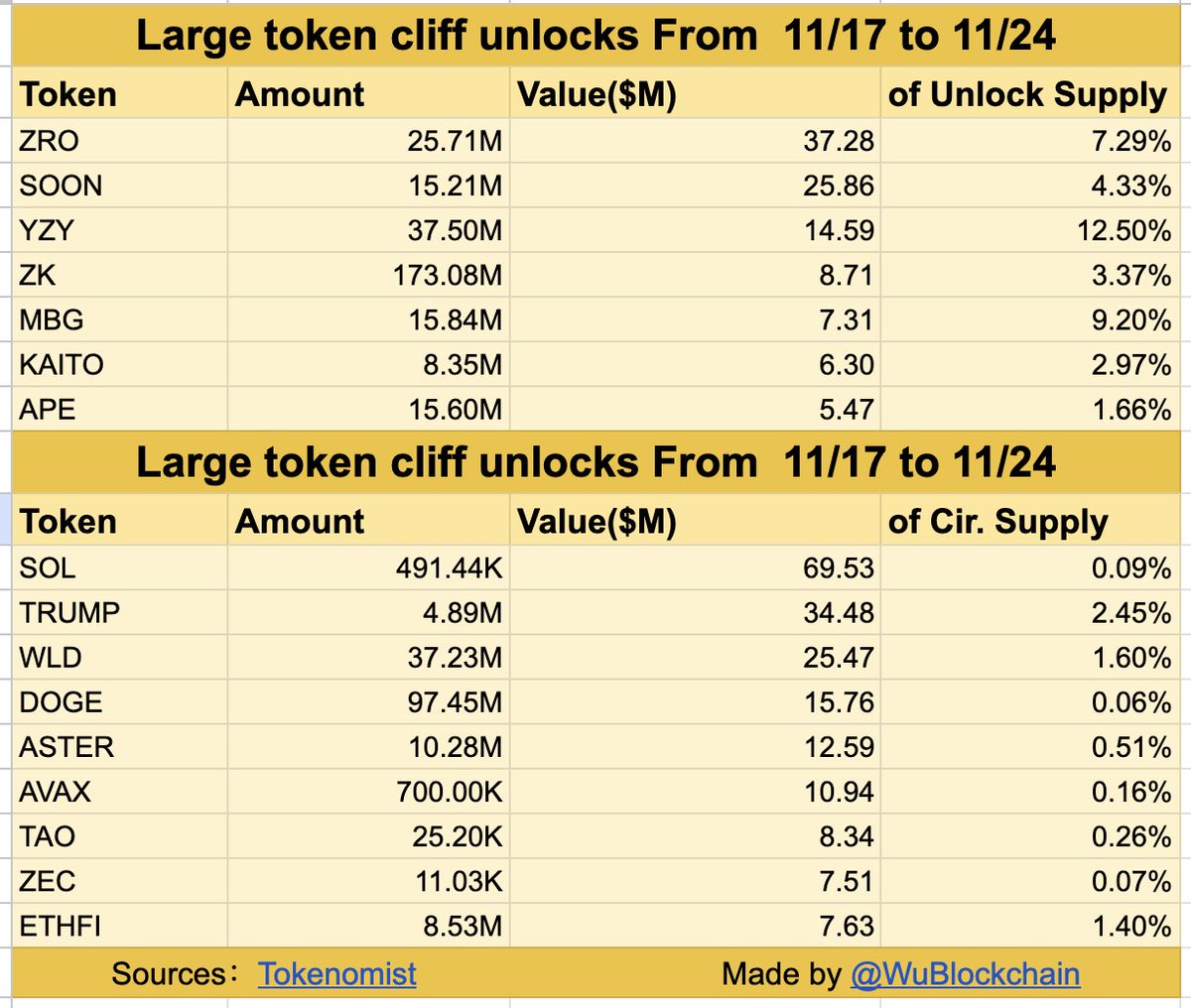

A massive round of token unlocks is about to shake the market, with over $297 million in supply scheduled to hit circulation between November 17 and November 24, according to new data published by Tokenomist and shared by Wu Blockchain.

This week’s unlocks include a mix of large cliff unlocks (one-time releases) and daily linear unlocks, impacting some of the market’s most actively traded assets, including SOL, TRUMP, WLD, DOGE, AVAX, ZEC, APE, ZK, and others.

Large One-Time Unlocks: ZRO, SOON, YZY, ZK Lead the List

Several tokens will undergo major single unlock events, each unlocking more than $5 million worth of supply:

- •ZRO: 25.71M tokens unlocked – $37.28M (7.29% of supply)

- •SOON: 15.21M – $25.86M (4.33%)

- •YZY: 37.50M – $14.59M (12.50%)

- •ZK: 173.08M – $8.71M (3.37%)

- •MBG: 15.84M – $7.31M (9.20%)

- •KAITO: 8.35M – $6.30M (2.97%)

- •APE: 15.60M – $5.47M (1.66%)

These cliff unlocks often create short-term selling pressure, especially when a high percentage of a project’s supply is released at once.

Major Circulating Supply Impacts: SOL, TRUMP, WLD, DOGE, AVAX

Tokenomist also highlights several tokens facing significant circulation-impacting unlocks this week:

- •SOL: 491.44K tokens unlocked – $69.53M, though just 0.09% of supply

- •TRUMP: 4.89M – $34.48M (2.45%)

- •WLD: 37.23M – $25.47M (1.60%)

- •DOGE: 97.45M – $15.76M (0.06%)

- •ASTER: 10.28M – $12.59M (0.51%)

- •AVAX: 700K – $10.94M (0.16%)

- •TAO: 25.20K – $8.34M (0.26%)

- •ZEC: 11.03K – $7.51M (0.07%)

- •ETHFI: 8.53M – $7.63M (1.40%)

What This Means for the Market

Large unlocks can often trigger:

- •Short-term volatility, especially in smaller-cap tokens

- •Price corrections if vested investors take profits

- •Higher trading volume as traders speculate on post-unlock movements

However, tokens with strong liquidity, including SOL, DOGE, and AVAX, typically absorb unlocks more smoothly unless combined with broader market weakness.

This week’s $297M unlocks arrive at a time of already heightened volatility across major assets, making the next seven days especially important for traders tracking supply-driven catalysts.