Market Overview

Memecoins have reached their lowest point of the year, with their combined market capitalization falling to $39.4 billion on Friday. This represents a significant loss of over $5 billion in a single day. The current market cap is a stark contrast to the January peak of $116.7 billion, marking a brutal 66% drop. Despite a 40% jump in trading volume, the activity was characterized by panic selling rather than buying.

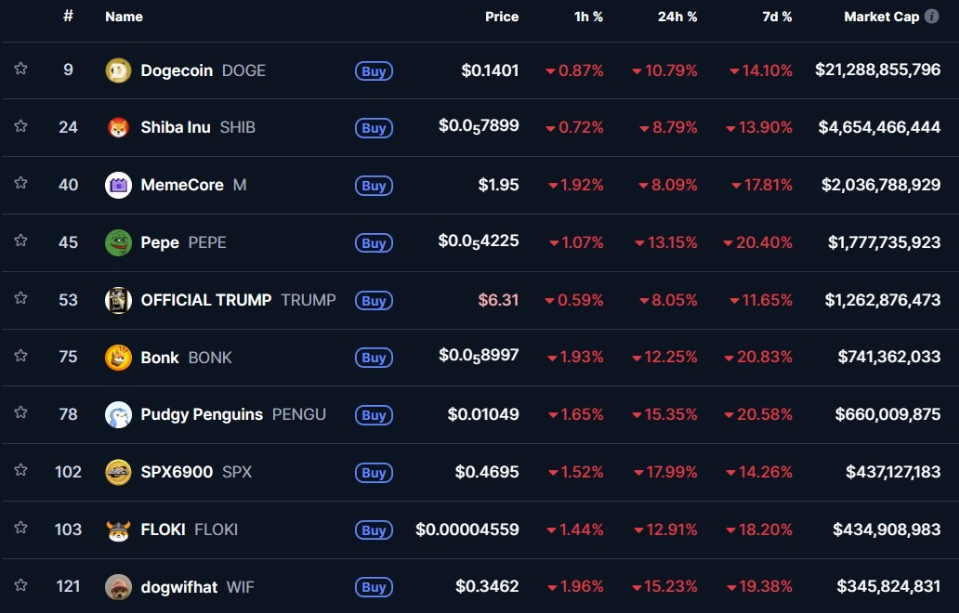

The broader cryptocurrency market has also experienced a severe downturn, shedding $800 billion in the past three weeks and declining to $2.96 trillion. Bitcoin saw a 14.7% decrease this week, falling to $82,778, while Ethereum dropped 16% to $2,688. All major memecoins experienced double-digit losses, with Dogecoin down 14%, and Pepe, Bonk, and Dogwifhat each losing around 20%. Even the Trump-themed TRUMP coin saw an 11.6% decline.

NFT Market Conditions

The non-fungible token (NFT) market is also experiencing significant declines, mirroring the trend in memecoins. The total NFT market cap has fallen to $2.78 billion, its lowest level since April. This represents a 43% decrease over the last month. Many prominent NFT collections have seen substantial drops in value, including Hyperliquid's Hypurr NFTs, which are down 41%, Moonbirds off 33%, CryptoPunks 27%, and Pudgy Penguins 26%. In contrast, Infinex Patrons saw a 11% gain, and Autoglyphs showed minimal change.

Investor Sentiment

The current market conditions reflect a strong "risk-off" sentiment among investors. This has led to widespread selling of speculative assets, including memecoins and NFTs. With Bitcoin and Ethereum leading the downward trend, the market for highly volatile assets has rapidly contracted, pushing the most speculative corners of the crypto space back to levels not seen since the spring.