Kyo Finance Targets DeFi's $100 Million Valuation Milestone

Kyo Finance, a component of the Soneium ecosystem, has successfully concluded a $5 million Series A funding round, which has propelled its valuation to $100 million. This funding is dedicated to simplifying access to decentralized finance (DeFi) by creating a unified liquidity layer. The initiative aims to eliminate chain boundaries and address the pervasive issue of liquidity fragmentation within the DeFi space.

The funding round was led by Castrum Istanbul, with significant support from Startale Ventures. This infusion of capital will enable Kyo Finance to advance its infrastructure, particularly through the implementation of its veDEX model, and to scale its operations effectively. By confronting the challenge of liquidity fragmentation, Kyo Finance is positioned to enhance investor engagement and streamline interactions within the DeFi markets. Institutional investors, such as TBV, anticipate substantial shifts in liquidity flows as a result of these developments.

Sota Watanabe, CEO of Startale, expressed positive sentiment regarding the development, stating: "Together, we will tackle some of the most pressing issues in today’s DeFi sector, starting with uniting fractured liquidity and enabling a truly multi-chain ecosystem."

Historical Context and Market Analysis

Kyo Finance's endeavor to establish a single liquidity layer draws parallels with historical successes in the DeFi space, such as Curve. These unified layers have previously demonstrated their ability to enhance token utility and increase the total value locked (TVL) in protocols, setting a precedent for emerging DeFi projects.

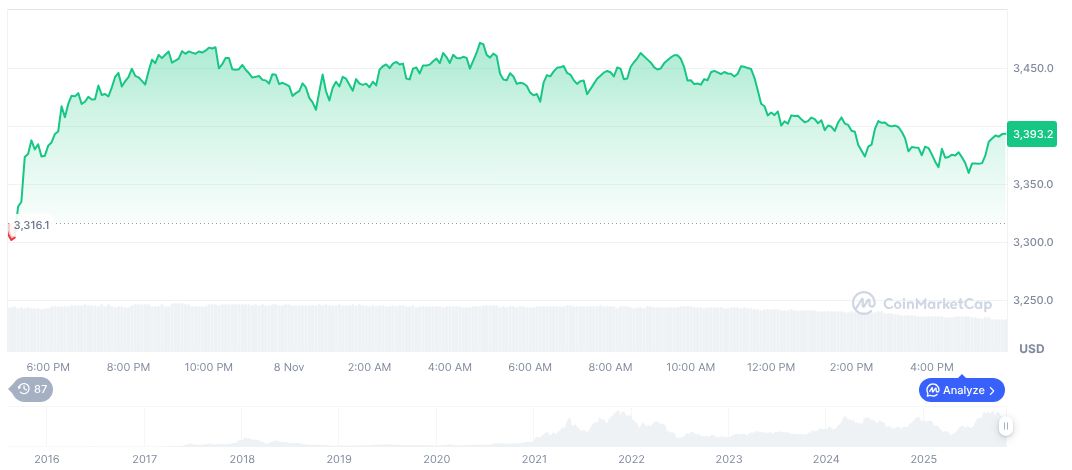

In the broader market context, Ethereum (ETH) is trading at $3,400.84, with a market capitalization of approximately $410.47 billion, according to CoinMarketCap. Despite a recent 1.80% decrease in its 24-hour price, the trading volume remains substantial at $25.70 billion, although it has seen a 37.51% decline. The circulating supply of ETH is currently around 120.70 million.

Coincu's analysis suggests that potential regulatory shifts in the DeFi landscape could further underscore the importance of compliant DeFi solutions. With the backing of institutional investors, Kyo Finance's strategic direction appears well-aligned to promote increased adoption of cross-chain liquidity aggregation methodologies.