Clarification on Bitcoin Transfers

Michael Saylor, the prominent figure behind Strategy Inc. (formerly MicroStrategy), swiftly addressed and refuted speculation that the company had sold a significant portion of its Bitcoin holdings amidst recent market volatility. The rumors gained traction after Arkham Intelligence data indicated a substantial decrease in Strategy's Bitcoin wallet balance, dropping from 484,000 BTC to 437,000 BTC, which implied a drawdown of approximately 47,000 BTC, valued at around $4.6 billion.

This development coincided with a period of sharp market fluctuations, as Bitcoin experienced a decline of over 1% within a 24-hour timeframe, trading below $96,000 for the first time in six months. Social media discussions intensified when Arkham reported that Strategy had moved 43,415 BTC, worth $4.26 billion, distributing the assets across more than 100 addresses since midnight UTC. The magnitude and timing of these transfers led some observers to believe it signaled the commencement of a major liquidation by one of the largest corporate holders of Bitcoin.

Arkham Data Points to Custodian Rotation, Not Sales

Arkham later provided clarification, stating that the observed movements were consistent with a custodian rotation rather than any selling activity. Their analysis indicated that Strategy has been in the process of transitioning its Bitcoin holdings from Coinbase Custody, its previous custodian, to a new service provider over the preceding two weeks.

These transactions encompassed three distinct categories: direct transfers from Coinbase to the new custodian, internal transfers within the new custodian's wallet cluster, and routine Coinbase wallet refreshes as older wallets became depleted. Arkham emphasized that none of these actions suggested a liquidation event.

Furthermore, Arkham noted that Strategy regularly conducts wallet rotations for security, operational, and counterparty-risk management purposes. They pointed out that monitoring the entity's activity over the past fortnight would have revealed similar patterns, predating the surge in online speculation on Friday. Despite these clarifications, market panic spread rapidly as automated trading systems identified the transfers during an already precarious market environment.

Saylor Reaffirms Accumulation Strategy and Confirms New Purchases

Michael Saylor directly countered the sale rumors through a post on X, stating unequivocally that there was "no truth" to the claims of Strategy reducing its Bitcoin holdings. He reiterated the firm's long-standing strategy:

"We’re buying quite a lot, actually, and we’ll actually report our next buys on Monday morning. I think people will be pleasantly surprised. And that we’ve been accelerating our purchases."

Saylor also reaffirmed his perspective that Bitcoin is a long-duration asset requiring a multi-year investment horizon.

Internal company records appeared to corroborate his statements. Strategy's corporate records continued to show 641,692 BTC under management, a figure consistent with previous disclosures. SEC filings revealed that between November 3 and November 9, Strategy acquired an additional 487 BTC for $49.9 million, at an average price of $102,557 per Bitcoin.

This acquisition was financed through the proceeds derived from several preferred stock offerings, including the Series A Strife, Stretch, Strike, and Stride tranches, which collectively generated approximately $50 million in net cash. No new common stock was issued during this period.

The most recent purchase brings Strategy's total Bitcoin acquisition cost to $47.54 billion, with an average cost of $74,079 per BTC. At current market valuations, the portfolio is worth over $65 billion, solidifying Strategy's position as the world's largest corporate holder of Bitcoin.

Market-to-NAV Slides Below 1 Amid Investor Reassessment of Leverage

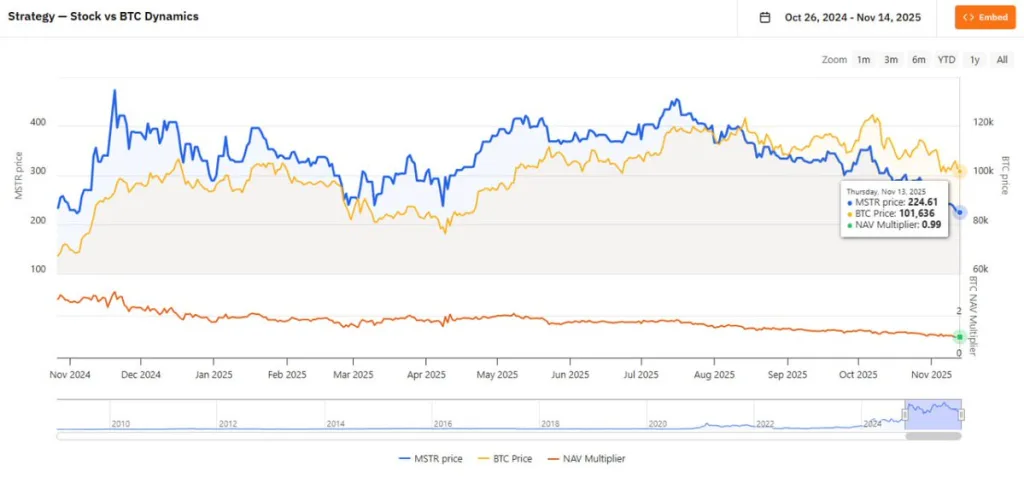

The turbulence fueled by the sale rumors led to increased scrutiny of Strategy's financial metrics. New data from November 13 indicated that the company's stock was trading at $224.61, while Bitcoin was priced at $101,636. This pushed Strategy's market-to-NAV multiple (mNAV) to 0.99, marking the first instance of this ratio falling below 1.

This discount suggests that investors were temporarily valuing the company at less than the market worth of its underlying Bitcoin holdings on a per-share basis, a reversal from years of consistent premium pricing. This shift reflects a broader cooling of enthusiasm for corporate digital asset treasuries. According to K33 Research, Strategy's equity premium has contracted by $79.2 billion since late 2024.

Analysts estimate that approximately $48 billion in implied Bitcoin demand did not translate into actual BTC purchases, despite the company raising over $31 billion through share issuances during the same timeframe. Nevertheless, some analysts suggest that Strategy does not face a structural obligation to sell its Bitcoin holdings until at least 2027, barring an exceptionally weak market cycle in 2028. For the time being, the market continues to observe whether Strategy's mNAV can rebound above 1 should Bitcoin stabilize.