Lighter, a crypto platform specializing in perpetual futures, has experienced a significant increase in daily trading volume over the past three days, surpassing competitors like Aster and Hyperliquid. On October 26, the platform facilitated $8.6 billion in trades. However, its total value of open positions stood at $1.7 billion, which remains lower than its main competitors.

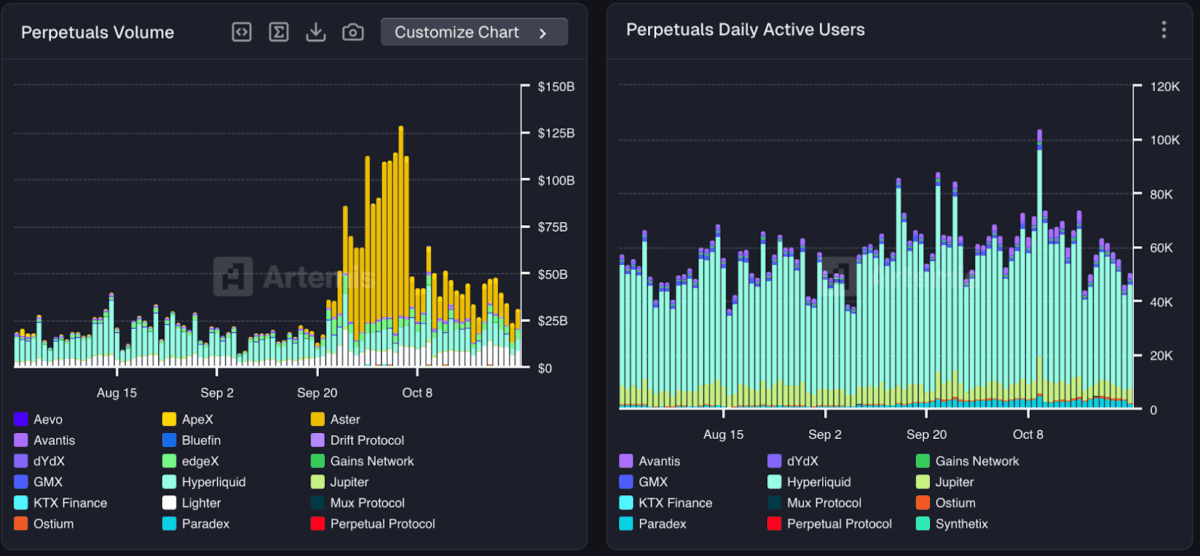

Data from Artemis indicates that perpetual trading activity saw a sharp rise in late September, briefly exceeding $125 billion. This surge was primarily driven by robust activity from the ApeX and Aster platforms. Following this peak, daily trading volumes moderated in early October, settling between $25 billion and $50 billion, which stabilized the overall trading environment.

Despite fluctuations in trading volume, the number of daily active users across various platforms has remained consistent. Platforms such as Hyperliquid, Paradex, and dYdX have been attracting between 40,000 and 80,000 users daily.

Lighter operates on the Ethereum network and utilizes zk-rollup technology, which enhances trading speed and reduces costs for perpetual futures. The platform's recent growth suggests continued trader engagement, even as the broader cryptocurrency market experiences reduced volatility.

Open Interest Trends and Market Dynamics

Open interest, a metric reflecting the total capital committed to open perpetual futures trades, saw an increase throughout September. It reached a peak of nearly $30 billion at the beginning of the previous month. Hyperliquid captured the largest portion of this open interest, with ApeX, Aster, and dYdX also experiencing significant gains during this period.

Following the highs observed in early October, open interest has normalized, settling in the range of $15 billion to $20 billion. This suggests that while Lighter currently leads in daily trading volume, its comparatively smaller open interest indicates a higher turnover of trades or the participation of new traders, rather than a dominance of long-term leveraged positions in the market.

On October 27, Astros launched its perpetual decentralized exchange (DEX) on the Sui network, which has since accumulated $2.6 billion in total value. Jerry Liu, founder of Astros, commented on the development, stating, "Perp DEXs have become the ultimate litmus test for a blockchain’s ability to handle real financial infrastructure."

The previous day, Surf Protocol introduced TurboFlow, a fully on-chain trading platform that offers traders leverage options of up to 1000x. This platform provides both traditional fee structures and a fee-free profit-sharing alternative.

These developments highlight the substantial growth of perpetual futures within the cryptocurrency space. This segment now constitutes 26% of all derivatives trading, with monthly volumes approaching $1 trillion.

Lighter's increased daily trading volume signifies growing participation from traders, even if long-term positions remain relatively smaller. The perpetual futures market continues its expansion, with fast and cost-effective platforms on emerging blockchain networks playing a crucial role in advancing decentralized finance (DeFi).