Key Investment Details

- •Metalpha Technology Holding Ltd. has secured a $12 million investment from Gortune International Investment Limited Partnership and Avenir Group.

- •The funds are designated for expanding digital asset technologies, blockchain services, and bolstering operating capital.

- •The stock subscription agreement is set to be finalized by November 30, 2025, indicating a strategic growth trajectory.

Metalpha's Strategic Funding Initiative

Metalpha Technology Holding Limited (NASDAQ: MATH) has successfully secured a significant $12 million investment from Gortune International Investment Limited Partnership and Avenir Group. This strategic financial infusion comes in the form of a private placement of common stock, with the transaction slated for completion by November 30, 2025. Metalpha CEO, Adrian Wang, highlighted the importance of this development, stating, "This funding marks a new era of growth, positioning Metalpha to deliver expanded blockchain trading strategies and digital asset innovation for our institutional clients."

The newly acquired capital will be strategically allocated to enhance Metalpha’s existing blockchain trading services, drive investment in cutting-edge digital asset technologies, and provide essential support for its operating funds. This initiative is designed to broaden the company's service portfolio and solidify its standing within the dynamic digital asset sector.

Market sentiment has responded positively to the news, largely acknowledging the potential for expansion and innovation that this investment signifies. Adrian Wang further commented on the company's readiness to offer enhanced services to its institutional clientele. However, the prevailing regulatory landscapes, particularly concerning digital asset oversight in various jurisdictions, remain a crucial factor influencing the sector's progression.

Impact on the Blockchain Sector

Metalpha's recent investment aligns with historical patterns observed in the financial technology sector, where substantial capital raises have often preceded periods of significant growth in financial product development and market influence. This trend is comparable to previous $10 million funding rounds experienced by other prominent asset management firms.

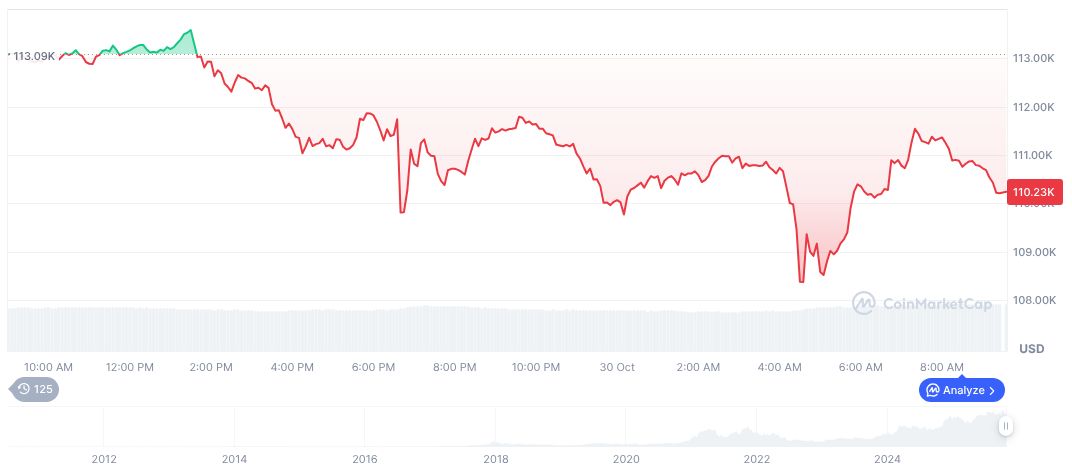

As of October 30, 2025, Bitcoin (BTC) holds a substantial market capitalization of $2.15 trillion, representing 59.24% of the total cryptocurrency market dominance. Despite a minor decrease of 3.23% in the past 24 hours, its trading volume reached $70.94 billion, marking a 13.42% shift. The fixed supply of Bitcoin remains at 21 million, with approximately 19.94 million coins currently in circulation.

The Coincu research team anticipates that Metalpha's strategic advancements could exert a considerable influence on the trading dynamics of Bitcoin (BTC) and Ethereum (ETH), particularly in light of the projected increase in market liquidity and heightened investor engagement. The company's future growth is heavily dependent on its ability to foster technological innovation and maintain strict regulatory compliance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |