Key Concerns Surrounding LSD Token

- •LSD, a Solana-based token, is under increased scrutiny due to unusual trading patterns and thin organic liquidity flagged by community members on decentralized exchanges.

- •Concerns have been raised regarding suspected bot-driven activity, an anonymous team structure, and limited public disclosures.

- •The situation highlights the broader risks associated with early-stage and thinly traded tokens in experimental market segments.

Analysis of Trading Activity

LSD, a token currently trading on Solana-based decentralized exchanges, has come under closer community review following discussions around its recent price behavior and transparency practices. Market participants have pointed to sharp price movements followed by relatively low sustained volume, prompting questions about the nature of recent trading activity.

According to on-chain data shared by users, LSD experienced rapid price increases on platforms such as Meteora before entering periods of consolidation. Some community members suggest these movements resemble patterns commonly associated with automated trading or artificial liquidity, although no definitive conclusions have been reached.

Additional scrutiny has focused on wallet activity and execution behavior, with users circulating Dexscreener links as examples of potentially irregular trades. Commenters note that similar patterns have appeared in past cases involving bot-assisted trading, though such signals alone do not confirm manipulation.

Project Infrastructure and Disclosures

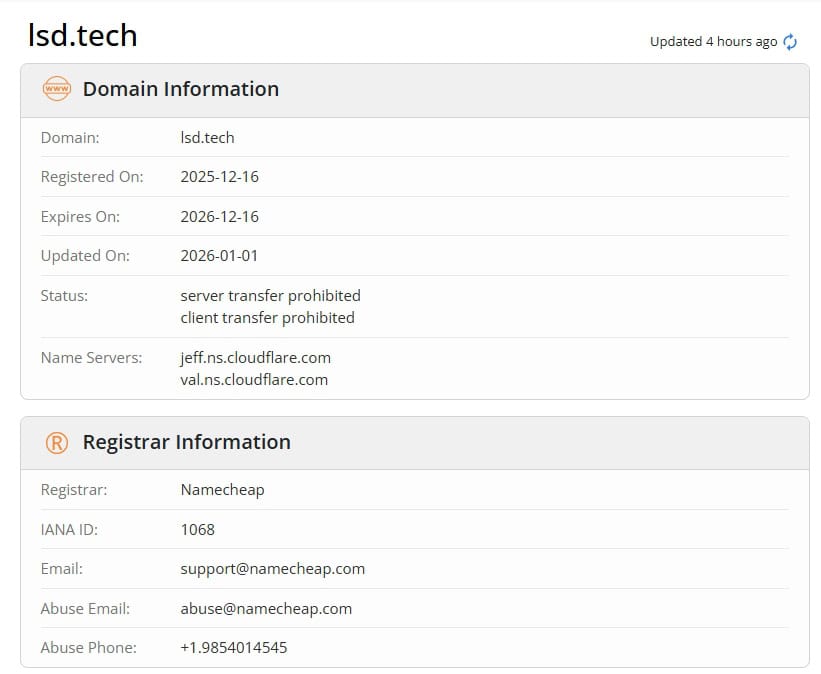

Beyond market activity, attention has shifted to the project’s infrastructure and disclosures. Domain records show that lsd.tech was registered for a one-year period, expiring in December 2026, despite the project being positioned as a long-term staking-focused protocol. While short-term domain registrations are not uncommon, some users view the contrast as a transparency concern.

Project documentation has also drawn criticism. LSD’s publicly available roadmap outlines broad ambitions, including validator analytics, AI-based risk modeling, and cross-chain staking features, but lacks detailed timelines or technical milestones, making execution progress difficult to assess.

Team Anonymity and Community Engagement

Community discussions further highlight team anonymity as a potential risk factor. LSD has not publicly disclosed verifiable team identities, and screenshots shared by users show Telegram accounts labeled as “not an official account” engaging with the community. Reports of automated promotional messages have added to skepticism around organic engagement.

User posts on CoinMarketCap’s community forum echo similar concerns, citing unclear governance structures, generic risk disclosures, and a user risk profile that appears non-specific to the project.

Current Status and Due Diligence

Despite the growing discussion, no formal determination has been made regarding misconduct or illegitimacy. Observers emphasize that individual signals are inconclusive on their own, but collectively reinforce the importance of independent due diligence, particularly for early-stage or thinly traded tokens.

As of publication, the LSD team has not publicly addressed the concerns raised across social platforms. Community members continue to monitor on-chain data and disclosures while urging caution until greater clarity emerges.