Illinois Regulators Approve LevelField's Acquisition of Burling Bank

LevelField Financial Inc. has received approval from Illinois state regulators to acquire Chicago-based Burling Bank. The company plans to transform the acquired bank into a cryptocurrency bank by the end of the year. This significant development aims to create a regulated, full-fledged cryptocurrency bank, marking a potential shift in how traditional financial institutions engage with digital assets. The acquisition, however, is still dependent on the Federal Reserve’s consent and the fulfillment of additional conditions before it can be finalized.

Integrating Digital Assets with Traditional Banking

The acquisition by LevelField is intended to redefine digital asset services within the banking sector. This move reflects a growing trend of traditional banks seeking to integrate with cryptocurrency markets. CEO Gene Grant II of LevelField emphasized their vision of merging traditional bank operations with digital asset services, which will include offerings like Bitcoin and Ethereum-backed loans. While state regulators have given their approval, the process is still awaiting the crucial consent from the Federal Reserve.

Upon completion of the acquisition, LevelField aims to strengthen its position in the crypto banking sector by continuing Burling Bank’s community operations. This strategic move is seen as a direct response to recent shifts and interests within the banking industry and could significantly influence future crypto adoption within banking services.

"We intend to retain Burling Bank’s core community banking operations, with a new focus on providing deposit accounts, loans, and custody services tailored to digital assets, such as term loans and credit cards secured by Bitcoin or Ethereum." — Gene A. Grant II, CEO, LevelField Financial Inc.

Market Context and Historical Trends

The proposed merger follows a history of attempts to acquire Burling Bank, indicating sustained industry interest, particularly in the wake of banking challenges experienced in 2023. This interest highlights the evolving landscape of financial services and the increasing integration of digital assets.

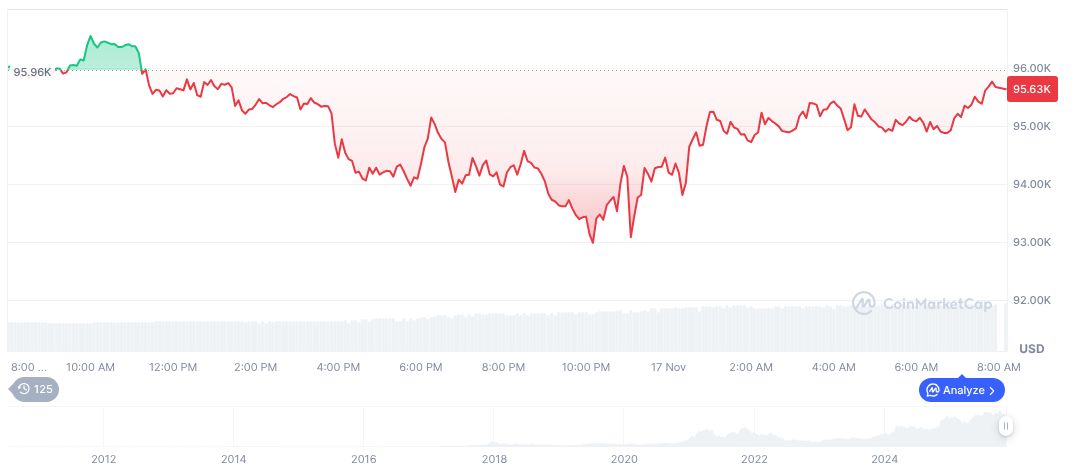

In the broader cryptocurrency market, Bitcoin (BTC) is trading at $91,595.01 with a market capitalization of $1.83 trillion. The reported trading volume for BTC stands at $95.53 billion, showing a 48.50% increase. Over the preceding 24 hours, BTC experienced a dip of 2.15%, and in the past 90 days, it has decreased by 19.31%. These market dynamics provide a backdrop to LevelField’s strategic acquisition.

Insights suggest that this acquisition could prompt a regulatory shift favoring greater institutional involvement in cryptocurrency. Past endeavors in this space underscore the necessity of robust compliance frameworks for maintaining stability as cryptocurrency markets and traditional banking sectors converge. This aligns with initiatives like those from the OCC concerning Financial Technology.