Strategy CEO Phong Le stated that Michael Saylor’s firm possesses "more flexibility than ever" to continue its Bitcoin acquisition strategy. Speaking on the "What Bitcoin Did" podcast, Le highlighted that Strategy's capital structure is built upon long-dated debt, eliminating any short-term pressure on its ability to raise funds.

The $60 Billion Bitcoin Bet | @Strategy CEO Phong Le https://t.co/H216CRFggP https://t.co/w0WBg42PaD

Capital Markets Enable Strategy's Bitcoin Purchases Across Market Cycles

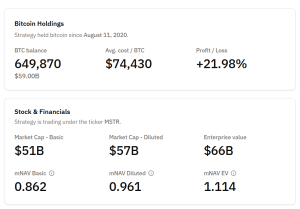

Strategy is recognized as the largest corporate Bitcoin holder globally, having initiated its Bitcoin purchases for its treasury reserves in 2020. According to data from Bitcoin Treasuries, the company currently holds 649,870 BTC, valued at approximately $59 billion at current market prices.

These substantial holdings were accumulated through a series of purchases funded by convertible note tranches. These notes are characterized by their long maturity dates and minimal near-term dilution risk.

Le emphasized that capital markets are the crucial element enabling Strategy to continue its Bitcoin accumulation through various market cycles. He explained that the company's balance sheet is specifically engineered to prevent liquidity stress and to maintain capacity for opportunistic issuances.

He noted that Strategy's first debt maturity is not scheduled until December of this year, which provides the company with significant flexibility to act opportunistically. Le further asserted that Strategy currently enjoys greater flexibility than at any previous point in its history. This is attributed to the company's proven ability to raise equity through at-the-market programs and its established track record of issuing zero-coupon or low-coupon convertible notes.

"We’ve shown we can do both," Le stated, indicating that the firm can choose to raise additional capital during periods of strong equity markets or utilize convertible notes when prevailing interest rates and market conditions favor long-duration debt issuance.

Strategy Share Price Shows Short-Term Uptrend

The company underwent a rebranding from MicroStrategy to Strategy earlier this year. This transition has shifted its business model from a traditional software company to a hybrid enterprise that combines its established enterprise analytics services with a treasury strategy focused on Bitcoin acquisition.

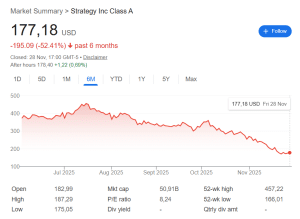

Le acknowledged that some investors continue to face challenges in valuing Strategy, particularly in light of the inherent volatility associated with Bitcoin's price. Strategy's stock, MSTR, experienced a significant decline, falling over 52% in the past six months.

This downturn, coupled with the decrease in Bitcoin's price, led to a sharp fall in Strategy’s Market Net Asset Value (MNAV). MNAV represents the ratio of the company's market capitalization to the net asset value of its crypto holdings. This ratio has since seen a partial recovery and currently stands at 1.13.

MSTR has demonstrated a recovery in the past week, with a 2.4% increase following a 0.8% gain in the preceding 24 hours. This upturn has coincided with a 5% rise in the Bitcoin price over the same weekly period.