The global non-fungible token market is currently facing its toughest times since the beginning of the year. In recent days, non-fungible tokens have fallen to their lowest monthly sales volume of this year, with digital collectibles declining by +66% in market capitalisation from their January highs. This article explores the state of NFTs in the fourth quarter of this year and what traders should expect in the days or weeks to come.

Monthly NFT Trading Sales Decline Significantly

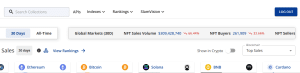

Data compiled by CryptoSlam.io, a leading cryptocurrency and non-fungible collections explorer, shows that the global non-fungible token trading sales volume declined by +50% to $320 million in November. This figure represents approximately half of the $629 million recorded in October. The drop pulled the monthly volumes back to levels not seen since September 2024, when digital collectible sales hit $312 million.

The NFT market meltdown has not shown signs of slowing down in December. Data also shows that from December 01 to December 08, the NFT market has generated just $62 million in trading sales, marking the weakest weekly trading sales volume total of 2025. The slow start to December suggests that the downturn may persist through the month as NFT momentum slows.

The latest decline comes amid a turbulent quarter for the NFT market. According to CoinGecko, the NFT sector’s overall market cap is at $3.1 billion, down 66% from its high of $9.2 billion in January. CoinGecko data showed that most of the top NFT collections mirrored the broader market decline, with CryptoPunks, the largest NFT collection by market cap, falling 12% in the last 30 days.

Bored Ape Yacht Club, another globally acknowledged NFT collection, slipped 8.5%, while Pudgy Penguins, also a globally recognized NFT collection, dropped 10.6% in the same time frame. This continues a pullback across the most dominant NFT assets. The biggest decline came from the Hypurr NFT collection, which shed 48%, making it the biggest decline among the top 10 NFT collections.

Optimism for the Future of NFTs

It's worth noting that non-fungible tokens have matured significantly. They have evolved from their initial speculative "hype cycle" centered on digital art into a technology focused on real-world utility and digital infrastructure. The NFT market has shifted away from a speculative frenzy to more deliberate, application-based growth. In 2025, the initial boom of high-profile, purely speculative sales has been replaced by a focus on tangible use cases.

Despite the current NFT downturn, several NFT projects are actively building. These projects are focusing on diverse NFT utilities, communities, and innovative business models that extend far beyond simple digital art. They are being integrated into gaming, real estate, social impact initiatives, and brand loyalty programs. In light of this ongoing maturity and innovation, better days in NFTs are anticipated.