Key Insights

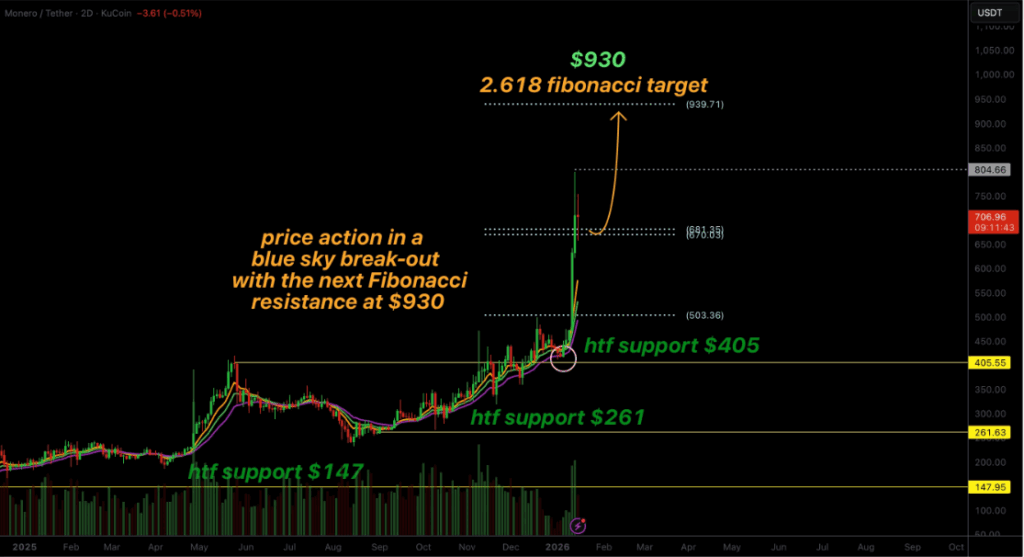

- •Monero has reclaimed the $670 extension level, confirming structural support through repeated daily closes above this zone.

- •The next upside target between $930 and $939 aligns with the 2.618 Fibonacci extension in current blue-sky conditions.

- •Elevated trading volume during expansion phases supports price continuation and reflects sustained buyer participation.

Monero's Upward Momentum and Structural Support

Monero is maintaining its upward momentum after firmly reclaiming the $670 Fibonacci extension level. The cryptocurrency has now entered a blue-sky breakout phase, trading above historically significant resistance with limited overhead supply. Strong price action above this level has turned previous resistance into support, setting the stage for continued gains.

After breaching the 0.618 Fibonacci extension level at $670, Monero stabilized with multiple daily closes above this mark. This development confirms acceptance of the level as a new support area. Such confirmations reduce the risk of price reversals and strengthen the structure for further upward movement.

The consolidation that followed the reclaim indicated that buyers remained active and that the breakout was not a short-lived move. This behavior is consistent with healthy trend continuation patterns in bullish markets.

$930–$939 Zone Becomes the Next Technical Target

Following the successful hold above $670, attention has shifted to the next key technical area between $930 and $939. This range aligns with the 2.618 Fibonacci extension, which typically acts as a magnet during upward price discovery phases. In the absence of historical consolidation zones above current levels, Fibonacci targets provide reliable guidance for price tracking.

Momentum indicators remain positive, suggesting that Monero could approach this level without facing significant resistance. A move toward $930 would represent a significant extension of the breakout leg, but conditions remain favorable.

Elevated Volume Confirms Market Participation

Volume trends have continued to support the breakout, with heightened activity during upward moves and steady participation during pauses. These signals point to strong buyer interest and reinforce the likelihood of sustained price appreciation.

The presence of consistent volume inflows reduces the risk of a failed breakout and supports the structural integrity of Monero’s bullish formation. As long as this participation continues, the upside scenario remains intact.

Conclusion

As Monero trades above $670 with momentum intact, the current setup supports a continued rise toward the $930–$939 Fibonacci target zone. Price structure, volume patterns, and market behavior collectively point to an active breakout with strong participation. Consolidation phases remain shallow and temporary, reinforcing the overall strength of the ongoing trend.