In crypto, hacks don’t just drain wallets – they drain belief. New data shows that nearly 80% of hacked crypto projects never truly recover, not because the technology can’t be fixed, but because user trust disappears faster than liquidity returns.

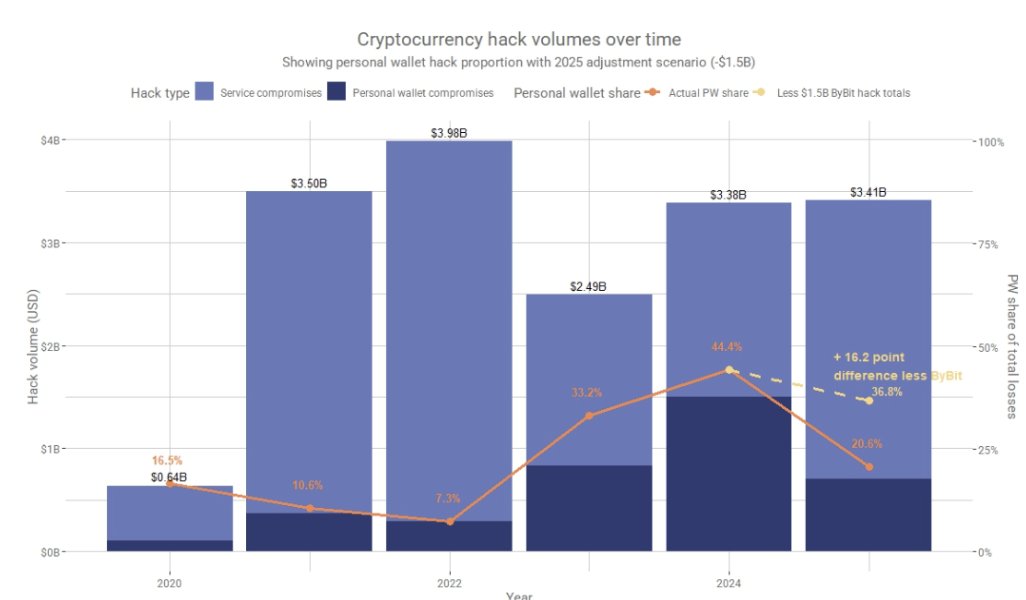

The chart highlights a crucial shift in the anatomy of crypto losses. While total hack volumes fluctuate year to year, personal wallet compromises are taking a growing share of total losses, especially after adjusting for one-off events like the Bybit hack.

This matters because personal wallet losses feel personal. They don’t just hit balance sheets – they hit confidence.

Historically, projects could survive smart contract exploits or service-side breaches if they responded quickly, compensated users, and improved security. But when users lose funds directly from their own wallets, the psychological damage is far deeper. The orange line on the chart shows this clearly: as the personal wallet share of total losses rises, long-term project survival rates fall.

The Impact of Trust Erosion

Once trust breaks, liquidity follows. Users withdraw, developers leave, partnerships stall, and token prices struggle to regain credibility. Even if a project patches the vulnerability, the market rarely grants a second chance. Capital is mobile, and in crypto, reputation is often more valuable than code.

Existential Risks in Crypto Security

The takeaway is stark: Security incidents are no longer just technical risks – they are existential risks. In today’s market, the difference between survival and slow death isn’t how fast a bug is fixed, but how convincingly trust can be rebuilt. And for most hacked projects, that trust never comes back.