- •Mantle (MNT) shows strong momentum with bullish technicals pointing toward $3.60 as projected by analyst Ali.

- •Trading volume and TVL confirm adoption strength, with buyers consistently defending critical demand zones in recent sessions.

- •Medium-term growth of +226% in 90 days underscores strong positioning, backed by institutional interest and healthy market structure.

Mantle (MNT) is showing one of the clearest technical structures in the mid‑cap market, with price action steadily advancing in an uptrend. The token has moved through earlier resistance zones and is preparing for higher targets in the months ahead.

Breakout Structure and Technical Targets

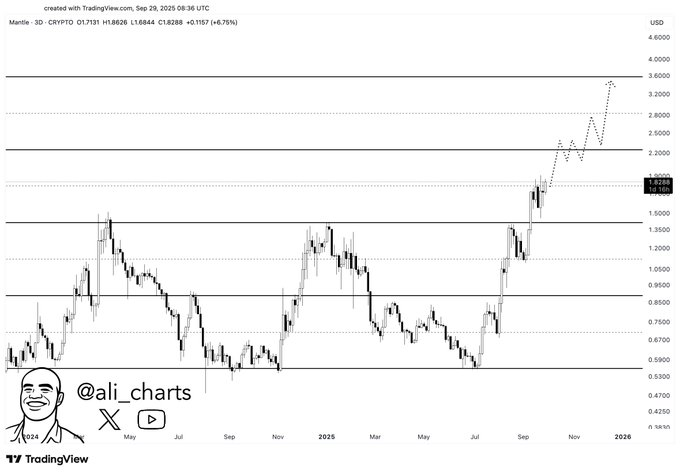

According to Ali (@ali_charts), Mantle has completed a crucial breakout, transitioning from accumulation to expansion. During most of 2024 and early 2025, MNT was in the range of $0.65‑$1.20, and it established a long‑term base on which it could be heavily supported. At the time of the breakout in September, the shift attested the closure of consolidation and the beginning of a new bullish cycle.

The chart now shows increased highs and increased lows and momentum is being supported by follow‑through of every breakout. Ali picks out major roadblocks at $2.20 and $2.80, and a medium‑term five‑year plan to hit $3.60. Notably, his calculated course contains detours and mergers as he recognizes that a market tends to move in wave patterns as opposed to linear ones.

Price behavior around $2.00 to $2.20 will be an important test, as psychological levels often attract sellers. Holding above this zone on a retest would provide confirmation of strength, setting up the advance toward higher resistances.

Market Data and Participation

At the time of writing, Mantle is trading around $1.84 after peaking near $1.92 earlier in the session. The intraday retracement to $1.83‑$1.85 demonstrates short‑term volatility but also shows how buyers continue to defend critical zones. This resilience is reinforced by strong liquidity and active order flow.

The 24‑hour trade volume is $343.6 million, and the Total Value Locked (TVL) of Mantle is $753.7 million. These statistics indicate strong interest and usage, not just in speculative trading, but also in the application of decentralized finance (DeFi). High TVL is often a marker of sustained utility and institutional confidence.

The supply structure shows 3.25 billion tokens in circulation out of a capped 6.21 billion maximum supply. With more than half already circulating, Mantle is positioned within a deflationary framework, where demand growth can directly support value over time.

Performance Across Timeframes

MNT’s performance across multiple horizons has been consistent. Short‑term gains include +0.59 % over four hours and +1.68 % in the last 24 hours. Over seven days, the token has risen 6.44 %, signaling steady accumulation rather than overextended surges.

Longer timeframes reveal stronger positioning. Mantle has spurted 55.14 % in 30 days, 226.97 % in 90 days and 136.93 % in 180 days. This play highlights a shift between stagnation and development fueled by institutional remittances and growing communal participation. On a year‑to‑year basis, MNT has gone up 47.68 %, whereas its one‑year performance is +186.58 %.

Exchange data such as Binance and OKX indicate that traders prefer a long exposure, with the most successful traders holding large allocations. This behavior indicates confidence in continued upside, particularly as Mantle holds above critical levels.