Mastercard is reportedly considering a strategic investment in crypto infrastructure firm Zero Hash, marking a shift from earlier plans that explored a full acquisition.

The move reflects a more flexible approach to gaining exposure to core crypto plumbing while allowing the Chicago-based startup to remain independent.

Earlier discussions had centered on a potential acquisition valued between $1.5 billion and $2 billion.

Those talks reportedly stalled after Zero Hash opted to retain its standalone status, prompting Mastercard to reassess its approach. Rather than pursuing outright ownership, a minority investment would still give Mastercard closer alignment with critical infrastructure as blockchain-based settlement gains traction across financial services.

The strategic rationale sits within Mastercard’s broader effort to integrate stablecoins and blockchain settlement rails into its global payments network.

Zero Hash provides API-driven infrastructure that enables banks and fintech platforms to offer crypto trading, custody, and settlement without building these systems internally. That positioning places Zero Hash at the intersection of traditional finance and digital assets, an area where Mastercard is increasingly active as it competes with peers such as Visa and Stripe pursuing similar integrations.

Competitive Landscape and Market Relevance

Competitive dynamics appear to be shaping this interest as well. Mastercard’s focus on Zero Hash followed reports that it lost a separate bidding process to Coinbase for another infrastructure provider, BVNK. Zero Hash already supports crypto offerings for major financial institutions including Interactive Brokers, SoFi, and Morgan Stanley through its E*Trade platform, underscoring its relevance within regulated markets.

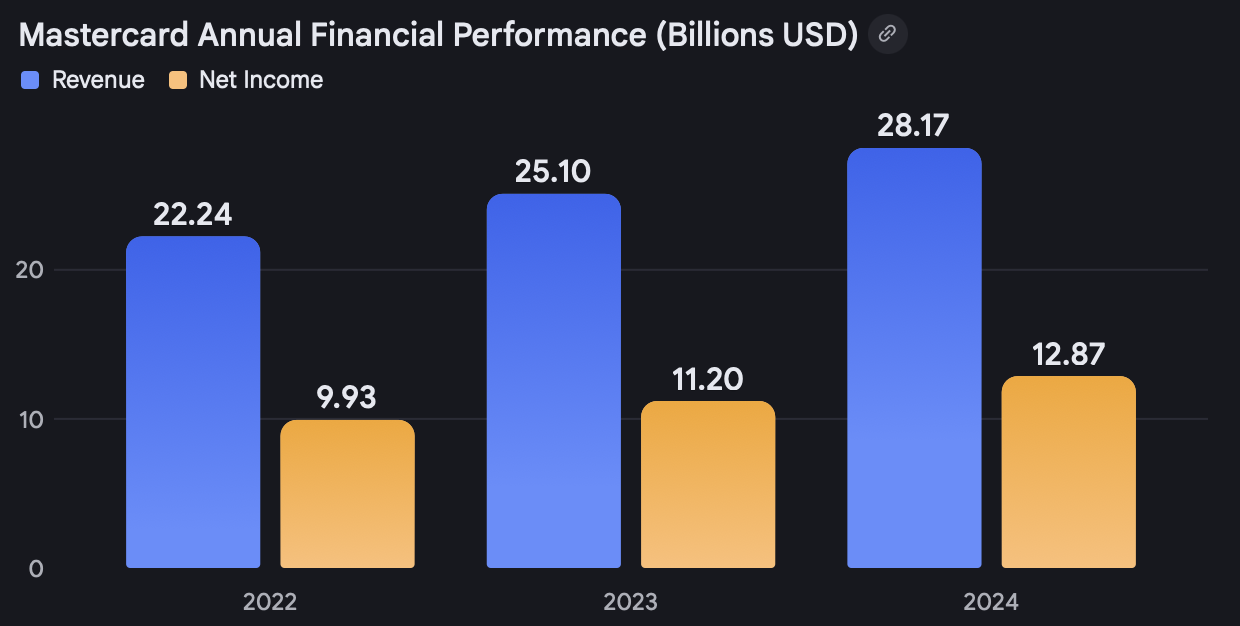

The potential investment comes as Mastercard continues to post solid financial performance. The company reported annual revenue growth of 12.2% in 2024, reaching $28.17 billion. That backdrop provides both the balance-sheet capacity and strategic incentive to selectively deploy capital into infrastructure that could shape the future of payments, even as the firm avoids the integration risks associated with large acquisitions.