Litecoin (LTC) is gaining momentum as it trades above key support and approaches critical resistance. A breakout could set the stage for a larger rally, as technical patterns align with bullish market sentiment.

Litecoin (LTC) is currently trading at $79.75, showing a 3.53% gain in the last 24 hours. After a recent dip, the price found support near $76.40. Buyers re-entered at this level, which has held steady over recent sessions. Resistance has formed just below the $80 mark, where upward momentum is pausing.

A move above this resistance could push the asset into a bullish continuation phase. This aligns with technical setups pointing to a breakout from a multi-year pattern.

Analysts Identify Bullish Long-Term Setup

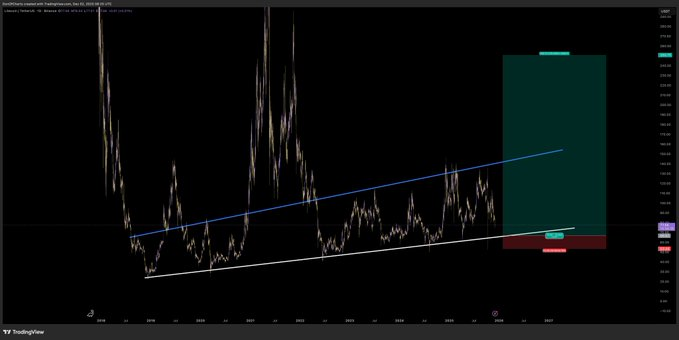

Trader Donald’s Trades shared a long-term chart showing Litecoin forming an ascending triangle. The setup features a rising white trendline acting as support and a flat resistance on a blue trendline. This pattern often suggests potential for upward movement if the price breaks through resistance.

According to the shared chart, a confirmed breakout could take Litecoin toward the $200–$250 range. A stop-loss is positioned just below the support line to manage downside risk. The triangle has been forming over several years, adding weight to the setup’s reliability.

Crypto analyst butterfly_chart also noted this structure. They mentioned that if the price holds above support and breaks the descending trendline, Litecoin may begin a broader rally. This could carry the price to mid-range resistance levels of $104 and $110 before possibly reaching $180.

Breakout May Signal Wider Upside Targets

The LTC/USD pair shows bullish structure on both short-term and long-term charts. Traders will be monitoring whether the price can close above the $80 resistance zone. Sustained momentum above this level could mark the start of a wider rally.

Analysts agree that a breakout from the current consolidation range could push the price toward $180 in the medium term. In the longer term, Litecoin could revisit the $200 to $250 zone, supported by technical patterns and market demand.