South Africa’s Competition Tribunal has approved Lesaka Technologies’ acquisition of Bank Zero for R1.1 billion ($63.8 million). This approval grants Lesaka direct control of Zero Research, the parent company of the digital-only bank. The deal, which was initially announced in June 2025, has now received clearance, although it still requires further approval from the Prudential Authority and Exchange Control.

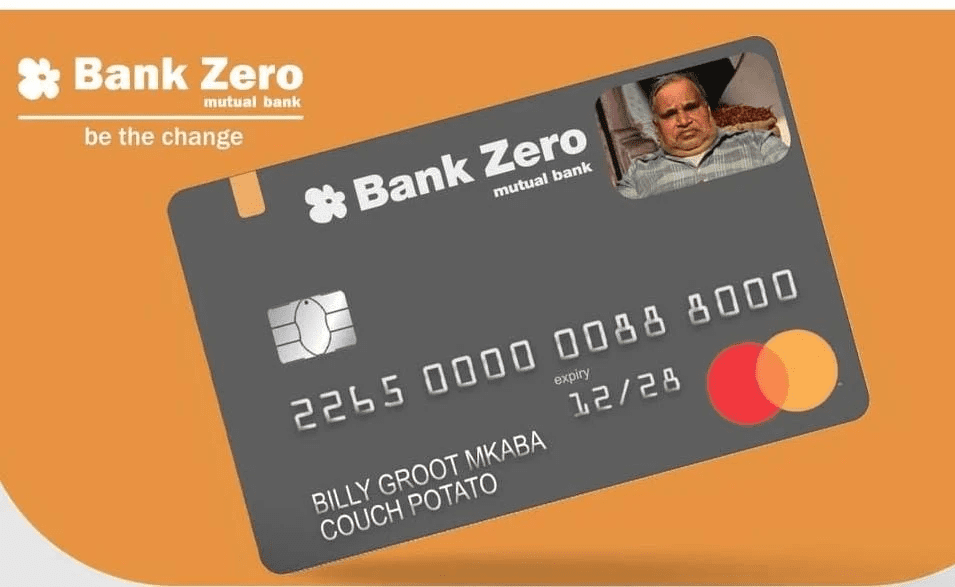

Bank Zero, launched in 2021, operates as a fully digital bank. It provides low-cost personal and business accounts that are accessible through its dedicated mobile application. The bank is recognized for its secure transaction capabilities, powered by IBM’s LinuxONE platform, and for its patented anti-fraud card. Following the acquisition, the bank is set to retain its current management team, which includes co-founder Michael Jordaan and CEO Yatin Narsai.

Lesaka Technologies, previously known as Net1, is a South African fintech company with listings on both the NASDAQ and the Johannesburg Stock Exchange. The company has been actively expanding its financial services portfolio through strategic acquisitions. Recent additions to its portfolio include Adumo and Touchsides, moves that have significantly strengthened Lesaka's market presence in both payments and enterprise solutions.

Lesaka to Build Unified Digital Banking Platform with Bank Zero

With the successful acquisition of Bank Zero, Lesaka Technologies intends to integrate the bank's advanced technology into a single, scalable system. This strategic integration is anticipated to optimize operations, broaden the range of banking services available to both consumers and merchants, and enhance the company's overall technological infrastructure. Furthermore, Lesaka plans to introduce cross-selling opportunities for banking products, launch new financial exchange solutions, and explore avenues for expanding its services across borders.

The acquisition is structured to bolster Lesaka’s financial standing, decrease its dependence on bank debt, and generate additional funding for lending initiatives through the utilization of customer deposits. The company projects that this transaction will yield substantial long-term revenue benefits, improve the economics of its lending operations, and create opportunities for the development of innovative digital banking services.

For Bank Zero, this transaction presents a significant opportunity to accelerate its growth trajectory and expand its customer reach without necessitating any alterations to its core management structure or its established digital-only operational model. In 2024, the bank reported approximately R400 million in deposits and R415 million in card spending, while consistently growing its user base.

Potential Challenges and Future Outlook

The integration process may present certain operational challenges. Lesaka will be tasked with unifying disparate platforms, migrating existing users, and ensuring robust data security, all while maintaining a seamless customer experience. While customers can anticipate the introduction of new products, any such transition inherently carries the usual risks of potential service disruptions or adjustment periods.

Upon completion, this acquisition is poised to solidify Lesaka's position as a more formidable entity within South Africa's burgeoning digital banking sector. The company will be able to offer expanded services tailored to underserved communities and businesses. This development underscores the ongoing consolidation occurring within the country's fintech landscape, as companies increasingly combine technological capabilities, customer bases, and infrastructure to achieve greater scale in their digital financial service offerings.