Chanos & Co Exits MSTR-Bitcoin Strategy Following Significant Price Declines

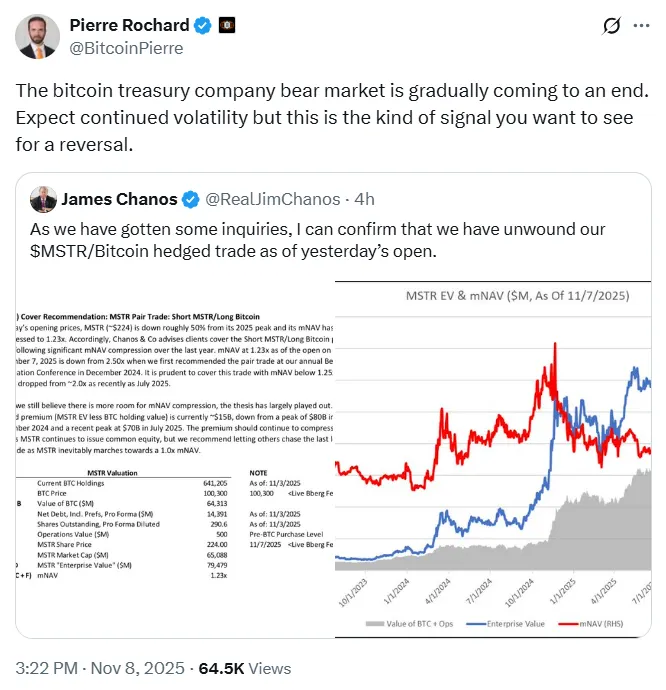

Investor Jim Chanos, the head of Chanos & Co, has confirmed that his firm has closed its short position on MicroStrategy (MSTR) stock and its accompanying long position on Bitcoin. This decision, effective November 7, 2025, comes after a substantial drop in MSTR stock price and a significant fall in its market net asset value (mNAV), indicating the trade has reached its conclusion.

The announcement was made following a steep decline in MSTR stock, which fell to approximately $241.93. This represents a drop of about 48% from its peak in 2025.

Chanos & Co's client note indicated that the mNAV ratio had decreased to 1.23 times as of November 7, 2025. This is a considerable decrease from the ratio of 2.50 times when the strategy was initiated in December 2024. The report suggested that the trade had largely fulfilled its objectives. The implied premium of MSTR stock, which represents its value above the worth of its Bitcoin holdings, has contracted to approximately $15 billion. This premium had previously reached as high as $80 billion in November 2024 and $70 billion in July 2025, highlighting a significant narrowing of the market value relative to the company's Bitcoin assets.

The firm had previously advised clients to short MSTR stock while simultaneously going long on Bitcoin, based on the company's stock trading significantly above the value of its Bitcoin reserves. The recent note advised that it is now "prudent to cover the trade" as the mNAV has moved below the 1.25 times threshold. The firm also stated that while further compression might be possible, the majority of the trade's potential gains have already been realized.

MicroStrategy's Bitcoin Holdings and Stock Performance

According to data from Chanos & Co, MicroStrategy currently holds approximately 641,205 Bitcoin. The company recently acquired an additional 397 BTC for $45.6 million. At a Bitcoin price of around $100,300, the company's total Bitcoin holdings are valued at roughly $64.1 billion. The report also indicates that MSTR's net debt stands at approximately $14.4 billion, with its total market value nearing $65.1 billion.

MSTR stock has experienced a sharp decline from its peak, trading between $219 and $244, a significant drop from its high of $542.99 earlier in 2025. The company's market value and share price have shown a strong correlation with Bitcoin's price movements. Market observers attribute this to MicroStrategy's core strategy of accumulating and holding substantial amounts of Bitcoin, making its stock price highly sensitive to fluctuations in Bitcoin's value.

Chanos' decision to exit the hedge trade aligns with the shrinking gap between MSTR's market price and the value of its Bitcoin holdings. The company's enterprise value, after accounting for its Bitcoin assets, has also seen a substantial decrease. The Chanos report noted that the trade proved successful as MSTR continued to issue new shares, which contributed to the reduction of the premium over time.

Market Reactions to the Trade's Conclusion

The conclusion of the Chanos hedge trade is being viewed by market participants as a potential indicator of shifting trends for Bitcoin-related equities. Pierre Rochard, a Bitcoin analyst, commented that the bear market for Bitcoin treasury companies appears to be gradually subsiding. He suggested that while volatility may persist, such developments often signal a transition in market sentiment.

At the close of trading on November 7, MSTR stock was priced at $241.93, showing a modest increase of approximately 2% for the day. Following the market close, the stock saw a slight dip to $241.40. The company's overall market capitalization is estimated to be around $69.5 billion.

In a post on X, formerly Twitter, Chanos humorously stated he would "let Boaz take the discount side of the trade," referencing investor Boaz Weinstein. The firm's decision to unwind the trade underscores that the initial thesis regarding MicroStrategy's overvaluation has largely played out.