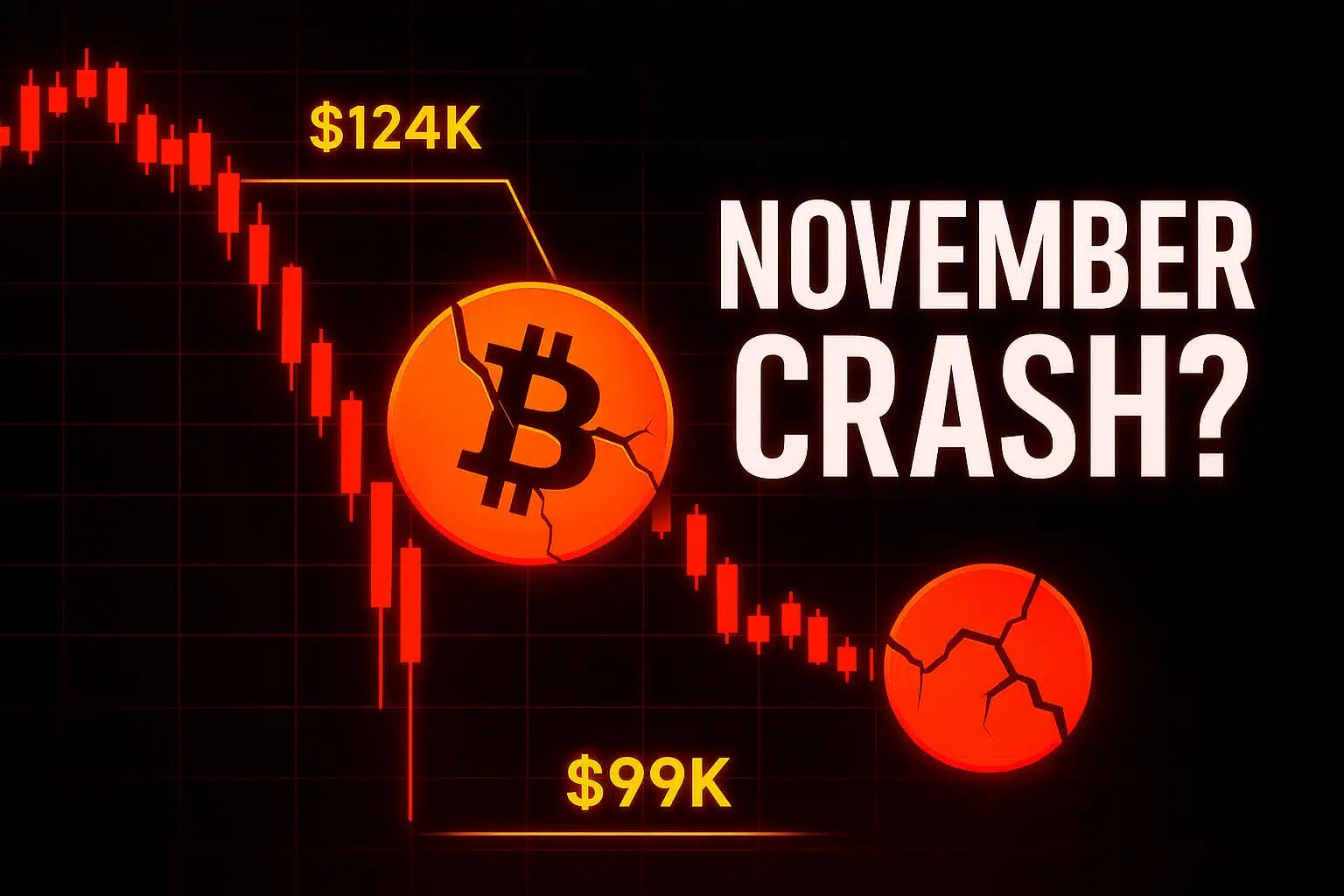

As of November 5, the cryptocurrency market is experiencing significant liquidation, with Bitcoin (BTC) dipping to around $101,600 USD. This represents a 2.9% slide in the last 24 hours and a substantial 19% decline from the mid-October peak of $124,765. The charts are showing increased volatility, with Bitcoin testing the $100,000 support level and briefly touching $99,000. This raises questions about whether this marks the end of the bull market or a temporary pause before further gains.

This analysis delves into the market chaos, shifts in sentiment, expert opinions, and potential future movements. It is important to remember that the cryptocurrency market is inherently volatile, and investors should always conduct their own research and invest responsibly.

November Bitcoin Crash: The Timeline of the Tumble

To understand the current situation, let's review the price action chronologically. September began calmly, with Bitcoin opening at $94,500 and closing strong at $108,240, marking a 14.5% increase driven by steady buying after a quiet summer. The price reached highs of $109,020, with lows holding firm at the opening price, indicating an accumulation phase.

October brought a significant shift. The month opened at $108,240 and surged to a new all-time high of $124,765 mid-month, fueled by excitement surrounding Exchange Traded Funds (ETFs) and election speculation. However, a sharp reversal occurred, and the month closed at $109,566, down 3.92% despite the earlier rally. The lowest point reached was $106,441, marking the worst monthly close since the bear market of 2022.

November continued this downward trend. Starting at $109,566, Bitcoin had fallen by 7.3% to approximately $101,600 by November 5, with intraday wicks reaching $99,000. The realized volatility has been high, at 55% for the 30-day period. Panic selling ensued after liquidations were triggered by overleveraged positions below $107,000. Despite this sharp correction, such pullbacks are not uncommon within bull cycles.

Is the Pump Over? Technical and On-Chain Indicators Suggest Otherwise for Now

The immediate answer to whether the rally is over is likely no. The rapid surge from $94,000 to $124,000 has cooled down. The Relative Strength Index (RSI) has moved from overbought territory (70+) to a more neutral 45 on the daily chart. The Moving Average Convergence Divergence (MACD) is also showing signs of weakening momentum, with no bullish crossover currently visible.

On-chain data indicates a slowdown in ETF purchases, leading some holders to sell and an increase in exchange inflows. Currently, the daily mined supply is exceeding net institutional inflows. The Puell Multiple is at 1.2, which is considered neutral and not overtly oversold.

However, it is important to note that Bitcoin has historically experienced mid-cycle corrections of 20-30%. These are typically seen as resets rather than the end of a bull market, and previous post-peak dumps in 2017 and after 2021 highs have often led to subsequent larger rallies. Historically, November has averaged a gain of +42%, often driven by year-end Fear Of Missing Out (FOMO) and increased liquidity. While macroeconomic factors such as sticky U.S. inflation (with the CPI report due November 13 potentially impacting the market if it exceeds 2.3%) and Nasdaq volatility pose challenges, potential positive developments from post-election policies, such as tax breaks, could alter the market's trajectory.

Sentiment Shift: From Euphoria to Extreme Fear

Market sentiment is a significant driver in cryptocurrency, and currently, it has shifted towards fear. The Fear & Greed Index has plummeted from a greedy 71 in October to 23 out of 100, indicating extreme fear. Online search trends for "Bitcoin crash 2025" have spiked, while general Bitcoin buzz on platforms like Twitter has soured.

With Bitcoin dominance at 57%, its social influence has decreased, potentially indicating a flight to perceived safer assets. As leverage is being reduced, funding rates have turned negative, short positions are dominating the perpetual futures market, and open interest has dropped by 15%.

Interestingly, significant holders (those with 1,000 or more BTC) have been observed discreetly acquiring Bitcoin during dips below $105,000. This contrasts with retail investors who appear to be capitulating, as evidenced by an increase in "sell Bitcoin" sentiments at current price levels. The equities market remains volatile, with the Nasdaq down 1.5% recently. However, potential positive influences from the upcoming elections could emerge. The extreme greed seen in October, driven by ETF FOMO, has now transitioned to a more pessimistic outlook in November, presenting a classic contrarian opportunity.

Crypto Twitter's Hot Takes: Bears Roar, Bulls Emerge

Crypto Twitter is a hub of discussion, with bears proclaiming the end of the rally and bulls advocating for buying the dip. Here's a summary of notable opinions from credible accounts (with over 50 likes, posted after October):

Bearish perspectives:

- •@CryptoFaibik predicts a 50% correction, citing an overextended RSI.

- •@BitBullish suggests the rally may be capped at 80%, with early investors exiting and reducing overall excitement.

- •@crypto_birb analyzes the cycle, stating that 99.3% of the upward phase is complete and anticipating a blow-off top followed by a bear market. This sentiment aligns with James Wynn's skepticism, who noted that "Billionaires are cashing out during the euphoria."

Bullish responses:

- •@APompliano asserts that the October bear market is over and emphasizes the importance of emotional management.

- •@DaanCrypto describes the current phase as "back season" chop, expecting a bounce from the current lows.

- •@DefiWimar outlines a pattern of pump-shakeout-consolidation-pump, believing the shakeout phase is now complete.

- •@Sykodelic observes aggressive bidding from whales and projects an end-of-year target of $150,000.

Neutral observations:

- •@gobitcoinisland believes the bull market has just begun, with significant fiat inflows expected.

Overall, the sentiment on Crypto Twitter leans approximately 60/40 bearish. However, the patient outlook expressed by figures like Pomp and Daan resonates with the view that "corrections are features" of the market.

Near-Term Outlook: Navigating Volatile Waters

In the near term, Bitcoin is projected to trade within a range of $98,000 to $113,000 through mid-November. A significant shift in sentiment could push the price target towards the $117,000 to $134,000 range by December. A decisive break below current levels might lead to a retest of the $90,000 support. For 2026, a price exceeding $150,000 is possible if the current cycle extends, although distribution risks will be significant.

It is advisable to avoid leverage, as it can be a trap leading to forced liquidations. Consider strategically placing buy orders on days characterized by fear and accumulating Bitcoin during such periods.

It is important to filter out the noise from social media and closely monitor the Consumer Price Index report scheduled for November 13. Volatility is an inherent part of participating in the crypto market. While the current upward momentum has paused, a subsequent rally may still be on the horizon.

Conclusion

The November Bitcoin crash, with its 19% drop from recent highs and a surge in fear, might feel like a major setback. However, history suggests that such corrections are often temporary intermissions rather than the end of the bull market. With historical patterns favoring rebounds, the presence of whales accumulating, and the potential for seasonal November gains, the outlook remains cautiously optimistic.