JPMorgan Says Bitcoin Could Hit $165K If “Debasement Trade” Continues

According to JPMorgan, BTC could climb to as high as $165K on a volatility‑adjusted basis relative to gold by the end of year. The bank’s bullish prediction is dependent on whether the “debasement trade” continues to gain momentum.

The debasement trade is when investors buy hard assets such as gold and Bitcoin to hedge against the devaluation of fiat currencies.

JPMorgan’s model suggests that BTC would need to rise another 40 % from its current levels in order to match the scale of private gold holdings once risk has been accounted for.

The bank’s projection comes as retail investors accelerated their embrace of the debasement trade recently and poured capital into both gold and Bitcoin ETFs (exchange‑traded funds) in the past quarter.

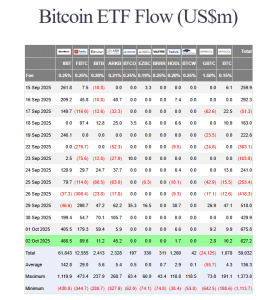

Looking at just the flows into the Bitcoin products in the past quarter, Bloomberg ETF analyst Eric Balchunas noted on X that the BTC products took in $7.8 billion in the third quarter.

The spot bitcoin ETFs took in $7.8b in Q3, now $21.5b YTD and $57b since inception. Solid climb up. Yet some on here are miserable bc they live in childish fantasy that expects $1T of inflows every day. But real growth in reality is two steps fwd, one step back. via @JSeyffpic.twitter.com/dAEJJTOYWW

— Eric Balchunas (September 30, 2025)

Year‑to‑date (YTD), the spot Bitcoin ETFs have pulled in $21.5 billion. Investors have also poured $57 billion into the funds since their inception at the start of 2024.

Citi Predicts BTC May Hit $133K By Year‑End, $181K In 2026

Citi also remains bullish on the Bitcoin price. In a recent report, the bank projected modest but meaningful momentum for the broader crypto market heading into the new year.

Analysts at Citi have now predicted that Bitcoin will reach $133K by the end of the year. This is a slight decrease from the bank’s previous year‑end target of $135K.

The bank also gave its bullish and bearish cases for the leading crypto. If equity markets continue to rally and flows pick up, the analysts said BTC could soar to as high as $156K by year‑end. Conversely, Bitcoin might also fall to as low as $83K under recessionary conditions, the bank warned.

Citi went on to say that Bitcoin is better positioned than Ethereum (ETH) to capture new inflows due to its scale and the “digital gold” narrative surrounding BTC.

On a longer‑term investment horizon, Citi predicted that Bitcoin’s price could surge to $181K in the next twelve months. However, the bank said that this price target will rely heavily on whether there are sustained inflows for BTC.

Spot Bitcoin ETFs Extend Inflows Streak

Amid the bullish forecasts from JPMorgan and Citi, spot Bitcoin ETFs find themselves on a multi‑day net inflows streak. In the latest trading session, investors pumped another $627.2 million into the products, extending the streak to four days, according to data from Farside Investors.

That was the second‑consecutive day that the net daily inflows for the investment products topped $600 million.

BlackRock’s IBIT played a major part in the substantial inflows seen in the latest trading session, with the fund recording $466.5 million inflows. IBIT now also holds 3.8 % of all the Bitcoin, according to Balchunas.

IBIT owning 3.8% of all the bitcoin is bonkers if you think about it. An equity ETF would need to have $2.2 trillion in assets to have as much ownership of its underlying asset class. eg $SPY owns 1.1% of most stocks and it's 32yrs old, IBIT is still a toddler. https://t.co/tgQ6bZxyWB

— Eric Balchunas (September 30, 2025)

Fidelity’s FBTC posted the second‑highest inflows of the day with $89.6 million entering its reserves.

Bitwise’s BITB, ARK Invest’s ARKB, VanEck’s HODL and both of Grayscale’s spot Bitcoin ETFs also registered net daily inflows yesterday. The remaining funds, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR, and WisdomTree’s BTCW, recorded no new funds on the day.