Michael Saylor’s company has implemented a strategy to alleviate investor concerns by establishing a $1.44 billion dividend reserve. However, the company's stock continued its downward trend, experiencing another 3% drop yesterday.

According to a press release, the reserve is designed to cover at least one year of dividends, with the ultimate goal of providing a two-year financial cushion. CEO Phong Le stated that the current reserve exceeds the company's near-term payout obligations.

Despite these measures, critics have raised questions about the company's ability to meet its obligations related to preferred stock, a concern that is exacerbated by the broader market weakness.

Even with the new cash safeguard, MicroStrategy (MSTR) shares have remained under pressure, falling as much as 12% yesterday before recovering some losses.

MSTR shares have experienced a significant decline, plummeting more than 35% in the past month and over 53% in the past six months.

Despite the stock performance, The Kobeissi Letter reports that even after subtracting the company's current debt of $8.2 billion from its Bitcoin holdings, the company's net Bitcoin reserves still exceed its current market capitalization by approximately $1.8 billion. The publication poses the question: "Can Saylor keep buying?"

The company has been actively working to ease investor anxieties regarding the sustainability of the crypto treasury business model it pioneered and which has been emulated by numerous other entities.

So $MSTR's new business model is to sell stock to raise cash, then use that cash to buy Treasuries that yield about 4% to fund the issuance of debt and preferred stock at a cost of 8%–10%. How much longer will investors pretend this is a viable business just to gamble on Bitcoin?

— Peter Schiff (@PeterSchiff) December 1, 2025

Over the weekend, Strategy CEO Phong Le expressed confidence in the firm's financial flexibility, stating that the company has "more flexibility than ever" to continue acquiring Bitcoin. He highlighted that its capital structure is built on long-dated debt, alleviating any short-term pressure on its ability to raise funds.

Earlier, Michael Saylor, addressing his 4.7 million followers on X, declared, "I won’t back down."

Strategy Continues to Acquire Bitcoin

Strategy also announced a new purchase of Bitcoin, adding $11.5 million to its substantial holdings. According to an 8-K filing with the U.S. Securities and Exchange Commission (SEC), Strategy acquired 130 BTC between November 17 and November 30, at an average price of $89,960 per coin.

Strategy has acquired 130 BTC for ~$11.7 million at ~$89,960 per bitcoin. As of 11/30/2025, we hodl 650,000 $BTC acquired for ~$48.38 billion at ~$74,436 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/UkWX7PRHms

— Michael Saylor (@saylor) December 1, 2025

Strategy's Bitcoin Holdings Exceed 3% of Total Supply

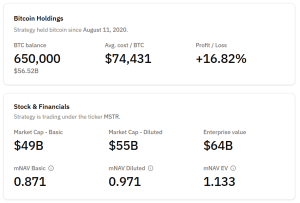

Following its recent acquisitions, Strategy now holds a total of 650,000 BTC on its balance sheet, representing over 3% of Bitcoin's total supply of 21 million coins, according to data from Bitcoin Treasuries.

The company's current Bitcoin holdings are valued at $56.52 billion, with an average acquisition price of $74,431 per Bitcoin.

Strategy Revises 2025 Profit and Yield Targets

The latest Bitcoin purchases occurred amidst a broader cryptocurrency market downturn, which has seen Bitcoin's price decrease slightly over the past week and by more than 21% in the last month. This correction, coupled with the decline in Strategy's stock price, has prompted the company to adjust its year-end profit projections.

Initially, the company had forecasted that Bitcoin would reach $150,000 by the end of the year. This target has recently been lowered to a range of $85,000 to $110,000.

In addition to the revised Bitcoin price target, the firm has also adjusted its full-year profit and Bitcoin yield forecasts. The company now anticipates its net income for the year to range from a loss of $5.5 billion to a gain of $6.3 billion. Concurrently, the company's Bitcoin yield target has been reduced from a previous goal of 30% to a new range of 22% to 26%.