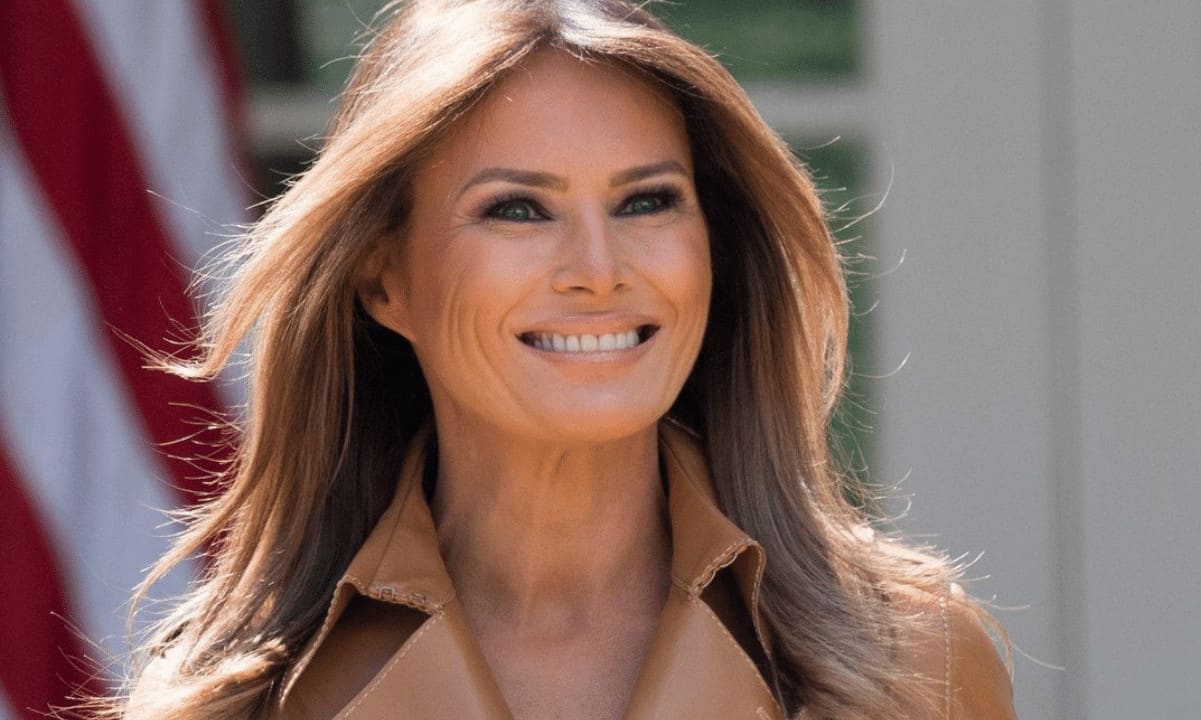

Benjamin Chow, a prominent crypto developer and co-founder of the Solana-based decentralized exchange Meteora, is alleged to be the central figure in a scheme to defraud investors through at least 15 different token ventures. A revised class-action lawsuit, initially filed in a New York federal court on April 21, 2025, contends that Chow, along with Meteora and Kelsier Ventures—a firm operated by Hayden Davis and his family—leveraged the names of public figures, including U.S. First Lady Melania Trump and Argentine President Javier Milei, to lend false credibility to coordinated scams designed to extract funds from unsuspecting crypto investors.

Mechanics of the Alleged Scheme

The original complaint asserted that Chow, Meteora, and members of the Davis family misled crypto investors, profiting at the public's expense through the manipulation of the Solana-based token M3M3. This token reportedly had a significant portion of its supply, up to 95%, controlled by insiders.

The amended legal document now alleges that fraudulent activities may have extended to as many as 15 cryptocurrencies. This includes the controversial MELANIA and LIBRA meme coins, which were purportedly promoted by Mrs. Trump and President Milei, respectively. This expanded claim is reportedly based on private messages shared by a whistleblower, in which Davis allegedly confessed to conducting "at least fifteen token launches at Chow’s direction."

The plaintiffs argue that Chow and the other defendants illicitly "borrowed credibility" from public figures, using them as "window dressing" to legitimize their operations. Consequently, the lawsuit does not hold Melania Trump or Javier Milei responsible but instead focuses on Meteora, its co-founder, and the Kelsier management.

The new filing details that the alleged plot was executed with a high degree of organization, assigning specific roles to each participant. Chow is said to have overseen the technical aspects due to his "unique knowledge of the code and the ability to manipulate liquidity, fee routing, and supply controls." This position, the complainants state, enabled him to control the supply and prices of new tokens, creating opportunities to artificially inflate their values before causing them to collapse, unbeknownst to ordinary traders.

For the marketing and promotional efforts, the lawsuit identifies Kelsier Ventures. Hayden, Charles, and Gideon Davis are accused of employing paid influencers and social media campaigns to simulate genuine public demand for meme coins like MELANIA and LIBRA. The group allegedly followed a consistent methodology for all 15 tokens: they manufactured artificial scarcity, saturated online platforms with paid promotions, and then, upon price surges, insiders would liquidate their holdings simultaneously. This action, as reported, caused the asset's value to plummet, leaving other investors with substantial losses.

A Pattern of Denial and Mounting Evidence

Following the collapse of the LIBRA token in February 2025, the lawsuit claims that Meteora publicly disassociated itself from Kelsier, a move the plaintiffs characterized as "performative." Chow and other Meteora executives reportedly submitted sworn statements portraying themselves as "passive developers of autonomous software," thereby denying any involvement in the price fluctuations of the crypto assets in question.

Chow resigned from Meteora in February, maintaining his claims of innocence. However, data from blockchain analytics firms, such as Bubblemaps, appears to contradict these assertions. A report issued on February 17, 2025, by Bubblemaps traced wallet addresses that reportedly revealed financial connections between the creators of MELANIA and LIBRA, and indicated that insiders had reaped over $100 million in profits.