A new analysis from Messari Research suggests a significant shift in the digital asset landscape, examining Bitget’s evolving market structure and growth drivers. The report highlights the rapid scale of the “Universal Exchange” (UEX) model, driven by the expansion of tokenized stocks and rising institutional participation.

The report stated cumulative tokenized stock futures volume on Bitget reached approximately $18 billion by December 2025, while institutional traders accounted for 82% of spot trading volume, underscoring a structural shift toward professional and cross-asset participation on the platform.

The Rise of Continuous Tokenized Equities

Messari’s findings emphasize a growing global appetite for borderless access to traditional markets. By tokenizing major U.S. equities, the platform has established a 24/5 trading cycle that allows international investors to react to earnings reports and macroeconomic shifts outside of standard US market hours. Trading activity reached a fever pitch in late 2025, with November alone accounting for $13.6 billion in futures volume. While East Asia remains the dominant hub—representing nearly 40% of all activity—the report noted significant expansion across Latin America and Southeast Asia, suggesting that tokenization is effectively redistributing global equity liquidity.

Institutional Maturation and Asset Concentration

Institutional participation emerged as a key structural driver in the report. The data shows that institutional market makers accounted for 60% of futures activity, providing the deep liquidity required for large-scale cross-asset execution. Messari’s findings also highlight strong asset concentration among major U.S. equities. Tesla led activity with over $6.3 billion in cumulative volume, followed by Meta, MicroStrategy, Apple, and Google, which together generated more than $6.6 billion. Shale Ferdana, a Research Analyst at Messari and author of the report, noted that unified platforms are becoming the preferred access point for both digital and traditional assets as market structures favor consolidation over fragmentation.

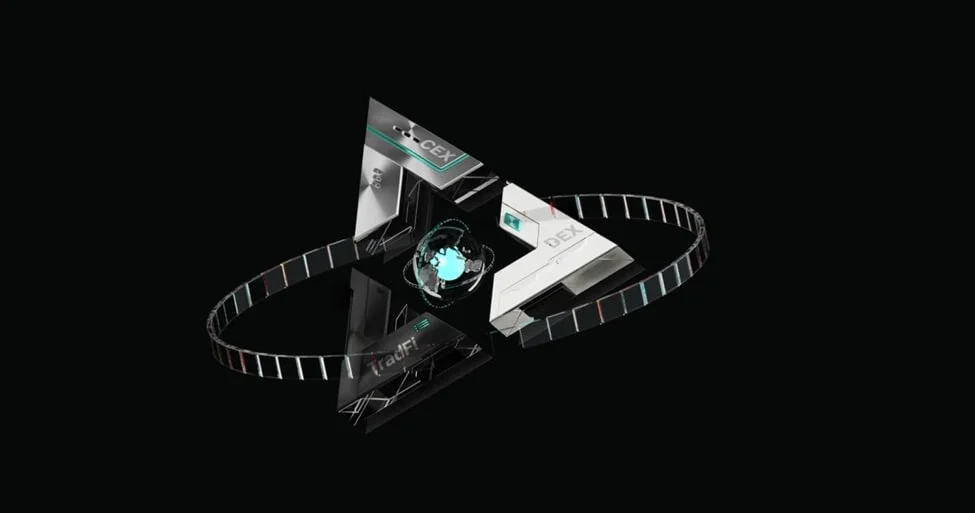

The Emergence of a New Market Standard

The Messari report concludes that the UEX model represents a broader trend where digital assets, tokenized real-world assets, and institutional liquidity converge within a single execution environment. As institutional capital continues to seek streamlined infrastructure, the distinction between crypto-native platforms and traditional financial brokerages is becoming increasingly blurred, reshaping how global capital accesses the broader market.