MicroStrategy's Bitcoin Model Stands Firm

Market commentator Fred Krueger has voiced support for MicroStrategy’s Bitcoin strategy, asserting that its combination of debt and MSTR stock remains stable despite price fluctuations. His remarks aim to alleviate concerns regarding potential liquidations faced by Bitcoin-linked treasury firms.

In a recent post on X, macro analyst Fred Krueger stated that MicroStrategy’s (MSTR) plan to increase its Bitcoin holdings is still robust. He elaborated that, if he were in Michael Saylor’s position, he would adopt the same approach. The strategy involves selling shares when prices exceed its trading average, borrowing approximately 40% of its asset value through specialized structures, and using these funds to acquire more Bitcoin.

Krueger further noted that this strategy benefits long-term investors who are confident in Bitcoin’s potential for growth. He acknowledged that short-term traders focused on daily price movements might find the approach less appealing. However, he emphasized that the company’s largest shareholder, Michael Saylor, is acting in his own long-term interests.

According to Krueger, MicroStrategy’s debt level is manageable and adaptable. He explained that payments on its financial structures can be deferred when necessary, and the company has the option to raise additional funds or sell Bitcoin if market conditions change. He also pointed out that there are no stringent requirements mandating immediate repayment, providing the MSTR stock with greater flexibility.

This flexibility, he added, enables MicroStrategy to mitigate risks more effectively than many other firms concentrating on Bitcoin. While the model might not be universally popular, it continues to attract individuals who view Bitcoin as a long-term asset rather than a short-term trading instrument.

Liquidation Fears Among Bitcoin Treasury Firms

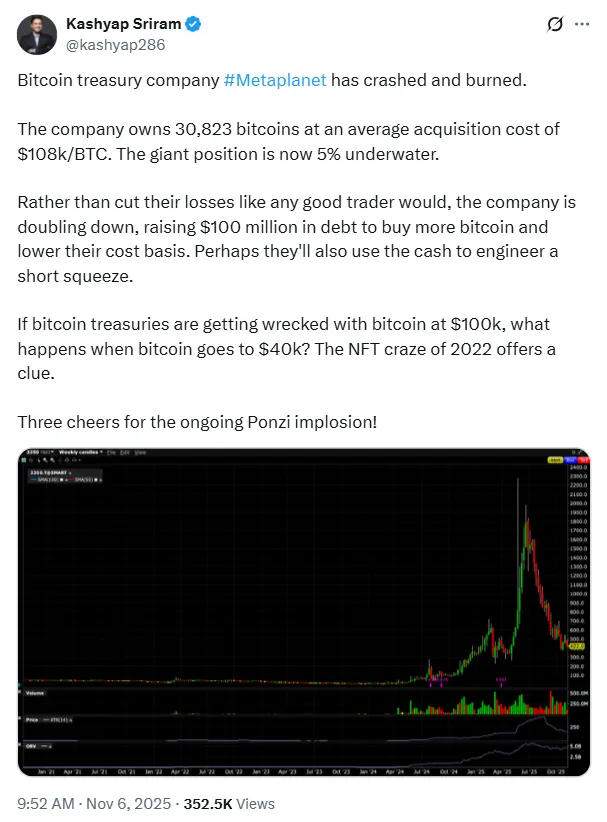

Concerns surrounding Bitcoin treasury companies have heightened following analyst Kashyap Sriram’s commentary on Metaplanet, another entity holding significant Bitcoin reserves. Metaplanet possesses 30,823 Bitcoins acquired at an average cost of $108,000 per coin. With Bitcoin currently trading around $100,000, the company's holdings have seen a value decrease of approximately 5%.

Instead of selling to limit losses, Metaplanet is taking on $100 million in debt to purchase additional Bitcoin, aiming to lower its overall cost per coin. This action has elicited mixed responses, with some analysts drawing comparisons to the speculative behavior observed during the 2022 NFT bubble.

Others have questioned the implications if Bitcoin’s price were to decline further, warning that companies heavily reliant on Bitcoin could face margin calls. It is worth noting, however, that Krueger distinguished MicroStrategy’s situation from these concerns. He argued that the company's structure allows for adjustments without resorting to panicked sales.

He believes that the equilibrium between its Bitcoin assets and its capital base positions it more securely than other firms attempting to replicate its model.

MSTR Stock Shows Support Amid Market Volatility

MicroStrategy’s MSTR stock has experienced some downward pressure, but analysts indicate it is holding a critical support level. The stock concluded trading at $237.20, marking a 6.98% decrease for the day, and subsequently fell another 3.77% in pre-market trading to $228.25.

Market data suggests strong support near the $230 mark, which aligns with its 2025 low and the 100-week moving average. Analysts characterize the current decline as a typical pullback rather than an indicator of a market collapse. Many anticipate that the MSTR stock could rebound if Bitcoin maintains its position above $100,000.

They have identified potential upward targets at $460 and $544, corresponding to its highs in 2025 and 2024, respectively. Several research firms have revised their price forecasts for MSTR upward, with some now projecting the stock could reach as high as $705.

This increasing optimism reflects a sustained confidence in MicroStrategy’s strategy of integrating Bitcoin investments with traditional stock ownership. While the short-term outlook remains uncertain, many experts believe the MSTR stock’s prospects could remain positive as long as Bitcoin prices are stable or trending higher. For the time being, MicroStrategy’s strategy appears to be on solid ground, supported by patient investors and a flexible financial structure.