According to a report shared by CryptoQuant, Bitcoin inflow data on Binance is revealing a clear shift in whale behavior, with mid-sized holders now driving the majority of exchange activity, while larger whales turn increasingly cautious.

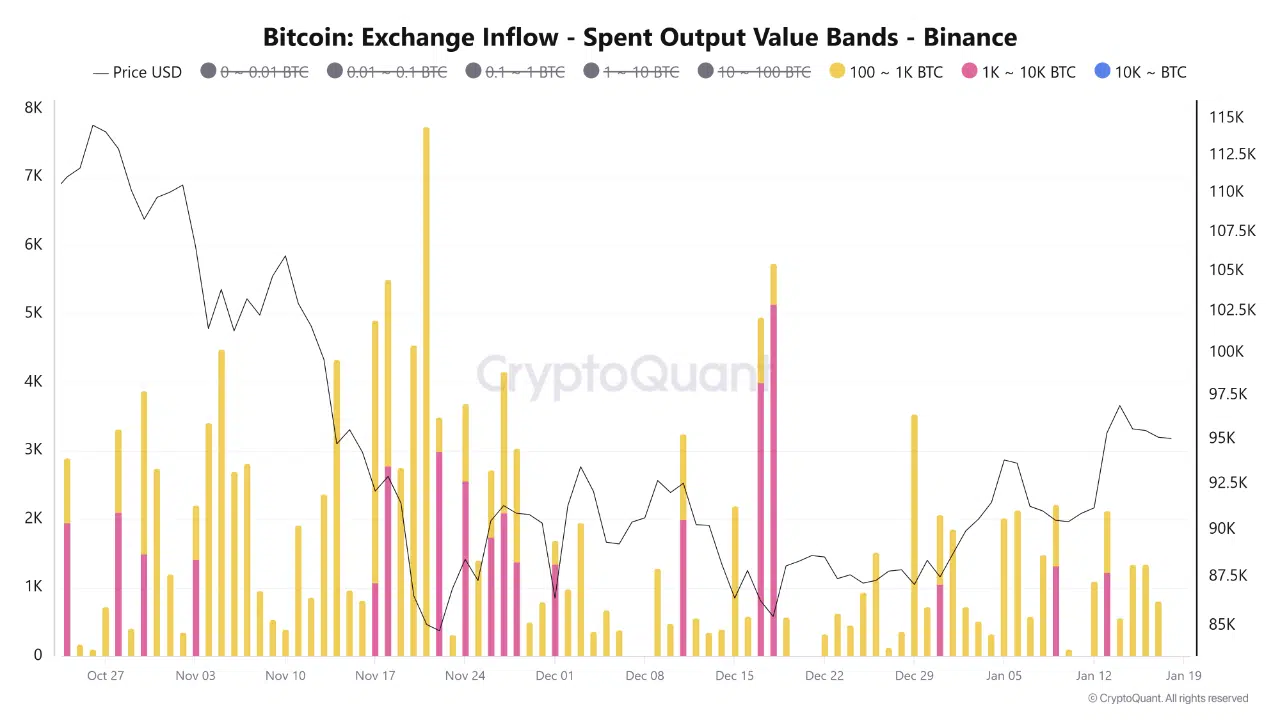

The latest breakdown of Bitcoin exchange inflows by spent output value bands shows that wallets holding 100 to 1,000 BTC remain the most active cohort. This group continues to dominate inflows, making it the primary source of liquidity entering Binance in recent weeks.

These mid-sized whales are typically more responsive to market conditions, balancing between tactical trading and longer-term positioning. As a result, their activity often provides early signals for short- to medium-term market direction.

Large Whale Caution and Inactivity

In contrast, the data highlights a sharp pullback from larger whale cohorts. Wallets holding 1,000 to 10,000 BTC recorded inflows of roughly 2,500 BTC in January, a steep decline from approximately 13,542 BTC in December.

This drop suggests growing caution among major holders, who appear less willing to move significant capital onto exchanges amid uncertain price conditions. Historically, this behavior aligns with periods where large investors prefer to wait for clearer confirmation before reallocating exposure.

Most notably, CryptoQuant’s data shows no observable inflows from wallets holding more than 10,000 BTC. The complete absence of activity from this ultra-large cohort signals an extremely conservative stance from the largest institutional or legacy holders.

Such inactivity is often interpreted as either strong long-term conviction, choosing to hold rather than trade, or reduced risk appetite during a consolidation phase.

Market Implications

Overall, the current structure indicates that Bitcoin’s near-term momentum is being shaped by mid-level liquidity, not by aggressive positioning from the largest whales. This pattern is commonly seen during accumulation or consolidation phases, where price discovery continues, but without decisive participation from top-tier capital.