Matrixdock, the issuer behind the XAUm gold-backed token, has strengthened its position in the real-world-asset (RWA) ecosystem as demand for on-chain precious metals continues to rise. XAUm represents 1 troy ounce of 99.99% LBMA-certified physical gold, fully backed and stored in audited vaults in Asia, according to documents from Matrixdock’s gold custody and verification files.

The project has seen steady growth in holders and market activity, with 2.39K holders and a $50.86M market cap reported. As gold becomes an increasingly preferred asset during macro uncertainty, digital gold tokens like XAUm have gained traction due to accessibility, transparency, and on-chain settlement.

Strengthened Physical Backing and Audit Transparency

Matrixdock recently highlighted updates in its vault audits, including Bureau Veritas physical gold verification reports (Jan & Jul 2025), confirming the integrity of the underlying reserves.

Key points from Matrixdock documentation include:

- •99.99% purity LBMA gold

- •480 individually catalogued bars

- •15,431 troy ounces of audited bullion backing the circulating supply

- •Fully documented storage in Singapore and Hong Kong vaults

This level of audit clarity supports XAUm’s position as a compliant gold-backed asset, further reinforced by its Hong Kong Precious Metal Dealer Category A License held by Matrix Infinitus (HK) Limited.

Expanding Utility Through Tokenized Gold Mechanics

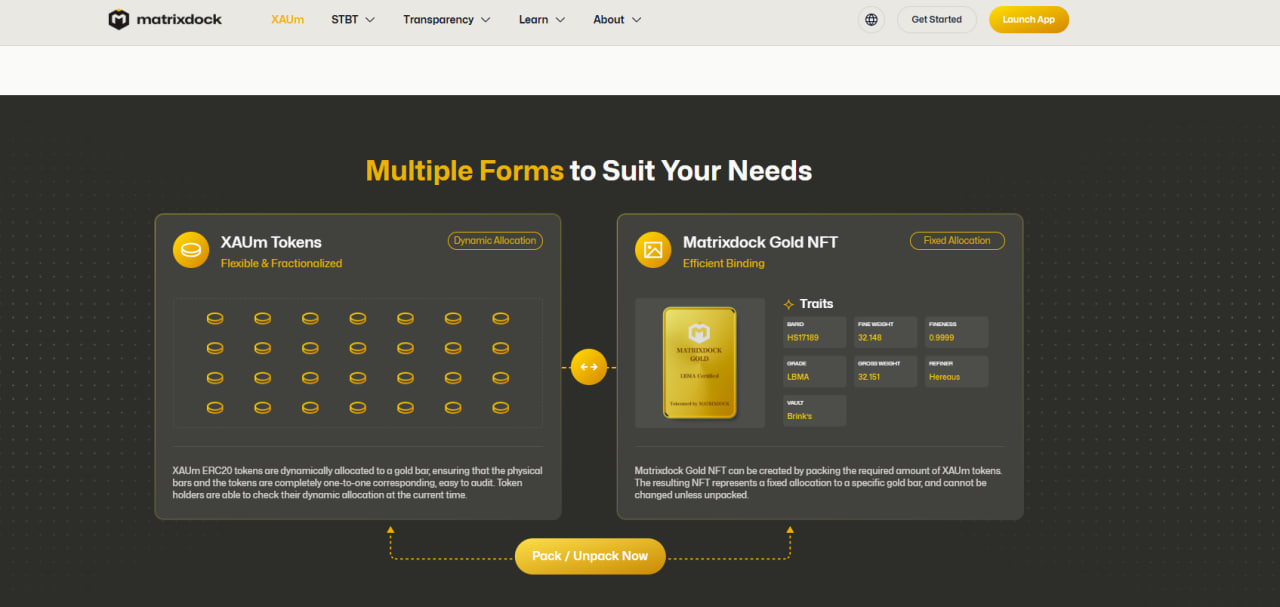

Matrixdock’s architecture introduces multiple forms of utility for XAUm holders:

- •Fractional Gold Access: XAUm is divisible up to 18 decimals, lowering the barrier to gold ownership.

- •Mint / Redeem Mechanism: Real-time mint and redeem pricing is available via the Matrixdock app, enabling physical redemption.

- •Dynamic Allocation System: Each token is mapped to a specific gold bar, ensuring transparent 1:1 allocation.

- •Yield Opportunities: XAUm can be used as collateral to access stablecoin yield products, as shown in Matrixdock’s ecosystem documentation.

This flexibility makes XAUm more adaptable compared to traditional gold investment vehicles, which typically lack programmability and liquidity.

Increasing Market Reach via Multichain Liquidity

XAUm is actively traded across major decentralized exchanges including:

- •PancakeSwap v3 (BSC)

- •Uniswap v3 (Ethereum)

- •Bluefin

- •BitKan

Data shows consistent liquidity distribution between USDT and USDC trading pairs, with XAUm’s depth supported by stable market behavior. This multichain presence reinforces its value proposition as an accessible on-chain commodity.

Conclusion

Matrixdock continues to expand XAUm’s role within the RWA landscape by combining audited physical gold reserves, licensed storage partners, transparent allocation mechanisms, and growing exchange coverage. As interest in tokenized hard assets accelerates, XAUm’s model of verifiable backing and cross-chain accessibility positions it as a leading digital gold product within the Web3 commodity sector.