Kazakhstan is rapidly transforming from a passive observer to an active participant in the cryptocurrency space. With a determined approach, the Central Asian nation is building the foundation for a new financial strategy centered around crypto. Its objective is not speculation, but the creation of a sovereign fund designed to convert confiscated assets into tools for economic growth. This initiative aims to modernize the economy and reduce the country's reliance on oil.

In brief

- •Kazakhstan is establishing a state crypto fund with a target valuation of up to one billion dollars by 2026.

- •This fund will be financed by seized cryptocurrency assets and revenue generated from public mining operations.

- •Investments will be channeled through Exchange Traded Funds (ETFs) and companies within the crypto sector, rather than direct cryptocurrency holdings.

- •The overarching goal is to facilitate a transition to a post-oil economy through carefully managed digital innovation.

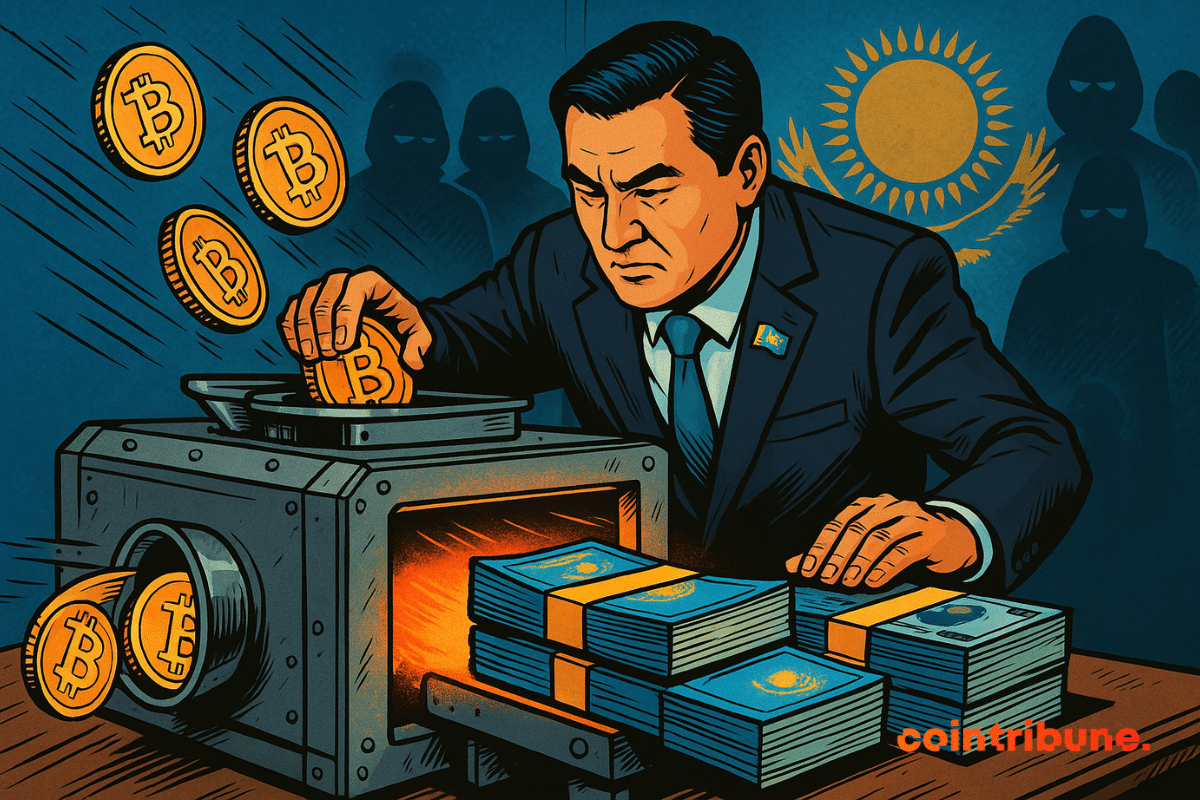

Kazakh Crypto Fund: Leveraging Illegality for State Advantage

Kazakhstan is making a significant move with the establishment of a national crypto fund, projected to be between 500 million and 1 billion dollars by 2026. The state's intention is not to accumulate Bitcoin reserves, but rather to invest in crypto ETFs and shares of companies operating in the digital asset sector. This strategy aims to secure exposure to the market without being directly vulnerable to its inherent volatility.

This fund will be capitalized by seized assets, including approximately 16.7 million dollars confiscated in 2024, as well as revenues from state-backed mining operations. This represents a strategic repurposing of assets, particularly as the country has successfully shut down 130 illegal platforms and dismantled 81 money laundering networks.

The management of the fund will fall under the purview of the Astana International Financial Centre (AIFC), the nation's financial hub. This entity is already recognized for attracting major blockchain companies and for its role in shaping the local regulatory landscape. By adopting this approach, Kazakhstan intends to transform a previously ambiguous area into a strategic advantage, moving from a defensive posture to proactive engagement.

From Black Gold to Digital Gold: A Vision for a Post-Oil Economy

For many years, Kazakhstan's economy has been largely dependent on oil revenues. However, the country is now embarking on a significant digital transformation. To diversify away from its reliance on oil, Kazakhstan is actively investing in the cryptocurrency market. Officials from the central bank have indicated that digital assets could become a key component of the nation's future reserves.

This strategy emphasizes a cautious and controlled approach, avoiding direct holdings of cryptocurrencies. Instead, the fund will prioritize investments in regulated and audited financial instruments. This model is inspired by established sovereign wealth funds, with a distinct Kazakh adaptation.

Kazakhstan's strategy is not merely imitative; it aims to attract international partners. Through the AIFC, the country is combining modern financial practices with robust regulatory frameworks, positioning itself as a prominent crypto hub in Central Asia.

This strategic initiative underscores a clear ambition: to establish Kazakhstan as a credible and influential player in the global digital asset landscape, at a time when many other nations are still exploring their options.

Web3, Regulation, and Ambitions: Kazakhstan's Strategic Crypto Play

The state-backed crypto fund is just one element of a much larger, comprehensive strategy. In 2025, the country launched CryptoCity, an ambitious initiative designed as a large-scale laboratory for testing cryptocurrency payments within the Alatau zone. The objective is to create a simulated environment for the economy of the future.

Kazakhstan's efforts extend further with the establishment of the Solana Economic Zone, recognized as the first official Web3 zone in Central Asia. This initiative is specifically tailored to support blockchain startups and includes educational programs focused on Rust programming and cybersecurity.

Concurrently, the country is strengthening its regulatory framework. This includes enhanced monitoring of ATMs, the blocking of over 3,500 illegal websites, and the dismantling of organized criminal networks involved in illicit activities. Kazakhstan is demonstrating a methodical approach to balancing innovation with control.

Key Figures in Kazakhstan's Crypto Transition

- •1 billion $: The maximum target valuation for the state crypto fund by 2026.

- •16.7 million $: The value of cryptocurrency seized by the Surveillance Agency in 2024.

- •CryptoCity: A pilot city project initiated in 2025 for testing cryptocurrency payments.

- •Solana Zone: The region's first officially designated Web3 economic zone.

- •3,600 shell companies: Dissolved over the past three years due to involvement in money laundering activities.

Kazakhstan's bold strategy involves transforming illicit activities into drivers of innovation. Adding to its significant advancements, the nation's central bank has reached another milestone by working on the launch of a national stablecoin, which will be backed by the Solana blockchain. This move lays the groundwork for a future digital monetary system. More than just catching up, Kazakhstan is demonstrating a significant upward trajectory in its engagement with the digital economy.