Kalshi Completes Significant Funding Round

Kalshi has announced the successful closure of a $1 billion Series E funding round, achieving a valuation of $11 billion. This substantial investment round was led by Paradigm, a venture firm focused on the crypto space. Other notable participants included Sequoia, Andreessen Horowitz, and ARK Invest, managed by Cathie Wood. The recent funding more than doubles Kalshi's previous valuation of $5 billion, which was established during a $300 million funding round in October. The company plans to utilize these new funds to enhance integrations with additional brokerages, forge new partnerships with news organizations, and broaden its overall product offerings.

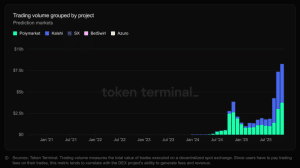

Prediction Market Volumes Surge in November

This significant funding milestone coincides with a period of remarkable growth in trading volumes for both Kalshi and its competitor, Polymarket. Both platforms experienced record-breaking activity in November, driven by increased adoption through various integrations. Kalshi's trading volume reached $5.54 billion in November, surpassing its previous record of $4.49 billion set in October, according to data from Token Terminal. Kalshi also reported that its trading volumes have increased by approximately 1,000% since 2024, with weekly activity now exceeding $1 billion. Kalshi has established a lead over its primary rival, Polymarket, which recorded a new all-time high (ATH) volume of $3.76 billion last month, an increase from the $3 billion activity seen in the preceding month.

Despite Kalshi's current dominance in trading volumes, its position may face increased competition as Polymarket prepares for its re-entry into the US market.

CNN Partners with Kalshi for Prediction Market Data

Kalshi's trading volumes are expected to see further growth following its designation as the official data partner for CNN. This collaboration, announced on Tuesday, will integrate Kalshi's real-time probability data on political, cultural, and economic events into CNN's programming and newsroom operations. The network intends to incorporate Kalshi's forecasts into its on-air analysis and introduce a live ticker to display the latest market-implied odds during segments utilizing this data. CNN's integration with Kalshi will be overseen by Harry Enten, the network's chief data analyst, who has expertise in polling and probability-based reporting. This partnership represents a significant step in the increasing integration between major media companies and prediction market platforms.

Tokenized predictions powered by Kalshi are live on @Solana

— Kalshi (@Kalshi) December 1, 2025

$2M+ in builder grants are open, @AxiomExchange is next, and more chains coming soon.

Welcome to the "Powered by Kalshi" era. pic.twitter.com/0zlNoyZNDA

Recent integrations also include Google, which announced it will incorporate data from both Kalshi and Polymarket into its Google Finance and Search products. Additionally, the NHL has entered into multi-year agreements with both Kalshi and Polymarket, naming them its official prediction market partners. The sports and fantasy sports operator PrizePicks has also established a multi-year partnership with Kalshi to power its prediction market offerings, mirroring the arrangement between Kalshi and Robinhood. Robinhood has noted that its prediction markets offering is one of its fastest-growing businesses, as stated in its latest earnings call. Reports have also emerged that Galaxy Digital is in discussions with both platforms to potentially serve as a liquidity provider.